Institutional involvement within the crypto market is rising as extra folks worldwide undertake digital property as a monetary instrument. Final 12 months, this progress was represented by the US’ approval of two crypto exchange-traded funds (ETFs) and Europe’s adoption of the MiCA framework.

Catherine Chen, Head of VIP at Binance, advised BeInCrypto that she expects 2025 to proceed driving investor curiosity. Chen expects different international locations to observe go well with because the crypto market anticipates extra favorable circumstances underneath Donald Trump because the US president.

The Variety of Institutional Traders in Crypto Rises

The crypto market is present process a big transformation, characterised by a notable enhance within the involvement of institutional buyers.

This inflow of capital from institutional gamers is essentially reshaping the crypto market, transitioning it from one primarily pushed by retail buyers to at least one characterised by elevated institutional dominance.

In accordance with Chen, Binance, one of many largest crypto exchanges by buying and selling quantity, has witnessed this transformation.

“At a global level we are already seeing a very rapid growth of institutional investors entering this market. In 2024, almost every quarter, the number of registered institutional clients growth doubled. In the first quarter, we saw a 25% increase. In the second quarter, 50%. Right now we’re at almost 100% from the beginning of the year,” she stated.

Final 12 months proved to be emblematic of the progress of cryptocurrency adoption throughout the globe. Regardless of resistance, digital property received battles on completely different fronts, from the approval of regulatory frameworks to crypto adoption inside conventional enterprise fashions.

ETFs Act as an Entry Level for Conventional Traders

In 2024, the approval of two crypto exchange-traded funds (ETFs) in the US uncovered conventional institutional buyers to the chance to interact with digital property with out requiring them to personal them immediately.

Bitcoin (BTC) was the primary to obtain an ETF approval final January. The panorama was significantly complicated underneath Gary Gensler, then-chairman of the US Securities and Change Fee (SEC). He constructed himself an adversarial fame for his hardline method to crypto regulation.

“The approval of the Bitcoin ETF was presumably the one most vital occasion in 2024. It has a significant long-term impact as a result of the ETF actually offers the legitimacy the crypto asset class deserves. The introduction of ETFs present that a lot of the world’s greatest ETF issuers are all taking this asset class severely.

The ETF is a car, as an funding wrapper, that makes it very simply accessible to all sorts of buyers. Along with that, after I say that it’ll have an extended time period impact, it’s as a result of the establishments which were ready on the sideline can lastly enter the crypto market utilizing an instrument they’re used to,” Chen stated.

In Could, Ethereum (ETH) carefully adopted go well with when the SEC greenlit spot Ethereum ETFs, which started buying and selling two months later on exchanges like Nasdaq, the New York Inventory Change, and the Chicago Board Choices Change.

The success of each of these digital property in attaining ETF approval after years of trial and error noticed substantial inflows and drove costs to report highs, sparking optimism amongst buyers and market analysts.

“2024 has been successful beyond expectation, a sort of new era for crypto, with relevant developments in many areas, including the fact Bitcoin and the total crypto market cap reaching new ATHs, the US spot Bitcoin ETFs accumulated over $31 billion in net inflows and over $100 billion in assets under management (AUM). The spot Ether ETFs approved in July 2024 also attracted the attention of investors, with over $730 million in inflows and over $9 billion in AUM,” Chen advised BeInCrypto.

Sentiment amongst trade gamers signifies that 2025 will see extra ETF approvals for different cryptocurrencies.

The Debate Over Future ETF Approvals This 12 months

A number of digital property have already submitted new functions for spot ETFs. In November 2024, asset managers VanEck, 21Shares, and Canary Capital filed for a Solana (SOL) ETF with the SEC. Grayscale did the identical one month later.

The SEC additionally obtained ETF functions from Litecoin (LTC), Hedera (HBAR), and Ripple (XRP).

“We are likely going to see more ETFs approved next year. This will bring in more institutional investors as crypto becomes a bigger part of the traditional market. We don’t share our targets, but for reference, the volume traded by institutional investors grew 60% in the 12 months through November, compared to the year earlier period. Globally, Binance saw 97% growth in the number of onboarded institutional investors this year,” Chen stated.

Regardless of widespread optimism over approving extra ETFs within the coming 12 months, a number of components must be thought of concerning this probability. In figuring out whether or not an ETF is match for approval, the SEC requires the asset to meet strict regulatory requirements.

These embody compliance and adherence to current monetary laws, ample market demand from institutional and retail buyers, dependable custody options, excessive liquidity ranges, and rigorous asset efficiency and governance transparency.

Bitcoin and Ethereum had a distinctive benefit once they utilized for an ETF with the SEC. Each networks have a fame past the borders of the cryptocurrency trade.

In contrast to its rivals, networks like Solana, Litecoin, and Hedera would not have the identical recognition, doubtlessly weakening an total market demand for an ETF amongst conventional buyers.

Crypto Turns into A part of US Political Agenda

Since Satoshi Nakamoto created Bitcoin in 2009, cryptocurrencies have come a great distance. For the higher a part of that trajectory, actors in conventional finance have regarded digital property as a fad. People with little information of their utility related them with rip-off dangers or fraudulent exercise.

In 2024, cryptocurrency turned one in all Donald Trump’s central pillars throughout his election marketing campaign.

“Let’s recall crypto was a topic in the election agenda for both US candidates. This is already very important. With pro-crypto president-elect Donald Trump and a number of pro-crypto politicians across the Senate and House of Representatives elected, we are likely going to see new developments in crypto legislation in 2025,” Chen recalled.

All through his marketing campaign path, Trump referred to himself as a “crypto president.” Since his victory within the November elections, he has made a number of appointments which have sparked widespread approval throughout the crypto sector.

In early December, Trump named David Sacks the White Home’s “crypto czar.” A seasoned entrepreneur and investor with over twenty years of expertise in Silicon Valley, Sacks is predicted to carry intensive expertise to this position.

Trump additionally picked Paul Atkins, a cryptocurrency advocate, to interchange Gary Gensler as Chair of the Securities and Change Fee (SEC). Crypto advocates celebrated the transfer, whereas the market reacted with instant features.

Trump appointed Stephen Miran, a former Treasury official throughout his first administration, to steer the Council of Financial Advisors (CEA). Miran, a vocal advocate for cryptocurrency, has beforehand known as for regulatory reforms in the US.

“Any regulation developments in the US should encourage more crypto participation across the market and will help increase the awareness of crypto for other countries across the world,” Chen stated.

This shift in authorities coverage in direction of a extra supportive stance on digital property may even have a domino impact on different nations.

Adoption Extends Past Monetary Giants

Institutional curiosity in cryptocurrency rose amongst main monetary gamers and corporations restricted to the retail sector.

“Financial giants like BlackRock and Fidelity entered the crypto business in 2024, and we expect to see more new players coming to crypto in the years ahead,” Chen stated to that time.

In March, BlackRock, the world’s largest asset supplier, unveiled the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), its first tokenized fund issued on a public blockchain. This supplied certified buyers the chance to earn US greenback yields. By means of Securitize Markets, LLC, buyers gained entry to this novel fund, heralding a shift in funding dynamics.

Coinbase turned a key infrastructure supplier for BlackRock’s novel blockchain fund. This collaboration marked a big milestone in integrating conventional finance with blockchain expertise, significantly by way of the launch of BUIDL.

In one other show by conventional monetary establishments, Constancy Worldwide adopted in BlackRock’s footsteps in June when it introduced that it had joined JPMorgan’s Tokenized Collateral Community (TCN).

The transfer positioned Constancy alongside different main gamers within the tokenization sector, whereas the collaboration with JPMorgan highlighted the growing curiosity in leveraging blockchain for real-world functions.

This elevated adoption extends past monetary giants.

“More companies are learning about crypto and integrating crypto features into their business. We believe this is a trend that has grown for years and we expect to see more development in,” stated Chen.

A number of high-fashion and luxurious retailers exemplify how crypto adoption is steadily rising. Famend manufacturers like Ferrari, Gucci, Balenciaga, and Farfetch have all broadened their fee methods to just accept crypto.

International Crypto Adoption

Crypto adoption amongst institutional buyers extends nicely past the US. As extra people begin to use digital property as a type of forex, completely different nations have began to manage this growth.

“About one-third of countries around the world have announced and put in place some sort of regulatory framework for crypto as an asset class or for VASPs, at different levels and approaches. Some countries like Dubai have an advanced framework of licenses, registrations and reporting. Japan, El Salvador and various European countries too, to cite a few. The regulatory debate is advancing faster,and becoming a topic in the political agenda, which definitely sets an optimistic precedent for the industry when we look into the future,” Chen advised BeInCrypto.

Financial powerhouses and nations with rising economies alike have taken these initiatives.

“Some countries like Dubai have an advanced framework of licenses, registrations and reporting. Japan, El Salvador and various European countries too, to cite a few. The regulatory debate is advancing faster,and becoming a topic in the political agenda, which definitely sets an optimistic precedent for the industry when we look into the future,” Chen added.

The record continues, spanning each continent. Some international locations are even contemplating adopting crypto as a reserve asset. Final week, Bhutan’s Gelephu Mindfulness Metropolis introduced that it had integrated digital property like Bitcoin, Ethereum, and BNB into its strategic reserves.

Earlier this month, the governor of the Czech Nationwide Financial institution, Aleš Michl, expressed curiosity in Bitcoin as a possible addition to the nation’s international change reserves.

Switzerland can also be considering holding Bitcoin as a strategic reserve, additional highlighting the growing position of cryptocurrencies in monetary innovation.

Equally, Bitcoin reserves are gaining momentum in the US, with 13 states main in 2025.

“Let’s not forget there’s a debate about a potential Strategic Bitcoin Reserve in the US. If that moves forward and comes true, we will likely see many other countries following this path. This will definitely impact adoption,” Chen stated on the subject.

The rising international adoption of cryptocurrencies and their potential use as reserve property suggests a promising future for his or her position within the larger monetary sector.

Europe Units Precedent on Crypto Regulatory Framework

In 2024, Europe established a specific international precedent concerning regulatory readability.

“On the regulatory front, we’ve seen developments around the world, notably MiCA in Europe, but also in other countries,” stated Chen.

Two days earlier than ringing within the New 12 months, the European Union handed the Markets in Crypto-Belongings (MiCA) framework, which gives unified crypto laws for all adhered nations.

In contrast to the US, which has generated an environment of regulatory uncertainty prior to now few years, the EU’s approval of MiCA eliminates the paradox related to differing regulatory necessities.

MiCA additionally enhances shopper safety by guaranteeing that each one crypto asset issuers and repair suppliers adhere to the identical guidelines and laws. A Crypto Asset Service Supplier (CASP) license issued by one EU member state permits firms to increase their providers throughout the bloc.

Since its approval, a number of crypto companies in several European international locations have utilized for a MiCA license.

MoonPay was one of many first worldwide firms to obtain this license within the Netherlands earlier this month. BitStaete, ZBD, and Hidden Highway additionally obtained approval from the Dutch Authority for the Monetary Markets (AFM).

Socios.com additionally introduced approval from the Malta Monetary Companies Authority (MFSA) for a MiCA license. This transfer permits the fan engagement platform to perform as a regulated supplier of digital monetary property.

Academic Boundaries Hinder Additional Institutional Involvement

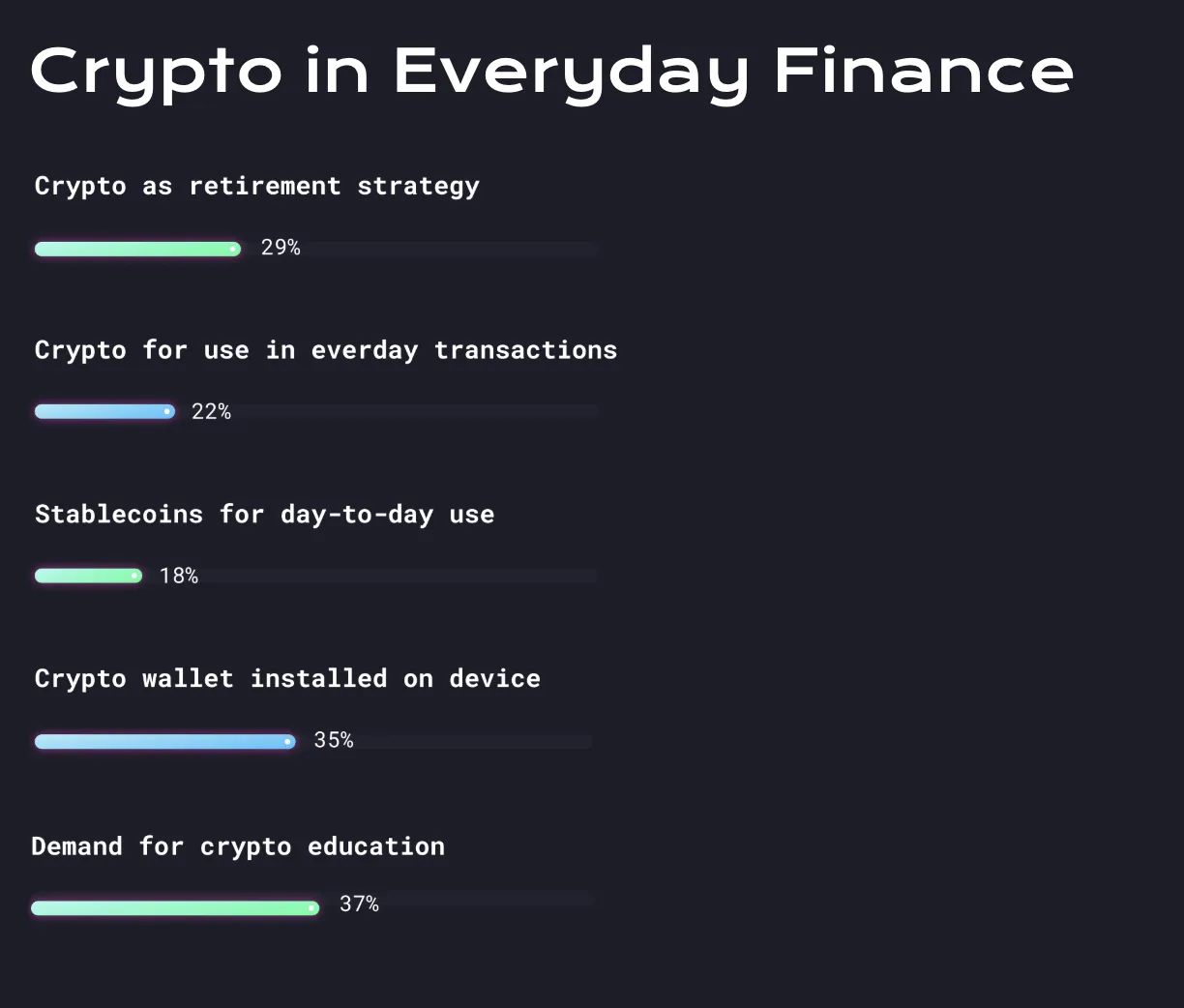

Whereas buyers are slowly mobilizing towards a extra widespread crypto adoption, instructional obstacles stay.

“Investing into cryptocurrency directly remains a hurdle, simply because the learning curve remains steep,” stated Chen.

Carried out in October 2024, the “State of Crypto Literacy” survey supplied a balanced pattern of 670 US respondents throughout age, gender, and earnings.

In accordance with the outcomes, solely 31.8% of respondents stated that they had “a great deal” of data in crypto. The report additionally highlighted the obstacles to broader adoption, with 26.6% of respondents reporting the necessity to perceive what offers a cryptocurrency worth.

An total lack of understanding over extra superior subjects like decentralized finance (DeFi) and staking additionally turned obvious.

Solely 22% of respondents appropriately recognized a non-public key because the crucial instrument for managing cryptocurrency, whereas 14% claimed to grasp DeFi’s performance. Solely 9% reported figuring out staking’s position in blockchain ecosystems.

“People are asking for crypto more than ever, but are they getting the right help to come into this space?” Chen added.

The survey underlines the crucial position of crypto literacy in fostering belief and driving broader adoption throughout the crypto trade. Bridging this data hole amongst buyers and people might be essential for institutional involvement in crypto to proceed.

Disclaimer

Following the Belief Mission tips, this function article presents opinions and views from trade specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its workers. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.