Bitcoin (BTC) surged practically 8% on Wednesday, reclaiming ranges above $90,000 after briefly dropping under $80,000 5 days in the past. This sharp restoration alerts renewed bullish momentum as buyers react to hypothesis surrounding Trump’s proposed US crypto reserve plan.

Key technical indicators, such because the DMI and Ichimoku Cloud, recommend that consumers have regained management. Whether or not BTC can maintain this momentum and push towards $100,000 or face renewed volatility relies upon largely on upcoming market developments, together with the White Home Crypto Summit.

Bitcoin DMI Reveals Consumers Have Reclaimed Management

Bitcoin’s Directional Motion Index (DMI) reveals that the ADX has fallen to 17.5, down considerably from 27.6 simply two days in the past. A declining ADX signifies weakening development energy, that means that the earlier downtrend has misplaced momentum.

On the similar time, the +DI has risen to 27.9 from 17.7 yesterday, whereas the -DI has dropped from 30.5 to twenty.5. This shift means that bullish momentum is growing whereas promoting strain is fading.

Bitcoin is at present trying to transition from a downtrend to an uptrend, and these actions within the DMI traces point out that consumers are beginning to acquire management.

ADX, or the Common Directional Index, measures development energy fairly than path. Values above 25 sometimes sign a powerful development, whereas values under 20 point out a weak or indecisive market.

With ADX now at 17.5, Bitcoin’s present value motion lacks robust development affirmation, making its subsequent transfer crucial.

Nevertheless, the rising +DI and falling -DI recommend that bullish strain is growing. If ADX begins rising once more alongside a widening hole between +DI and -DI in favor of consumers, Bitcoin might set up a brand new uptrend.

Conversely, if ADX stays low, value motion might keep uneven, missing the energy wanted for a decisive breakout.

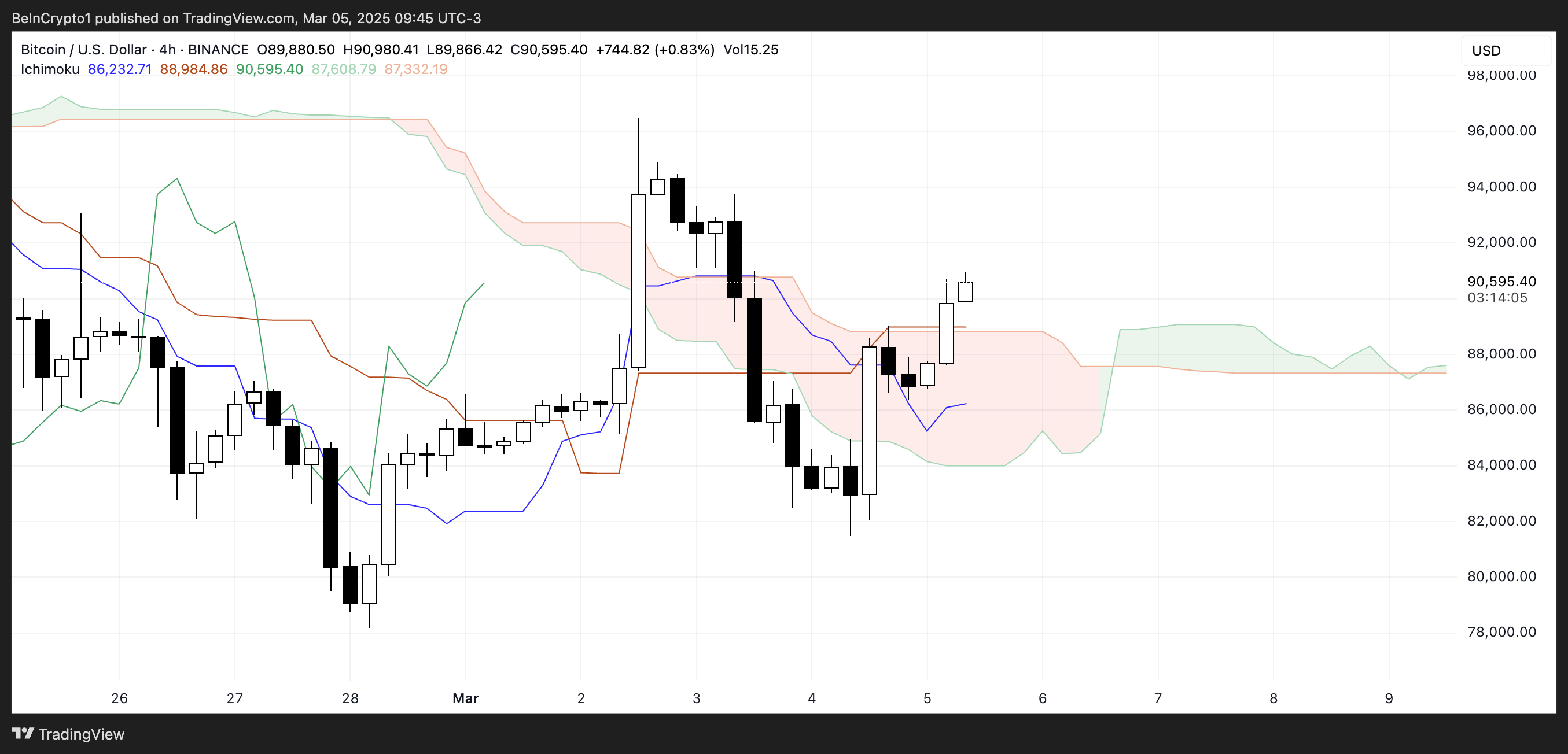

BTC Ichimoku Cloud Reveals a Shift In Momentum

Bitcoin’s Ichimoku Cloud construction suggests a possible shift in momentum as the value strikes above key ranges. The worth has not too long ago damaged above the purple baseline, indicating rising bullish strain. Nevertheless, it’s nonetheless interacting with the cloud, which represents a zone of uncertainty the place traits typically get examined.

The inexperienced main span A is starting to slope upward. In distinction, the orange main span B stays comparatively flat, displaying that the cloud forward is transitioning right into a potential assist space.

Moreover, the lagging span (inexperienced line) is approaching value motion from 26 intervals in the past, suggesting that Bitcoin is figuring out whether or not this breakout has sufficient energy to proceed.

The Ichimoku Cloud is a dynamic indicator that highlights development path, momentum, and key assist and resistance zones. A decisive transfer above the cloud would affirm a stronger bullish development, permitting Bitcoin to determine a extra outlined uptrend.

Nevertheless, if the value fails to carry above the purple baseline and re-enters the cloud, it might point out a interval of consolidation or perhaps a retest of decrease ranges.

The present setup means that Bitcoin is at a crucial level. Continued momentum might result in a breakout, however hesitation close to the cloud might end in sideways motion earlier than a clearer development emerges.

How Will Bitcoin React After the White Home Crypto Summit?

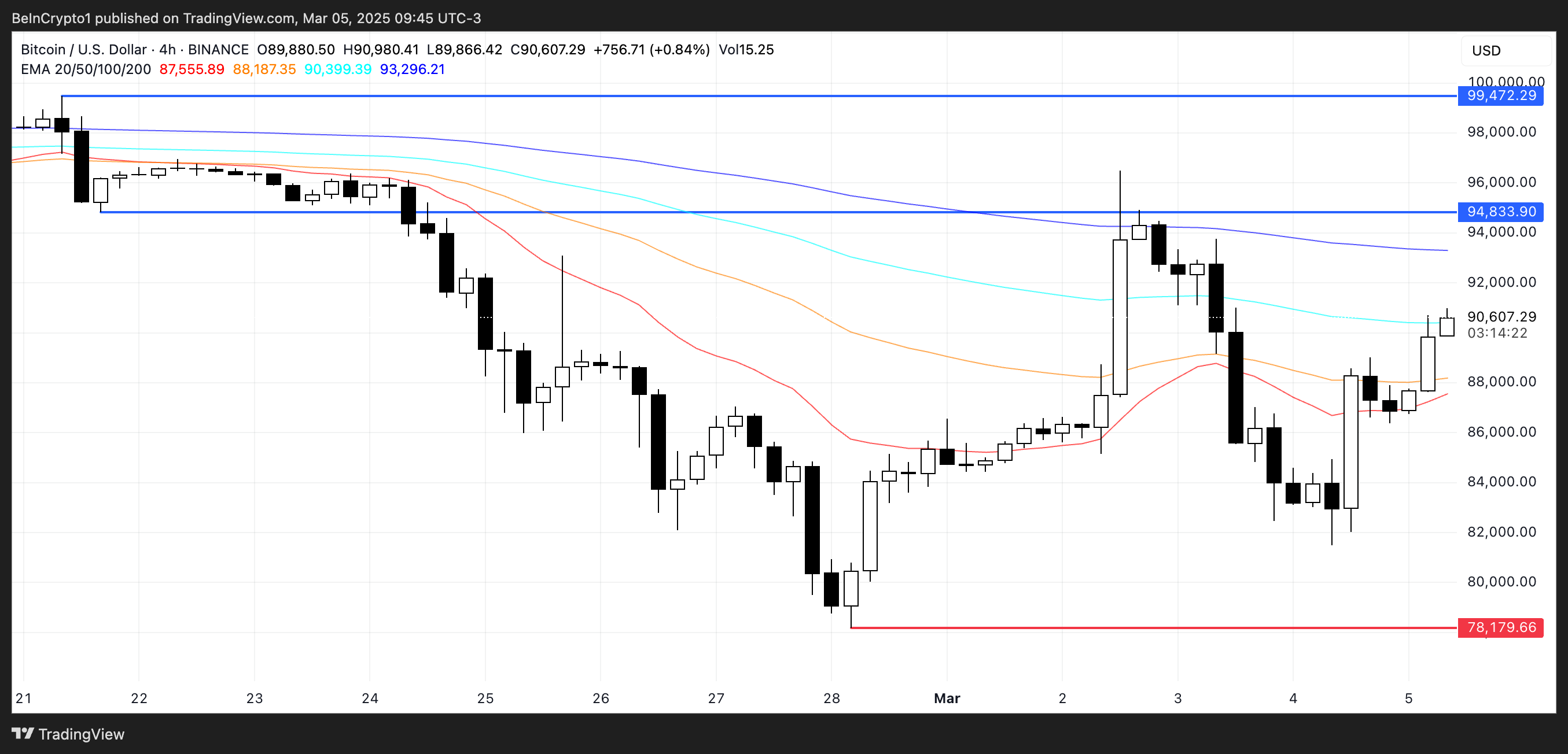

Bitcoin has reclaimed the $90,000 stage as hypothesis grows over potential particular therapy in Trump’s proposed US crypto reserve plan.

This renewed bullish momentum places BTC ready to check key resistance at $94,833. A breakout above this stage might probably result in a rally towards $99,472.

If bullish sentiment continues to construct, Bitcoin might surpass $100,000 for the primary time since February 3, marking a major milestone.

The general development will depend upon whether or not shopping for strain stays robust sufficient to maintain the present momentum and push previous these crucial ranges.

Nevertheless, Bitcoin’s latest value motion has been extremely risky, with robust swings in each instructions over the previous few weeks.

Market uncertainty surrounding the upcoming White Home Crypto Summit on March 7 provides additional danger, as any developments that fall wanting investor expectations might set off a renewed downtrend.

If bearish strain intensifies, BTC might face a pointy decline, probably dropping as little as $78,179.

Disclaimer

Consistent with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.