On Tuesday, Bitcoin (BTC) exchange-traded funds (ETFs) skilled their first internet adverse move in seven days. This comes amid the regular decline in market exercise, which has triggered the main coin’s value to plummet to a weekly low.

As of this writing, Bitcoin trades at $66,776, noting a 2% value drop over the previous week. With bearish sentiment steadily rising across the coin, holders might have to organize for potential additional losses.

Bitcoin ETFs Document Outflows

Knowledge from SosoValue reveals that BTC spot ETFs skilled a internet outflow of $79.09 million on Tuesday, breaking a streak of seven consecutive days of inflows that totaled over $2 billion.

Learn extra: Prime 7 Platforms To Earn Bitcoin Signal-Up Bonuses in 2024

Tuesday’s adverse move was primarily as a result of a $134 million outflow from the ARK 21Shares Bitcoin ETF, as different ETF merchandise noticed both inflows or recorded no exercise. Moreso, the biggest ETF supplier by property underneath administration, BlackRock’s iShares Bitcoin ETF (IBIT), recorded $43 million in inflows, considerably down from $329 million the day before today.

This decline in institutional demand is essentially attributed to the latest drop in Bitcoin’s worth. Over the previous week, the cryptocurrency has fallen by 2%, reaching its lowest value level in seven days as of press time.

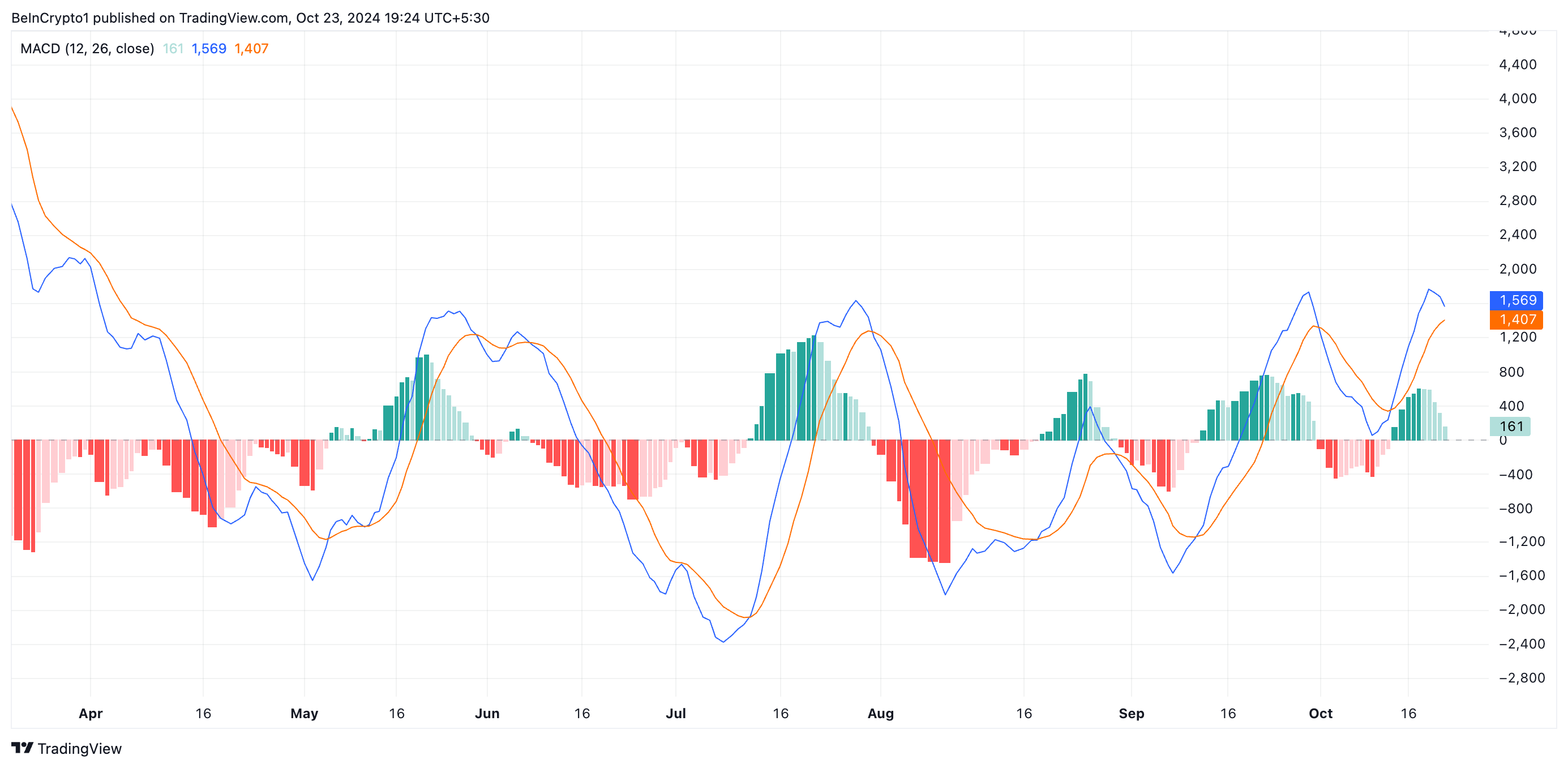

BeInCrypto’s evaluation of its momentum indicators has revealed the gradual progress in bearish sentiment towards the main coin. For instance, readings from its Shifting common convergence/divergence (MACD) present its MACD line (blue) poised to cross beneath its development line (orange).

This indicator measures an asset’s value traits and momentum and identifies potential purchase or promote alerts. When arrange this manner, it confirms elevated promoting stress available in the market. The potential crossover means that the asset’s value momentum is weakening, and a downward development or correction might observe.

BTC Worth Prediction: Coin Has Solely Two Choices

Bitcoin’s value is falling towards its 20-day exponential transferring common (EMA), which measures its common value over the previous 20 buying and selling days.

When an asset’s value falls towards this degree, it suggests the asset is pulling again however could discover help across the 20-day EMA. If the worth fails to carry above the 20-day EMA and breaks beneath it, this considerably will increase the potential of a development reversal. It means that bearish sentiment is rising, and additional draw back would possibly observe.

As of this writing, Bitcoin is buying and selling at $66,776. That is simply above the earlier resistance degree of $64,543, which it lately flipped into help.

If the rising bearish sentiment causes this help to fail upon retest, Bitcoin’s value might drop towards its subsequent main help at $61,686. Ought to BTC bears break via this degree, the worth could plunge additional to $58,828.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

Nonetheless, if market sentiment improves and bullish momentum builds, Bitcoin might rally towards $68,612. Clearing this resistance would place BTC for a possible run to reclaim its all-time excessive of $73,794.

Disclaimer

Consistent with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.