Over the previous seven days, Bitcoin’s (BTC) worth has dropped by 10%. It has trended downward because it exchanged arms at a weekly peak of $69,801 on July 29.

As of this writing, the main digital asset trades at $60,551, providing a shopping for alternative for these trying to commerce towards the market. Nevertheless, an evaluation of the coin’s social exercise reveals that merchants are usually not eager on “buying this dip.”

Bitcoin Merchants Shy Away From “Buying the Dip”

Bitcoin’s market worth to realized worth (MVRV) ratio suggests the main cryptocurrency could also be undervalued. The detrimental readings of this ratio, when assessed over totally different shifting averages, affirm this. In keeping with Santiment, the 30-day and 90-day MVRV ratios are -6.08 and -6.57, respectively.

An asset’s MVRV ratio compares its present worth to the typical acquisition worth of all its cash or tokens. If the MVRV ratio is above zero, the asset’s present market worth is greater than the typical buy worth for many traders.

Conversely, an MVRV ratio under zero signifies the asset’s market worth is decrease than the typical buy worth of all its tokens in circulation, suggesting the asset is undervalued.

A detrimental MVRV ratio presents a great shopping for alternative as a result of the asset trades at a lower cost, and merchants can accumulate it at that stage to promote it at the next worth later.

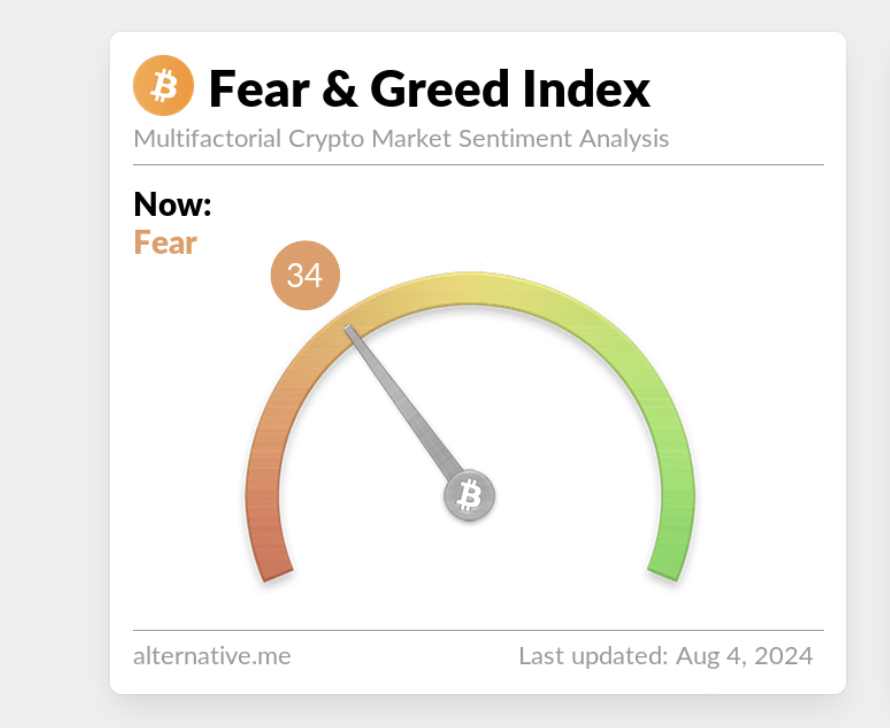

Nevertheless, whereas the worth dip could have introduced a shopping for alternative, retail merchants are usually not all for accumulating the king coin. That is principally because of the concern of an additional worth decline. As of this writing, BTC’s Worry and Greed Index is at 34, indicating that market members are fearful.

Learn extra: The place To Commerce Bitcoin Futures: A Complete Information

Additionally, in a put up on X, on-chain information supplier Santiment stated that regardless of the present worth dip being just like the one witnessed in early July, the identical enthusiasm for getting the dip has but to emerge amongst market members.

BTC Worth Prediction: Coin Might Fall to $50,000 or Decrease

Analysts predict that rising detrimental sentiment within the cryptocurrency market and unfavorable broader macroeconomic situations put BTC vulnerable to falling to the $50,000 worth area or under.

In keeping with pseudonymous CryptoQuant analyst Abramchart, BTC holders have failed to take care of the essential short-term assist stage of $64,580, representing the typical buy worth over the past six months. If the coin holds under this assist stage, its worth is probably going “to target the range of $53,000 to $54,000, which corresponds to the lower edge of the descending channel,” Abramchart finds.

Additionally, crypto analysis agency 10x Analysis notes that BTC could fall under $50,000. In keeping with it, the weakening ISM Manufacturing Index and potential inventory market decline improve this danger.

Moreover, 10x Analysis states that if the Federal Reserve responds to a declining inventory market with an emergency charge lower, it would sign financial misery reasonably than restoration, exacerbating BTC’s decline.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

In keeping with readings from the coin’s Fibonacci Retracement ranges,if the present downtrend persists, BTC’s subsequent worth goal is $58,699. Nevertheless, if it witnesses an uptrend, its worth will climb to $61,466.

Disclaimer

In keeping with the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.