Bitcoin soared to a historic excessive of almost $80,000 on Sunday, fueled by renewed optimism throughout the crypto group following Donald Trump’s reelection as US president.

This assist has powered Bitcoin’s upward momentum, with its rally showing unstoppable in the interim.

Bitcoin’s Newest ATH Drives $400 Million Market Liquidation

On November 10, Bitcoin reached an unprecedented peak of $79,600, surpassing its prior all-time excessive (ATH) of greater than $77,000, in response to BeInCrypto information. Although it has barely receded to $79,326 at press time, the main digital asset’s value has nonetheless skilled a notable improve of over 3% prior to now 24 hours.

“$79k bitcoin, new ATH. Steady folks, this is just the beginning. This is a time for being right and sitting tight. No rash action is needed, HODLing does the work for you,” Bitcoin investor Tuur Demeester stated.

Analysts credit score a serious portion of this progress to the optimism surrounding Trump’s return to workplace. Many speculate his administration could take a positive strategy to crypto regulation, including additional momentum. Trump himself has proven assist for crypto, taking part in a number of business occasions, together with the Bitcoin2024 Convention, and has pledged to foster a pro-crypto atmosphere.

Equally, the current cuts in international rates of interest have additionally fueled Bitcoin’s current value motion. Each the US Federal Reserve and the Financial institution of England lately minimize charges by 25 foundation factors, a transfer that usually boosts liquidity whereas softening the greenback. These situations traditionally favor danger property like Bitcoin, making it an interesting possibility for buyers amid a relaxed financial coverage.

In the meantime, Bitcoin’s value new file excessive has additionally positively affected the broader crypto market, with a number of main property driving the wave. Prior to now 24 hours, Ethereum rose 5.4%, Solana gained 3.2%, and Dogecoin skilled an 11% bounce.

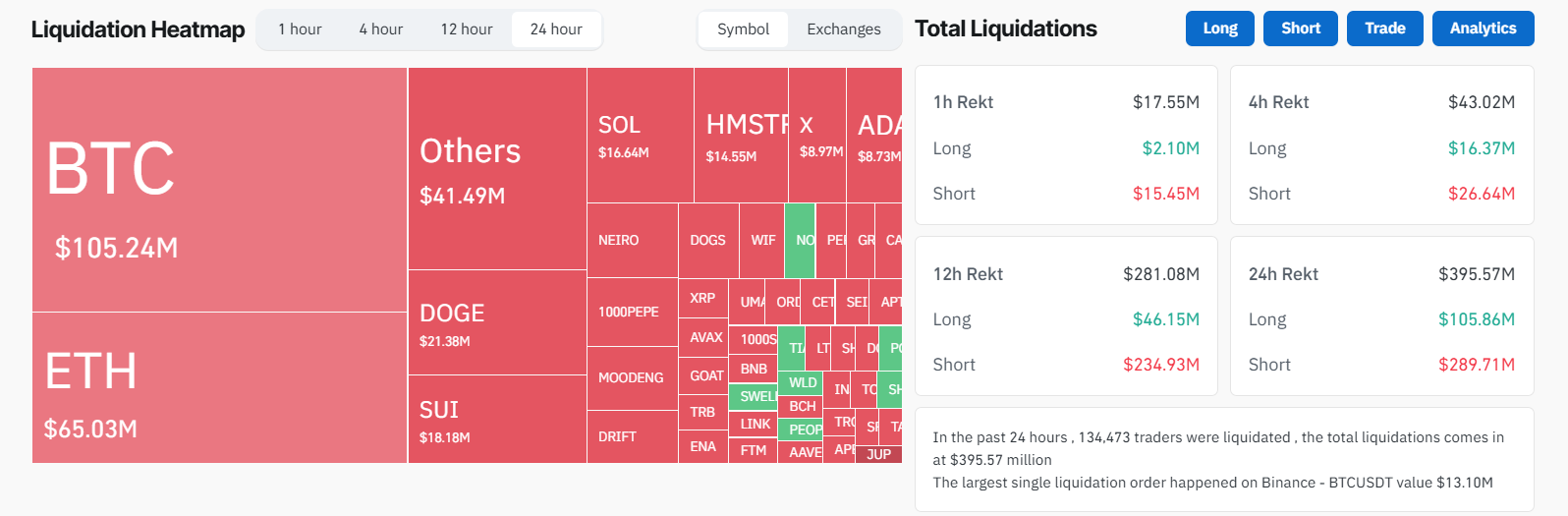

But, this bullish market efficiency has led to important losses for merchants speculating on the costs of those digital property. In keeping with Coinglass information, over 132,000 merchants had been liquidated for almost $400 million in the course of the market uptrend.

Brief sellers — who had been betting on a market decline — noticed the largest losses, totaling roughly $288.46 million. Lengthy merchants confronted smaller setbacks, with whole losses of round $105.6 million. Bitcoin merchants accounted for round 30% of the liquidations at $105 million, adopted by Ethereum merchants at $65 million.

Throughout exchanges, Binance skilled the very best quantity of liquidations, representing 46.76% of the whole, or about $180 million. Different exchanges, resembling OKX and Bybit, additionally recorded important losses, with $79.6 million and $65.4 million, respectively.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.