Polymarket is recording heightened exercise as merchants show rising curiosity in prevailing market situations. Contributors are betting 1000’s of {dollars} in a daring try to predict the market.

Whereas the platform’s impartiality has been questioned, particularly relating to exhibiting market sentiment, its position in driving crypto adoption can’t be ignored.

Polymarket Merchants Guess Huge

In keeping with Dune Analytics, Polymarket has seen a major enhance in day by day quantity and lively merchants as members attempt to predict market outcomes. These metrics have been steadily rising since Might.

Narratives comparable to US elections proceed to drive this curiosity. Nevertheless, the most recent crypto market crash has additionally contributed to the surges in exercise. Completely different dashboards on Polymarket present members betting on a number of questions.

Amongst them, the percentages of Bitcoin (BTC) value dipping under $45,000 earlier than September and Ethereum (ETH) reclaiming above $3,000 on August 9. BeInCrypto knowledge exhibits that at press time, BTC is buying and selling at $53,625, whereas ETH stays under $2,400.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

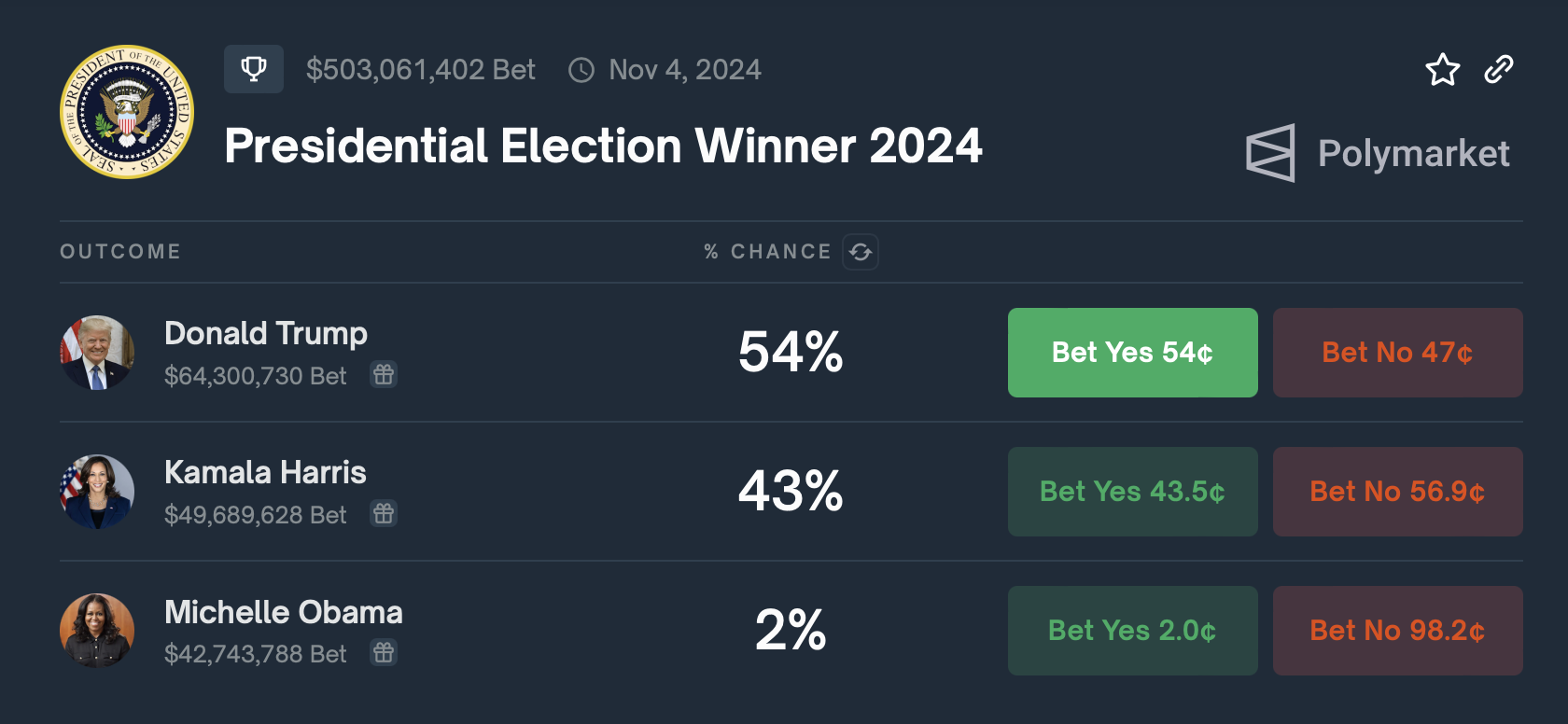

The US presidential race stays one of many favourite matters amongst Polymarket customers. The crypto neighborhood is more and more participating in predictions, wagering on potential outcomes.

Republican ticket nominee Donald Trump is main with 54% success odds. In distinction, Kamala Harris stands at 43%, whereas former US First Girl Michelle Obama has 2% odds.

Learn extra: How Can Blockchain Be Used for Voting in 2024?

Polymarket bets additionally present merchants’ curiosity in whether or not there might be an “emergency rate cut in 2024.” This gamble comes as markets decry the most recent trade droop.

“Jerome Powell needs to call a meeting now and announce an emergency rate cut,” Bitcoin veteran Kyle Chassé remarked.

In a latest assembly, Federal Reserve chair Jerome Powell hinted at potential coverage easing in late 2024. He acknowledged {that a} fee reduce might be on the desk in September. Whether or not an emergency fee reduce will come amid stays unknown.

In addition to emergency fee cuts, Polymarket members speculate a few potential recession in 2024. Nevertheless, this guess might roll over quickly as US financial exercise challenges recession warning.

As BeInCrypto reported, markets watched Monday’s S&P Closing US Companies PMI knowledge. The most recent knowledge launch exhibits that financial exercise within the companies sector expanded in July, with the Companies PMI registering 51.4%, exhibiting sector enlargement for the forty seventh time in 50 months.

“In July, the Services PMI registered 51.4%, 2.6 percentage points higher than June’s figure of 48.8%. The reading in July marked the fifth time the composite index has been in expansion territory in 2024,” the report learn.

Learn extra: Easy methods to Shield Your self From Inflation Utilizing Cryptocurrency

The bullish growth helps Bitcoin rebound. It factors to greater demand for companies and, due to this fact, will increase in inflows to companies. Constructive financial knowledge typically influences investor sentiment within the crypto area.

As conventional markets strengthen, traders might change into extra assured within the economic system. This might enhance threat urge for food and enhance curiosity in various belongings like cryptocurrencies.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.