Bitcoin’s value fell under $85,000 throughout Friday’s early Asian hours because the market reacted to US President Donald Trump’s newest govt order to ascertain a Strategic Bitcoin Reserve.

The announcement, supposed to solidify BTC’s function within the nation’s financial system, has fueled volatility, with liquidations exceeding $250 million prior to now 24 hours.

Trump’s Bitcoin Transfer Triggers Liquidations

On Thursday, President Trump signed the manager order establishing a Strategic Bitcoin Reserve. Nevertheless, opposite to expectations, the market’s response has been removed from bullish. Merchants have rushed to dump their holdings, triggering a decline in BTC’s worth.

In the course of the early Asian buying and selling hours on Friday, BTC plummeted to a low of $84,667. Whereas its value has since rebounded barely, the main cryptocurrency remains to be down 5% prior to now 24 hours.

This value decline has triggered a wave of liquidations in BTC’s futures market, which have totaled $261 million prior to now 24 hours, in keeping with Coinglass information.

On-chain information reveals that the majority of those losses come from lengthy positions, indicating that merchants anticipating a value rally had been caught off guard by the sudden downturn. Per Coinglass, BTC lengthy liquidations at the moment stand at $115.60 million—the best in three days.

Lengthy liquidations occur when merchants with lengthy positions are compelled to promote the asset at a cheaper price to cowl their losses as the worth declines. This often happens when the asset’s value falls previous a sure threshold, forcing merchants betting on a value improve to exit the market.

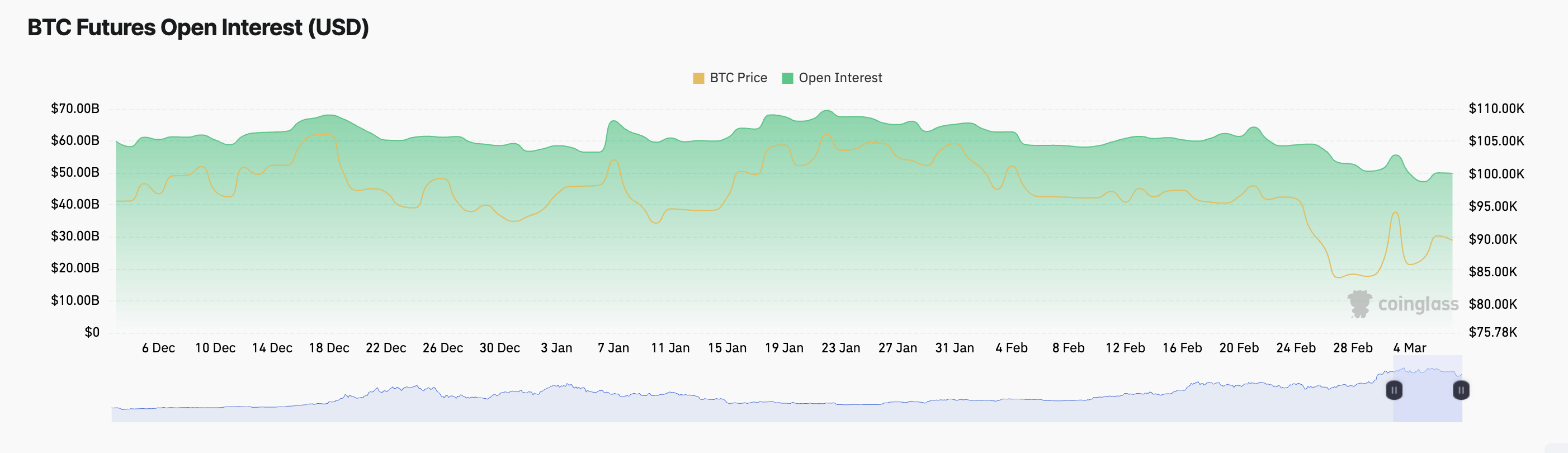

Furthermore, BTC’s open curiosity has declined, highlighting the decline in buying and selling exercise since Trump’s govt order. At $50 billion as of this writing, it has plummeted 5% prior to now 24 hours.

An asset’s open curiosity measures the whole variety of excellent by-product contracts that haven’t been settled. When it drops alongside a declining value, merchants are closing positions reasonably than opening new ones. This means weakening market conviction amongst BTC holders and hints on the probability of an prolonged decline.

BTC Slides Forward of Crypto Summit

BTC’s decline comes simply hours forward of a extremely anticipated crypto summit scheduled for later at the moment. If demand stalls and the downtrend continues, the coin’s value might once more retest the assist fashioned at $85,357.

If the bulls fail to defend this degree, the coin might prolong its decline within the coming days and fall towards $80,580.

Nevertheless, a bullish resurgence would invalidate this bearish projection. If new demand enters the market, it might push BTC’s value again above $90,000 and trigger it to commerce at $92,247.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.