The Bitcoin (BTC) market has not too long ago seen a notable shift within the exercise of its long-term holders.

On Thursday morning, there was a notable surge within the “age consumed” metric, indicating that traders who’ve held their cash for an prolonged interval at the moment are turning into lively once more.

Bitcoin Lengthy-Time period Holders Are on the Transfer

In response to Santiment, Bitcoin’s “age consumed” metric spiked to 34.16 million on Thursday morning, marking the very best single-day stage since August 5, when a broader market downturn led to over $1 billion in liquidations. The age consumed metric tracks the motion of dormant cash by calculating the time they’ve been held earlier than being moved, multiplied by the variety of cash moved.

Sometimes, long-term holders don’t regularly transfer their cash, so a spike on this metric can usually sign a forthcoming shift in market tendencies.

Following this bounce in age consumed, Bitcoin skilled a 1% enhance over the previous 24 hours. When a value spike accompanies a surge in age consumed, it may well point out {that a} native backside. Nevertheless, the current 1% progress isn’t sufficient to verify this thesis.

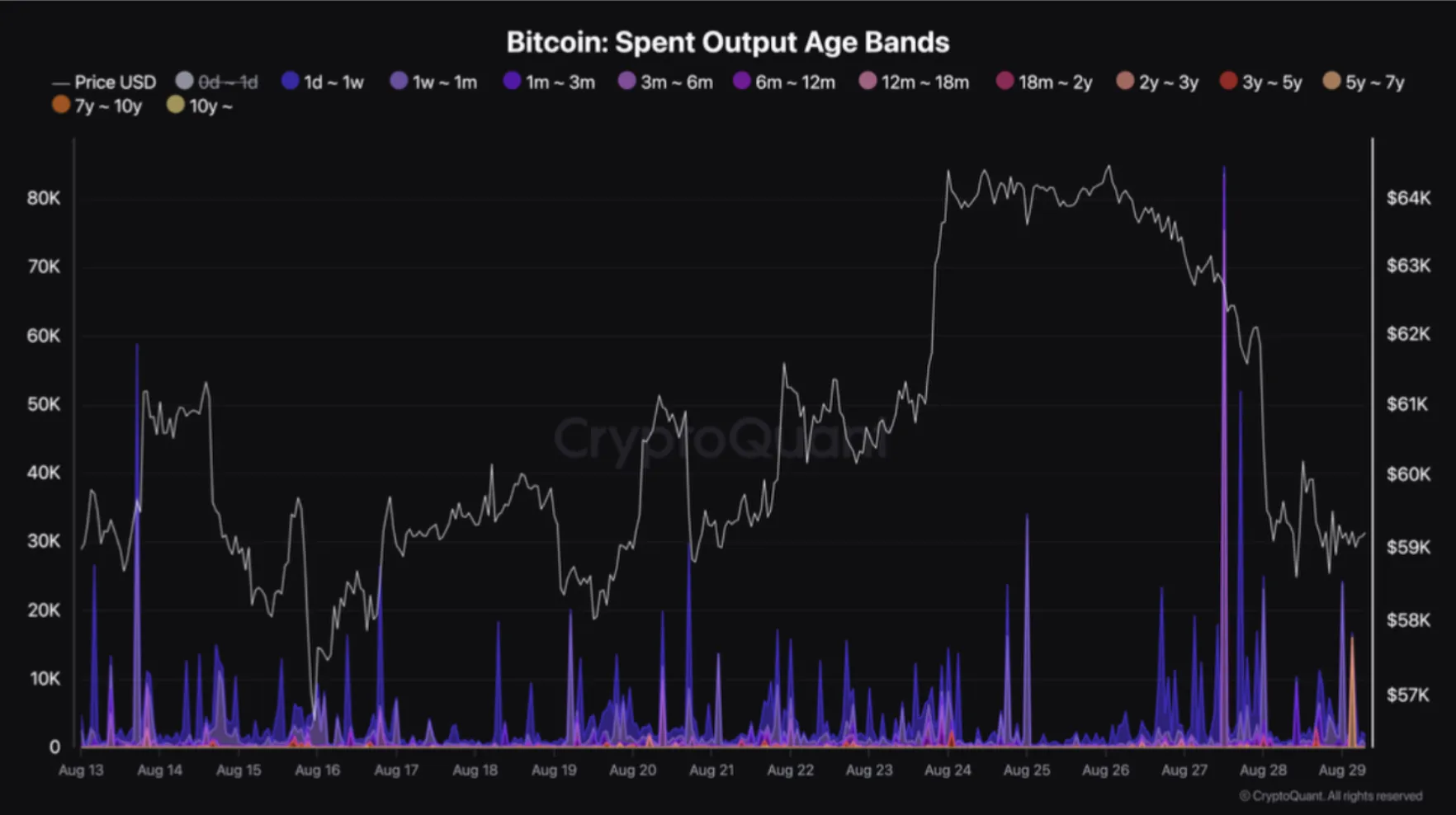

Additional evaluation of Bitcoin’s spent output age bands reveals widespread distribution of cash by numerous holder cohorts over the previous few days. A report from Cryptoquant analyst XBTManager highlighted important transfers, together with 7,788 cash aged 1 to three months and 75,228 cash aged 3 to six months on August 27.

The next day, the market noticed the switch of 19,067 cash aged one week to 1 month, together with smaller quantities of cash aged as much as 2 years. Right this moment, merchants have moved 23,345 cash aged one week to 1 month, 1,220 cash aged six to 12 months, and 16,003 cash aged 5 to 7 years.

Learn extra: What Occurred on the Final Bitcoin Halving? Predictions for 2024

“These transfers need to stop; otherwise, they will continue to contribute to the decline. When bitcoins that have remained dormant for a long time are moved, it’s usually in preparation for something, and you may see them used for selling. Transfers that occur at the right time and place tend to have a negative impact on Bitcoin,” he famous.

BTC Value Prediction: A Rally Above $60,000 Is Potential

At press time, Bitcoin is buying and selling beneath its 20-day exponential transferring common (EMA) at $59,640. This transferring common, which tracks the coin’s common value over the previous 20 days, is a key indicator of market sentiment.

When an asset’s value falls beneath its 20-day EMA, it usually alerts a rise in promoting stress.

Learn extra: Bitcoin Halving Historical past: Every thing You Want To Know

If this promoting stress intensifies, Bitcoin dangers shedding its positive aspects from the previous 24 hours and will drop to $58,790. Nevertheless, if the coin manages to interrupt above its 20-day EMA, the renewed shopping for momentum might push its value again above the $60,000 mark.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.