As much as 60% of prime US hedge funds now maintain Bitcoin ETFs, a pointy enhance since Could. This shift highlights rising institutional adoption as extra conventional buyers are drawn to crypto.

The January determination by the US Securities and Change Fee (SEC) to approve Bitcoin (BTC) ETFs marked a vital second, offering institutional buyers with direct entry to the crypto market.

Hedge Funds Flocking to Bitcoin ETFs

Sam Baker, a analysis analyst at BTC-focused agency River, notes that 60% of the most important US hedge funds now maintain Bitcoin ETFs. None of those funds bought throughout Q2, with many persevering with to extend their holdings.

Citadel Investments, Millennium Administration, Mariner Funding, and Fortress Funding are among the many companies that added extra shares in Q2. Moreover, 13 out of the 25 prime registered funding advisors (RIAs) within the US now have Bitcoin publicity by ETFs.

Furthermore, some, reminiscent of Cambridge Associates, Hightower Advisors, Moneta Group, and Cresset Asset Administration, are slowly rising their allocations.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Strategy

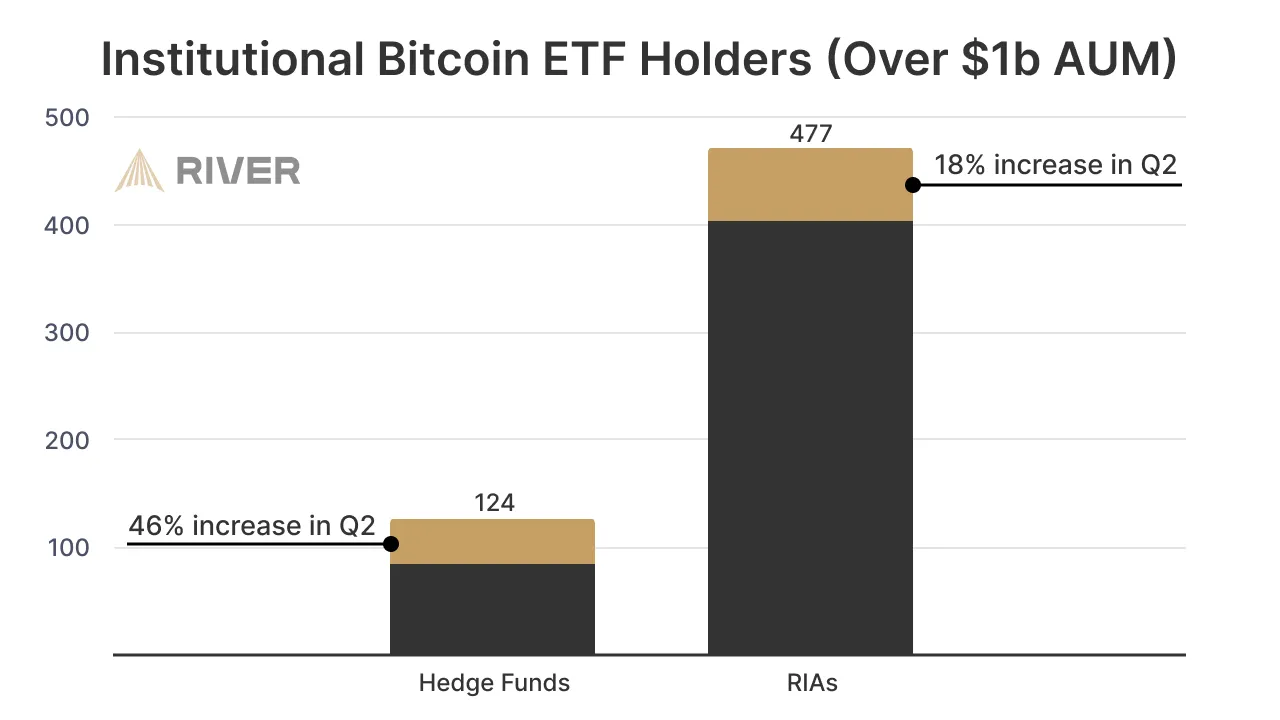

Additional, massive establishments with over $1 billion in belongings beneath administration (AUM) have continued to extend their Bitcoin publicity. In Q2 alone, the variety of registered funding advisors (RIAs) with a Bitcoin allocation grew by 18%.

In the meantime, the variety of hedge funds holding Bitcoin elevated by 46%, reflecting the rising confidence in Bitcoin amongst main monetary gamers.

For hedge funds, the surge to 60% marks a notable enhance, up 8% since Could. As reported by BeInCrypto, round 52% of hedge funds had invested in Bitcoin ETFs as of Could, allocating a median of two.1% of their portfolios to BTC. This factors to rising institutional enthusiasm for Bitcoin.

Certainly, establishments have capitalized on the latest market correction, shopping for the dip and exhibiting sustained curiosity. In keeping with capital compounder HODL15Capital, BTC ETF flows have been web constructive in eight of the final ten days.

Amid this rising curiosity, BlackRock’s Bitcoin holdings are approaching 350,000 BTC, rating simply behind pseudonymous Bitcoin creator Satoshi Nakamoto and Binance. Equally, different issuers like Bitwise, Ark Investments, and Valkyrie Investments are actively exploring growth alternatives.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Regardless of the position of ETFs in including legitimacy to crypto, some argue that these monetary devices sidestep Satoshi’s imaginative and prescient. The priority is that as institutional stakes develop, energy shifts again into the arms of huge entities, contradicting crypto’s decentralized ethos. This might result in Bitcoin and different cryptocurrencies buying and selling extra like conventional shares beneath Wall Avenue’s affect, diluting the core ideas of decentralization.

“I still wish Bitcoin never got an ETF. It moves slower than most stocks and has lost its appeal to trade. We replaced exciting volatility with boring stability, just what the suits and institutions wanted,” mentioned one person on X.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.