Spot Bitcoin ETFs prolonged their influx streak by one other day on Thursday, marking the fifth consecutive day of internet constructive flows. The entire influx for the day stood above $440 million.

The continued inflows come amid a modest market rebound over the previous 24 hours.

Bitcoin ETF Inflows Hit $2.68 Billion for the Week

Bitcoin ETFs recorded one other day of internet inflows on Thursday, extending their streak to 5 consecutive days. The most recent addition of $442 million introduced the week’s complete to $2.68 billion, the very best weekly internet influx for the reason that first week of December 2024.

On Thursday, BlackRock’s ETF IBIT recorded the most important day by day internet influx of $327.32 million, bringing its complete cumulative internet inflows to $40.96 billion.

Ark Make investments and 21Shares’ ETF ARKB adopted in second place with a internet influx of $97.02 million, pushing its complete historic internet inflows to $3.09 billion.

BTC Futures Present Uptick in Demand

The crypto market has witnessed a modest rebound over the previous 24 hours, pushing BTC’s worth up by 1% over the previous day. Throughout the identical interval, open curiosity in BTC futures has additionally risen, signaling a slight uptick in investor demand.

At press time, that is at $65.31 billion, up 1% at the moment. The gradual rise in BTC’s worth and open curiosity alerts rising market participation and growing confidence within the ongoing development.

This simultaneous uptick means that new positions are being opened to help the value motion, typically interpreted as a bullish indicator.

Furthermore, name volumes have outpaced places within the choices market, reflecting a tilt towards bullish sentiment. As of this writing, the coin’s put-to-call ratio is at 0.74.

When an asset’s put-to-call ratio is beneath 1, extra name choices are being bought than places, reflecting a bullish sentiment amongst choices merchants. This implies that traders are positioning for a sustained upside in BTC’s worth.

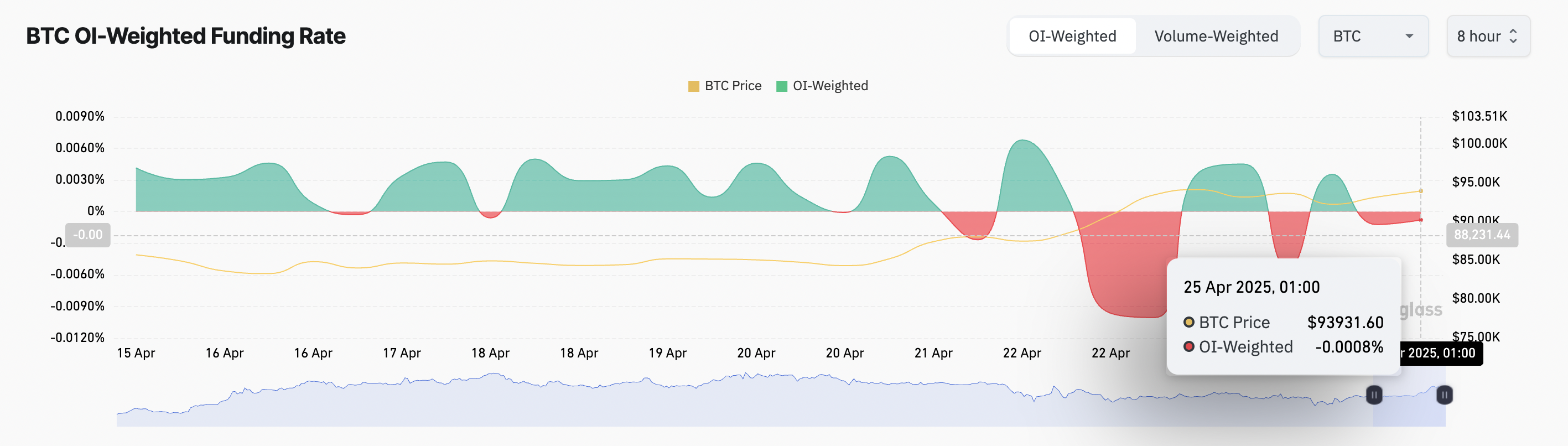

Nevertheless, regardless of these constructive indicators, BTC’s funding fee stays adverse. At press time, the metric is at -0.0008%.

The funding fee is a periodic cost between lengthy and quick positions in perpetual futures contracts. It retains the contract worth consistent with the spot market. When the funding fee is adverse, it signifies bearish sentiment, as extra merchants are betting on a worth decline.

This implies that some futures merchants are nonetheless betting on BTC’s short-term draw back, at the same time as ETF demand and market metrics present renewed energy.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.