Ethereum (ETH) worth continues to nurture a restoration, drawing tailwinds from rising demand within the ETF (exchange-traded funds) market. Nevertheless, broader market jitters and promoting strain from establishments proceed to behave as a counterweight.

Crypto markets proceed to report a sentiment shift, with the worldwide market capitalization up virtually 3%.

Ethereum Levels Restoration

Ethereum’s worth has surged almost 30% since bottoming out at $2,111 on August 5 amid ongoing restoration efforts. The every day chart reveals a sample of upper lows in each the value and the Relative Energy Index (RSI), indicating rising bullish momentum. This momentum may strengthen additional if the RSI decisively strikes above the 50 mark.

The spikes on the quantity profile (orange) additionally present ETH bulls are ready to work together with the Ethereum worth as soon as it enters the demand zone between $2,924 and $3,075. Notably, this order block changed into a bearish breaker when Ethereum’s worth slipped under it on August 3.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

With Bitcoin taking again the $60,000 psychological stage and the worldwide market capitalization up 3%, crypto markets present a shifting sentiment. Amongst different causes, tailwinds sprout from constructive ETF flows, with ETH ETFs taking the lead.

As BeInCrypto reported, Ethereum led capital inflows into crypto funding merchandise final week. It attracted $155 million out of the whole $176 million.

“Ethereum has benefited the most from the recent market correction, attracting $155 million in inflows last week. This brings its year-to-date inflows to $862 million, the highest since 2021, largely driven by the recent launch of US spot-based ETFs,” a CoinShares report learn.

Counterbalances to ETH Value Motion

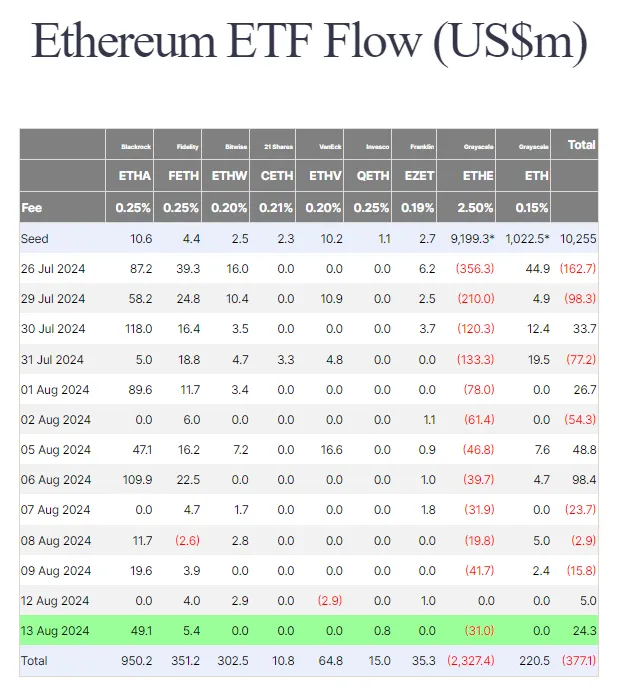

On Tuesday, spot Ethereum ETFs registered $24.34 million in web inflows, successfully beating the $5 million recorded on Monday. As per Farside Traders, BlackRock’s ETHA has persistently attracted inflows since its launch, suggesting robust investor confidence.

Particularly, ETHA recorded inflows of $49.1 million, bringing its whole inflows to $950.2 million. Alternatively, Grayscale’s ETHE continues to grapple with damaging flows, recording whole outflows of $2.327 billion. This displays the divergent efficiency between the 2 distinguished Ethereum ETFs, with Grayscale’s case ascribed to buyer redemptions because it occurred for Bitcoin in January.

“Institutions have done it before with BTC. They are doing it again with ETH. They almost made people believe that BTC ETF was a failure. It is almost the same story being repeated with ETH. We might retrace the gains of this cycle and then go back higher, but until then it is painful. Seeing the next-gen financial rails hammered to ashes is very painful!” Vikas Singh expressed.

Learn extra: The best way to Put money into Ethereum ETFs?

Nonetheless, whereas Ethereum ETF inflows create constructive momentum for ETH, the institutional sell-off acts as a counterforce, creating headwinds. Based on Lookonchain, Bounce Buying and selling began promoting ETH once more on Wednesday. The crypto arm of a Chicago-based buying and selling firmunstaked 7,049 ETH value $46.44 million from Lido Finance and put it up on the market.

“Jump Trading started selling ETH again just now! They claimed 17,049 ETH ($46.44 million) from Lido and transferred it out for sale. Jump Trading currently has 21,394 wstETH ($68.58 million) left,” Lookonchain wrote.

BeInCrypto reported that the agency had utilized to redeem over 14,000 ETH, valued at over $48 million, on August 7. Thiswas the identical day it unstaked 11,500 ETH, valued at $29 million from Lido Finance, and moved it to a centralized change. It additionally offered ETH value over $231 million on August 5.

Transferring locked belongings to centralized exchanges typically signifies an intention to promote, doubtlessly placing downward strain on ETH’s worth. These sell-offs in opposition to ETF investor demand have capped Ethereum’s upside under $2,800, with potential for range-bound motion amidst these counterbalances.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.