Cardano (ADA) is going through renewed strain, dropping almost 5% on Wednesday. ADA buying and selling quantity has additionally slipped 19% to $751 million. Regardless of this pullback, some indicators are starting to flash early indicators of potential development shifts.

The BBTrend has turned optimistic for the primary time in over every week, hinting at a attainable change in momentum, whereas the DMI exhibits that ADA could also be consolidating after a pointy transfer.

Cardano BBTrend Is Now Constructive, However Nonetheless At Low Ranges

Cardano’s BBTrend indicator is at present at 2.25, marking its highest studying since March 8. For the previous 9 days, since March 18, the BBTrend remained damaging or hovered close to zero, even reaching a low of -2.14 on March 19.

This latest uptick suggests a shift in market habits, because the indicator strikes out of neutral-to-bearish territory and right into a extra optimistic development construction.

Whereas 2.25 isn’t an excessive studying, it does sign that momentum is starting to tilt in favor of patrons after a protracted interval of indecision or weak spot.

The BBTrend, or Bollinger Band Pattern indicator, measures the power and route of a development based mostly on value habits relative to the Bollinger Bands.

Values above zero typically level to bullish situations, whereas values under zero recommend bearish sentiment. A studying of two.25 signifies that value is beginning to development upward with rising volatility enlargement—although not but at robust development ranges, it marks a notable enchancment.

If the BBTrend continues to rise, it may assist the event of a extra sustained uptrend for ADA, particularly if accompanied by elevated quantity and a break above key resistance ranges.

ADA DMI Exhibits The Consolidation May Finish Quickly

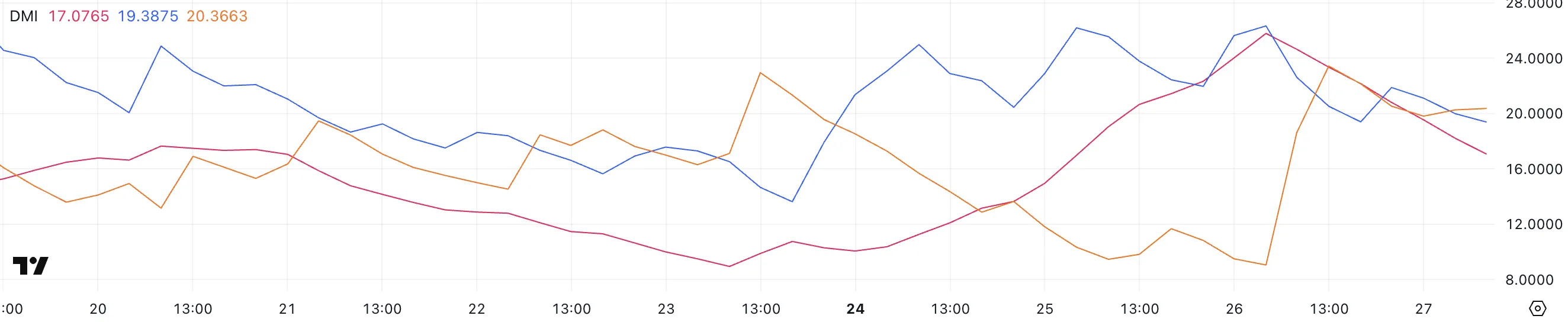

Cardano’s DMI chart exhibits that the Common Directional Index (ADX) has dropped to 17, a pointy decline from 25.79 only a day earlier. This means a big weakening in development power following yesterday’s fast value surge and subsequent drop.

The ADX is a key element of the DMI system and is used to gauge the power of a development—no matter route.

Usually, an ADX under 20 indicators a scarcity of robust development or consolidation, whereas readings above 25 point out a extra established development gaining traction.

Alongside the ADX, the +DI (Constructive Directional Indicator) and -DI (Adverse Directional Indicator) present perception into the route of momentum. Presently, +DI has fallen to 19.38 from 26.33, whereas -DI has surged to twenty.36 from 9.

This crossover means that sellers are starting to take management, whilst the general development weakens.

With each the ADX trending downward and the DI traces crossing in favor of the bears, this implies a market in consolidation however with growing draw back strain. Until momentum shifts once more, ADA could wrestle to regain upward traction within the brief time period.

Can Cardano Return To $1 Earlier than April?

Cardano’s DMI traces recommend the asset is present process a correction following a failed try to interrupt above the important thing resistance degree at $0.77.

This rejection has shifted momentum, and if Cardano’s value continues to drop, the following space to look at is the assist round $0.69. Ought to that degree fail to carry, it may set off additional draw back motion, probably pushing ADA right down to the $0.64 vary.

The DMI’s directional shift helps this short-term bearish view, with sellers progressively gaining power as patrons lose momentum.

Nevertheless, if ADA can reclaim its upward momentum, there’s nonetheless room for a bullish reversal. A renewed push towards the $0.77 resistance degree may deliver a breakout state of affairs again into play.

If that degree is breached with robust quantity, it may open the door for a rally towards the $1.02 area—taking Cardano above the $1 mark for the primary time since early March.

Such a breakout would probably be supported by a bullish crossover within the DMI traces and a strengthening ADX, confirming a brand new upward development.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.