Canada is without doubt one of the wealthiest international locations on this planet. For generations, this has meant Canada is a spot the place

everybody might safe a greater future for themselves and their youngsters. That is in no small half is because of our

dedication to progressive taxation, investments in Canada’s robust social security web, and an efficient,

environment friendly authorities. Collectively, Canada’s tax and profit methods have supported equality of alternative

for generations of Canadians.

In the previous few many years, the pathways loved by generations of Canadians to construct a center class life have

come beneath strain. From the pandemic’s disruptions of the worldwide economic system to persistent underinvestment in

housing by earlier governments, the price of dwelling disaster and the worldwide shift to a winner-take-all digital

economic system, these on the high have been getting richer whereas youthful generations battle to purchase a primary dwelling and

afford to begin a household.

At this time, youthful Canadians—by no fault of their very own—are too usually discovering that their arduous work is just not

paying off. That is not honest.

Canada’s potential should be leveraged to repair this; we should make investments to make sure youthful generations have the

identical alternatives as these earlier than them.

That’s the reason the federal authorities is taking motion to construct a fairer future, with transformative investments

in housing, innovation, the clear economic system, and in youthful generations. We’ll unlock the promise of Canada,

so each era can construct a greater life, as their mother and father and grandparents did earlier than them. It’s essential

that the federal government ensure youthful Canadians can afford to get an excellent schooling and in-demand abilities, purchase a

dwelling, elevate a household, and construct an excellent center class life.

Canada’s fiscally accountable financial plan and our AAA credit standing are the inspiration for the

stability of our economic system. They make Canada a protected and enticing vacation spot for funding and create enterprise

certainty. Financing the funding we want by extra debt could be unfair to younger Canadians—we would like them to

inherit prosperity, not our unpaid payments.

We now have a greater, fairer choice. We’re making the accountable selection.

The federal government is asking the wealthiest Canadians to pay their justifiable share.

Funds 2024 proposes new measures that may make the tax system extra honest and generate $21.9 billion in

income over 5 years to spend money on constructing extra houses, quicker, creating good-paying jobs, and incentivizing

financial development that delivers equity for each era.

Evaluation by the Parliamentary Funds Officer exhibits that in 2019 the highest 1 per cent held 24.9 per cent of

Canada’s family wealth.

At a time when center class Canadians are struggling to get forward, when their arduous work is not paying off,

the federal government is enhancing the equity of the tax system. We’re asking the wealthiest Canadians to contribute

a bit extra, in order that we are able to make investments to make sure a good probability for each era.

Common Household Internet Value by Revenue Group, 2019

8.1 Tax Equity

Key Ongoing Actions

Serving to the Center Class Save Tax-Free

Tax-sheltered financial savings plans allow most Canadians to earn their funding earnings tax free. An eligible

Canadian with taxable earnings of $100,000 in 2023 can contribute as much as $18,000 to their Registered Retirement

Financial savings Plan (RRSP), $8,000 to their Tax-Free First Dwelling Financial savings Account (FHSA), and $7,000 to their

Tax-Free Financial savings Account (TFSA) in 2024 is along with any unused saving room from prior years.

- Funding earnings, together with capital positive factors, earned in an RRSP, FHSA, or TFSA is just not taxed.

- Contributions made to an RRSP or FHSA will be deducted from an individual’s earnings within the 12 months they’re

made, lowering taxes. - Withdrawals from an FHSA are tax-free.

Onerous work ought to repay. And Canada’s tax system must be honest. By investing in housing, college students,

researchers, post-secondary establishments, youngster care, and good-paying job alternatives, we are able to restore the

worth of arduous work and unlock the complete potential of Canada’s youthful generations. Canada’s future

success is determined by their success. It is just honest that these vital investments are funded by those that have

benefited probably the most from all the chance that Canada has to supply, together with the highest 1 per cent.

Canada’s tax system will be extra honest. The rich are presently capable of profit from tax benefits that

center class Canadians and, particularly, youthful Canadians are not often capable of profit from. And, because of the

international company tax race to the underside, the most important multinational firms don’t all the time pay their honest

share.

Canada’s potential should be leveraged to repair this; we should make investments to make sure youthful generations have the

identical alternatives as these earlier than them and to make sure the best way we fund these generational investments is

basically honest— to Canadians immediately, and tomorrow.

Our tax system must work higher for nurses, lecturers, development staff, servers, labourers, and younger

professionals—these within the center class, and people working arduous to affix it.

These with the best potential to pay ought to contribute extra to assist fund the social security web that advantages

all Canadians. To develop the center class and spend money on youthful Canadians—whereas protecting their taxes decrease—new

generational investments in Funds 2024 shall be supported by contributions from the wealthiest Canadians.

Bettering Tax Equity

Canadians pay tax on the earnings from their job. However presently, they solely pay taxes on 50 per cent of capital

positive factors, which is the revenue usually made when an asset, reminiscent of shares, is bought. That is the capital positive factors tax

benefit.

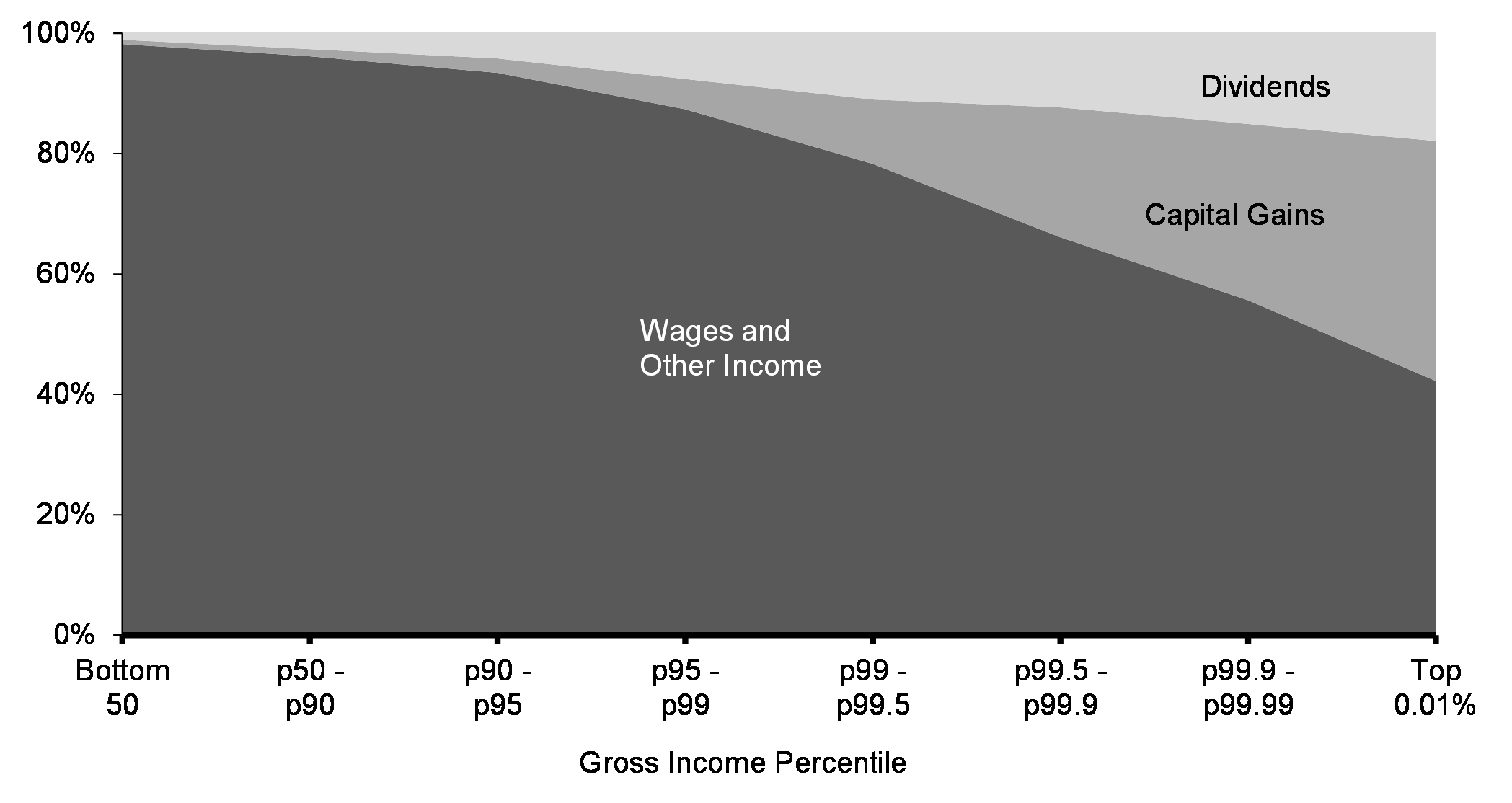

Whereas all Canadians can profit from the capital positive factors tax benefit, the rich, who are inclined to earn comparatively

extra earnings from capital positive factors, disproportionately profit in comparison with the center class (Chart 8.2). In 2021,

the highest 1 per cent earned 10.4 per cent of all earnings in Canada; when capital positive factors are factored in, this jumps

to 13.4 per cent.

Tax equity is vital for each era, and it’s significantly vital for youthful Canadians. In

2021, solely about 5 per cent of Canadians beneath 30 had any capital positive factors in any respect.

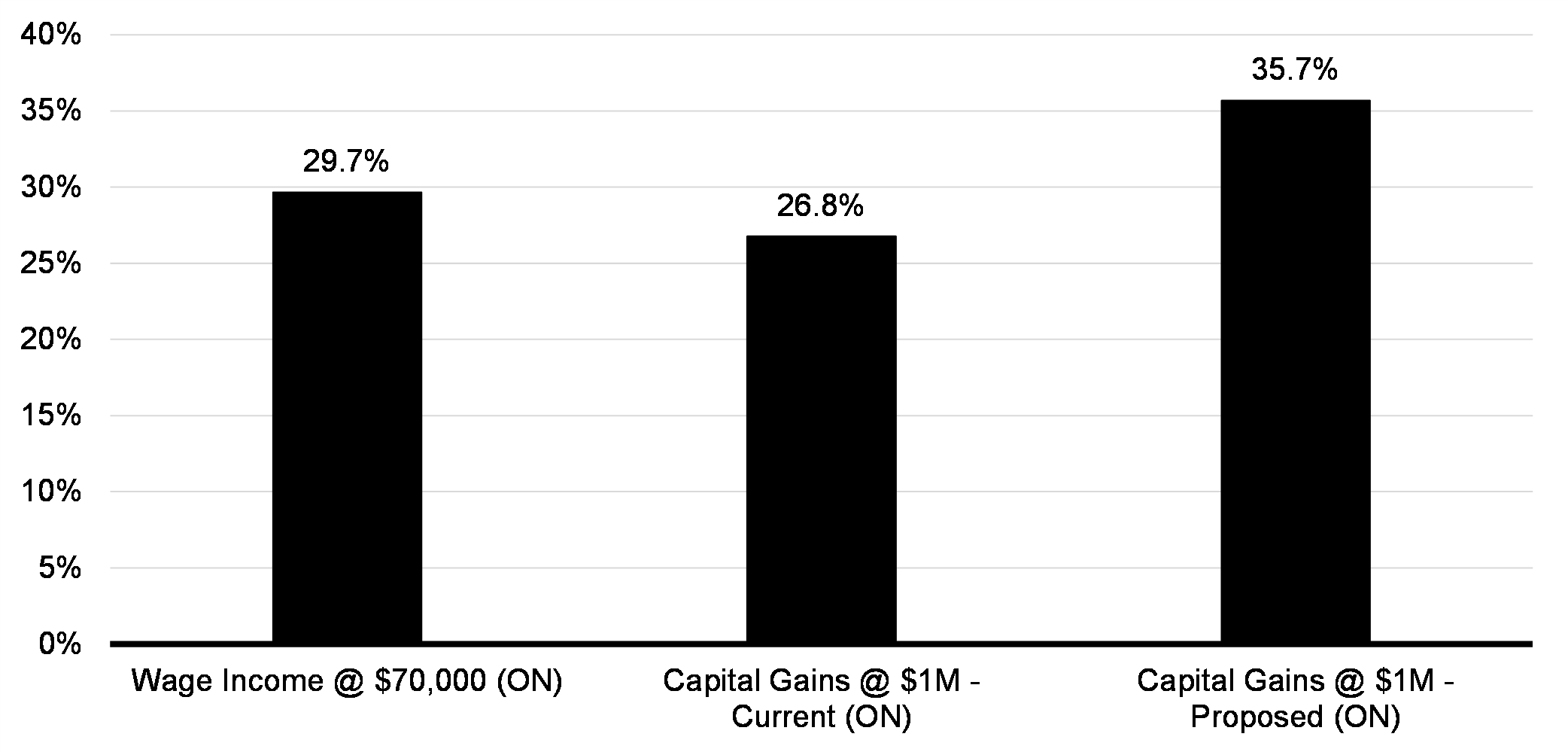

The present regime might end in conditions the place rich people face a decrease marginal tax price on their

capital positive factors than what a center class employee would face on their earnings. As an illustration, a nurse in Ontario

incomes $70,000 would face a mixed federal-provincial marginal tax price of 29.7 per cent. As compared, a

rich particular person in Ontario with $1 million of earnings would face a marginal tax price of 26.8 per cent on their

capital positive factors.

Variations in taxation charges between earnings earned from wages, capital positive factors, and dividends presently favour

the wealthiest amongst us.

Capital Beneficial properties as a Share of Gross Revenue by Revenue Percentile

The federal government is dedicated to a good and progressive tax system. By rising the capital positive factors inclusion

price, we are going to sort out some of the regressive components in Canada’s tax system. Our authorities is proud

to be lowering this inequity. Taxing capital positive factors is just not an inherently partisan concept. It’s an concept that

everybody who cares about equity can assist.

The truth is, the concept of taxing capital positive factors in Canada first received traction with the federal government of Prime Minister

John Diefenbaker and the Royal Fee on taxation, chaired by Kenneth Carter. Within the Royal

Fee’s report, Carter declared that equity must be the foremost goal of the tax system,

famously insisting “a buck is a buck is a buck”. As of 1990, the federal government of Prime Minister Brian

Mulroney had raised the capital positive factors inclusion price to 75 per cent.

To make Canada’s tax system extra honest, the federal government is proposing a rise in taxes on capital positive factors.

The proposed greater inclusion price on capital positive factors would end in extra equitable marginal tax charges throughout

income sources and earnings ranges. Particularly, the proposal would enhance the common federal-provincial

marginal tax price on capital positive factors above $250,000 of somebody incomes $1 million a 12 months, to 35.7 per cent (chart

8.3).

Marginal Tax Charges on Wages versus Capital Beneficial properties

To make sure this enhance within the capital positive factors inclusion price is concentrated among the many wealthiest, whereas protecting

taxes decrease on the center class, the primary $250,000 of capital positive factors earnings earned by Canadians every year will

not be topic to the brand new two-thirds inclusion price. Business homeowners can have entry to this exemption from the

elevated inclusion price as people.

Subsequent 12 months, 28.5 million Canadians will not be anticipated to have any capital positive factors earnings, and three million are anticipated

to earn capital positive factors beneath the $250,000 annual threshold. Solely 0.13 per cent of Canadians with a median

earnings of $1.4 million are anticipated to pay extra private earnings tax on their capital positive factors in any given 12 months

(Desk 8.1).

Because of this, for 99.87 per cent of Canadians, private earnings taxes on capital positive factors won’t

enhance.

| Variety of folks1 | Share of all folks | Common gross earnings, together with capital positive factors | |

|---|---|---|---|

| Capital positive factors above $250,000 | 40,000 | 0.13% | $1,411,000 |

| No capital positive factors or lower than $250,000 | 31,531,000 | 99.87% | $60,000 |

|

Notes: Inhabitants is projected share of T1 filers. Doesn’t account for behavioural

1 Capital positive factors are web of these for which the Lifetime Capital Beneficial properties Exemption is claimed. |

|||

Along with the $250,000 threshold for the brand new price, center class Canadians will proceed to learn from

tax-free financial savings accounts, the principal residence exemption, and exemptions for registered pension plans. The

following examples of tax-sheltered center class financial savings won’t be impacted by lowering the capital positive factors tax

benefit:

For Canadian companies, solely a small minority shall be affected by these modifications: in 2022, solely 12.6 per cent

of Canada’s over two million firms had capital positive factors (Desk 8.2).

| Variety of firms | Share of all firms | Common taxable earnings1 | |

|---|---|---|---|

| Capital positive factors | 307,000 | 12.6% | $702,000 |

| No capital positive factors | 2,124,000 | 87.4% | $174,000 |

|

Notes:

1 Information don’t modify for earnings of associated firms. |

|||

The proposal would scale back the tax price differentials that presently exist between the varied sources of

earnings, as an example between dividends and capital positive factors. A extra impartial system on this regard has the

further benefit of lowering tax planning incentives.

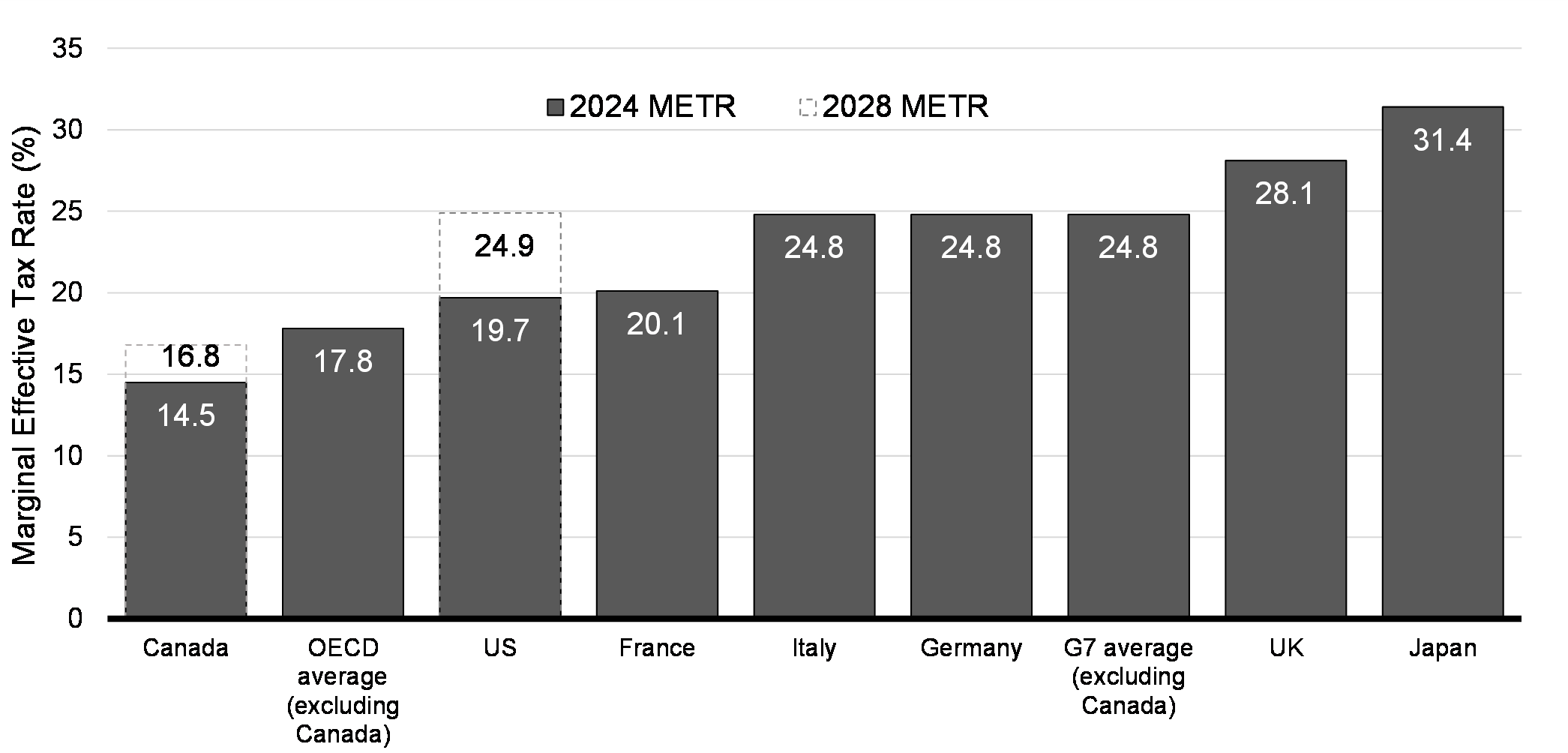

Rising the capital positive factors inclusion price is just not anticipated to harm Canada’s enterprise competitiveness.

The Marginal Efficient Tax Charge (METR) is an estimate of the extent of taxation on a brand new enterprise funding,

accounting for federal, provincial, and territorial taxation, in addition to funding tax credit, and capital

price allowances. It is without doubt one of the fundamental metrics for evaluating the extent of taxation on a brand new enterprise funding

between international locations. Sustaining a aggressive METR is vital for Canada’s attractiveness as an

funding vacation spot.

Canada’s common METR is the most effective within the G7, and much more advantageous than within the U.S. and different OECD

international locations. Rising the equity of capital positive factors taxation won’t impression Canada’s METR rating.

Canada Has the Lowest Marginal Efficient Tax Charge within the G7

It’s estimated that this measure would enhance federal revenues by $19.4 billion over 5 years beginning in

2024-25.

Rising the inclusion price on capital positive factors can be anticipated to generate vital new income for

provincial and territorial governments, equal to as much as 60 per cent of the brand new federal income. For

provinces and territories, this new income can be utilized to raise up each era by making transformative

investments in housing, well being care, schooling, youngster care, infrastructure, and extra.

A Tax Break for Entrepreneurs

To start out and scale-up a enterprise, entrepreneurs want entry to capital. Within the early development phases, accessing

the required capital to make investments of their workforce, cutting-edge applied sciences, and new places of work, labs,

or manufacturing amenities will be tough. Whereas some entrepreneurs depend on enterprise capital or loans, the

authorities acknowledges funding is just not obtainable to all entrepreneurs, and even when obtainable, will not be

enough.

Entrepreneurs want extra assist to drive Canada’s financial development, enhance productiveness, patent new

improvements, and create good-paying jobs. Offering a partial lifetime capital positive factors exemption for entrepreneurs

will allow them to recycle extra capital in direction of their subsequent aim, whether or not or not it’s a brand new firm, an funding in

a promising start-up, or a cushty retirement.

Finally, when the Canadian Entrepreneurs’ Incentive is absolutely carried out, and mixed with the

elevated whole lifetime capital positive factors exemption of $1.25 million, entrepreneurs will profit from no less than

$3.25 million in whole and partial lifetime capital positive factors exemptions. Entrepreneurs with eligible capital positive factors

of as much as $6.25 million shall be higher off beneath these modifications. In observe, these numbers will seemingly be greater

to mirror the inflation adjustment for the lifetime capital positive factors exemption and the power to unfold capital

positive factors over a number of years.

Guaranteeing entrepreneurs profit from their improvements

Kate based a fintech start-up a number of years in the past, and decides to simply accept a suggestion to promote her firm to a

giant fintech firm, which is able to use its assets to scale-up her expertise. She earns $2 million in

capital positive factors on this sale.

Kate has already used her elevated lifetime capital positive factors exemption of $1.25 million when she bought

a few of her enterprise shares to a enterprise accomplice.

At the moment, Kate would pay tax on $1 million—or 50 per cent of her $2 million in capital positive factors.

When the Canadian Entrepreneurs’ Incentive is absolutely carried out, Kate would solely pay tax on 33 per

cent of the $2 million—$667,000. The inducement reduces her taxable earnings by $333,000 when promoting her

enterprise.

Guaranteeing World and Digital Firms Pay Their Honest Share

The worldwide company tax race to the underside undermines Canada’s potential to make investments at dwelling that

assist restore equity for each era. Our tax base wanted to pay for a sustainable social security web is

weakened, and duty to fund these applications is unfairly distributed and handed on to the subsequent

era. This should change to make sure equity for youthful Canadians immediately, and tomorrow.

In Canada, we’re laser centered on ensuring the most important international firms pay their justifiable share.

That is why Canada strongly helps the two-pillar tax reform plan agreed to in 2021 by members of the

OECD/G20 Inclusive Framework on Base Erosion and Revenue Shifting.

Pillar One and the Digital Providers Tax

Pillar One would be certain that the most important and most worthwhile international firms, together with giant digital

firms, pay their justifiable share of tax within the jurisdictions the place their customers and prospects are positioned.

Canada reaffirms its dedication to Pillar One and can proceed to work diligently to finalize a multilateral

treaty and convey the brand new system into impact as quickly as a important mass of nations is prepared. Nonetheless, in view

of consecutive delays internationally in implementing the multilateral treaty, Canada can’t proceed to attend

earlier than taking motion.

In October 2021, the federal government agreed to pause the implementation of Canada’s Digital Providers Tax,

first introduced in 2020, till the top of 2023, to offer time for Pillar One negotiations to conclude. In the meantime,

no less than seven different international locations (Austria, France, India, Italy, Spain, Türkiye, and the UK) proceed

to use their Digital Providers Taxes.

The federal government is transferring forward with its longstanding plan to enact a Digital Providers Tax. It will guarantee

digital companies that monetize the info and content material of Canadian customers are paying their justifiable share, and that

Canada is just not at a drawback relative to different international locations. Implementing laws is presently earlier than

Parliament in Invoice C-59.

According to Canada’s place since 2021, and topic to Parliamentary approval of the laws,

the tax would start to use for calendar 12 months 2024, with that first 12 months masking taxable revenues earned since

January 1, 2022.

Canada is dedicated to proceed working with worldwide companions in view of its desire for an

internationally agreed method.

It’s estimated that the Digital Providers Tax will enhance revenues by $5.9 billion over 5 years beginning

in 2024-25.

Pillar Two and the World Minimal Tax

Pillar Two of the plan is a world minimal tax regime to make sure that giant multinational firms are

topic to a minimal efficient tax price of 15 per cent on their income wherever they do enterprise. The federal

authorities is transferring forward with laws to implement the regime in Canada, following consultations final

summer time on draft legislative proposals for the brand new World Minimal Tax Act. The federal government intends to

quickly introduce this laws in Parliament.

It’s estimated that the worldwide minimal tax, which is able to apply for fiscal years of taxpayers that start on or

after December 31, 2023, will enhance revenues by $6.6 billion over three years beginning in 2026-27.

8.2 Modernizing Canada’s Tax System and Higher Providers for Canadians

Every day, hundreds of thousands of Canadians work together with the federal government once they entry the providers and advantages,

together with these delivered by the tax system, which have vital roles in enhancing their high quality of life

and constructing a stronger, extra aggressive Canada. Canadians ought to be capable to depend on environment friendly, well timed, and

high-quality providers from the federal authorities. That’s the reason the federal government has been making sustained

investments to make the tax system and different providers simpler to make use of and extra handy for Canadians.

Funds 2024 proposes new investments to simplify tax providers and ship advantages and providers by trendy

applied sciences which can be designed to fulfill the evolving wants of Canadians, together with over ten million Canadians

receiving advantages price over $150 billion yearly from Previous Age Safety, Employment Insurance coverage, and the Canada

Pension Plan.

Key Ongoing Actions

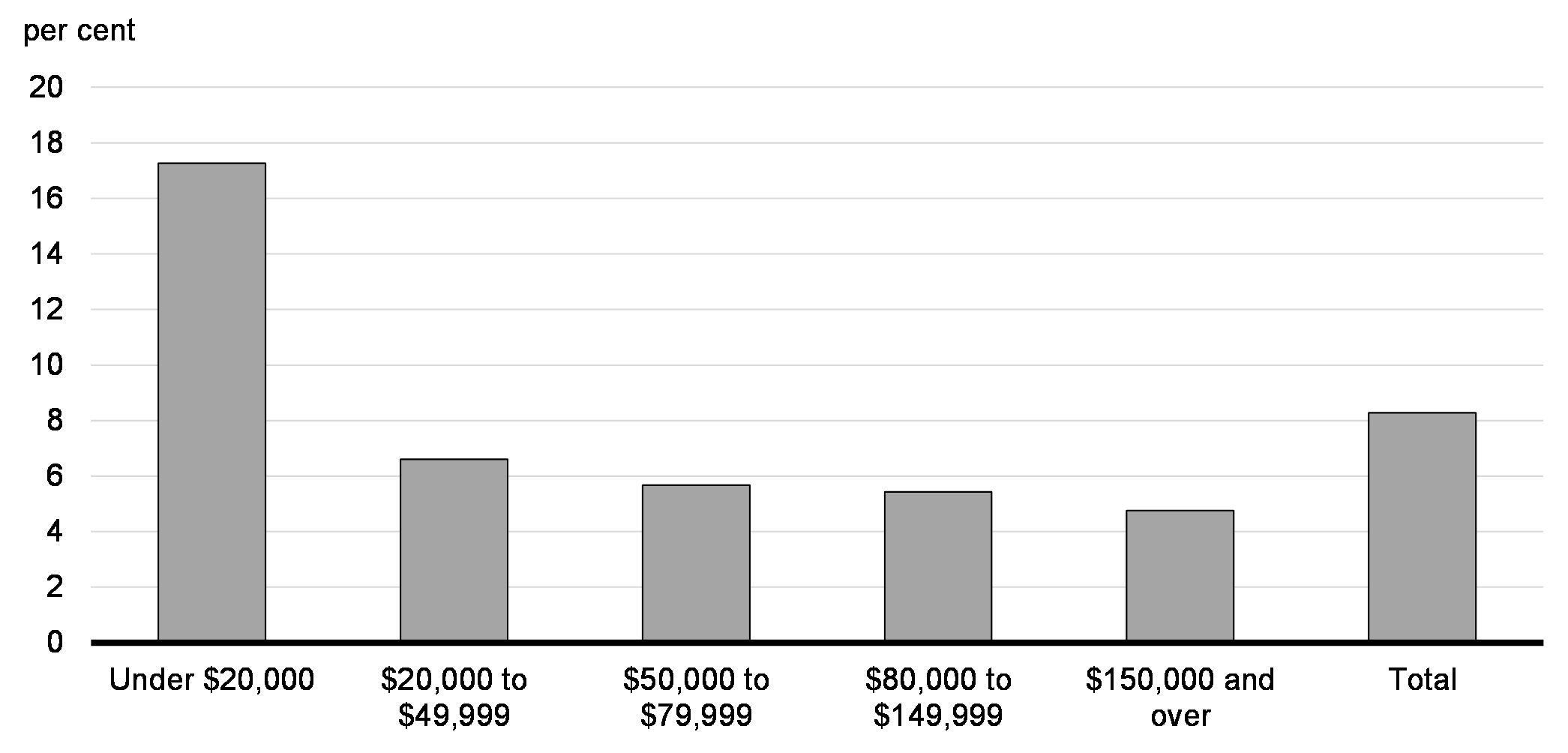

Automated Tax Submitting for Low-Revenue Canadians

Canadians ought to be capable to simply and shortly obtain the advantages to which they’re entitled. Nonetheless,

lower-income Canadians, in addition to youthful Canadians, might not obtain their advantages—such because the Canada Youngster

Profit and Canada Carbon Rebate which make life extra reasonably priced—due to the problem of submitting a tax

return.

In February 2024, the Canada Income Company (CRA) elevated the variety of eligible Canadians for SimpleFile by

Cellphone (previously File My Return) to 1.5 million folks, greater than double the variety of folks eligible final

12 months. The CRA is on observe to extend this quantity to 2 million by 2025.

The CRA will have interaction main consultants and trade to determine additional alternatives to assist extra Canadians

obtain the advantages designed to assist them. CRA will present an replace on this work in fall 2024.

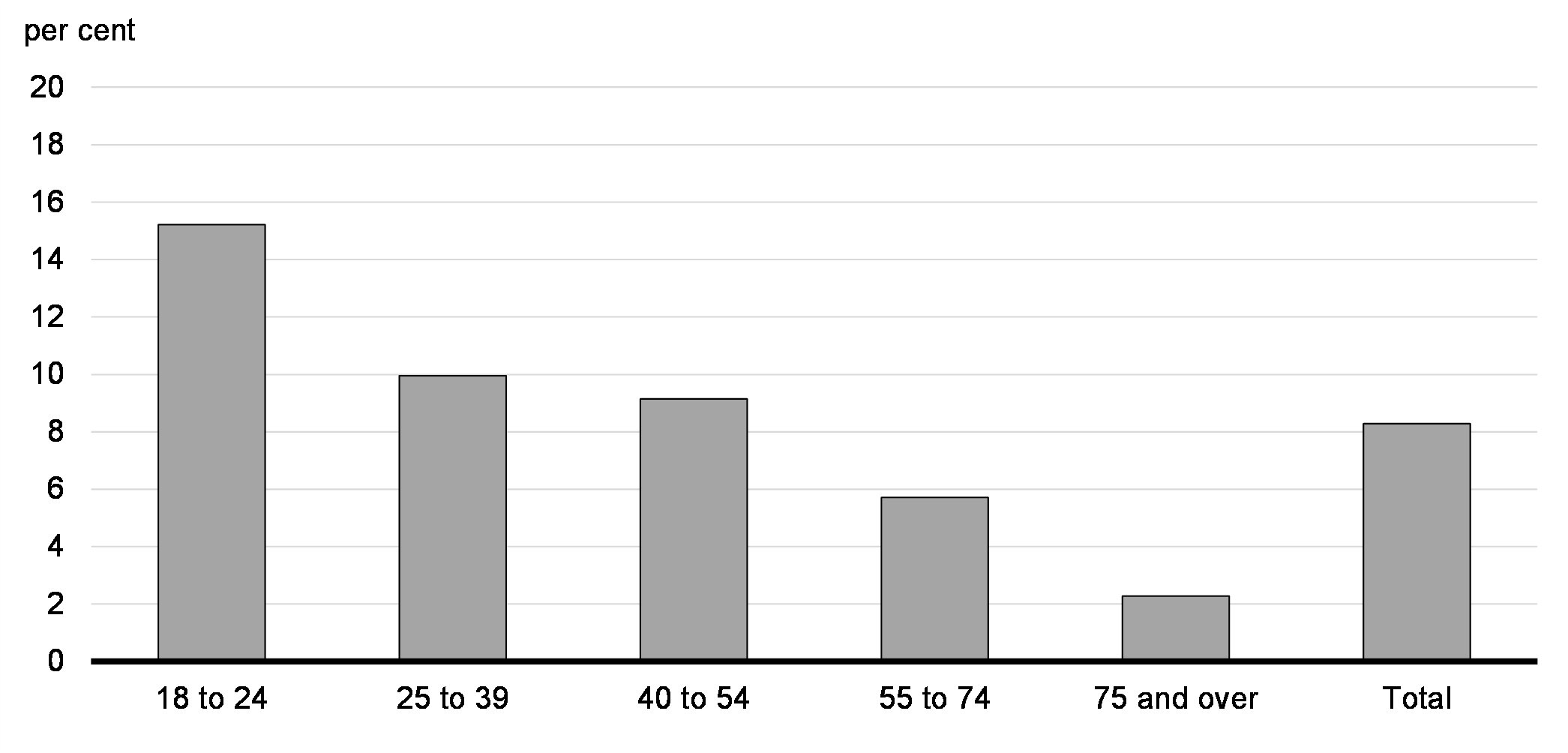

Non-Submitting Charges by Revenue Group, 2020

Non-Submitting Charges by Age Group, 2020

Automated tax submitting pilot

Johnny lives in Manitoba and has by no means filed a tax return, and in consequence is lacking out on advantages reminiscent of

the GST Credit score, Canada Carbon Rebate, provincial hire credit, and probably others that assist make life extra

reasonably priced.

Johnny’s main supply of earnings is social help, which suggests he could also be invited to take part in

the SimpleFile pilot. Johnny wouldn’t need to fill out complicated types. The CRA would use the

data it has readily available for him and his responses to a sequence of brief easy questions, together with

data on his hire funds which the CRA doesn’t in any other case have, to finish and file his tax return,

thereby unlocking the federal government assist to which he’s entitled.

Decreasing CRA Name Centre Wait Occasions

Canadians deserve high-quality and well timed entry to authorities providers. Nonetheless, when calling the Canada

Income Company (CRA), Canadians usually face lengthy wait instances—which delay Canadians from getting assist with submitting

their taxes and receiving the advantages they’re entitled to.

To make sure Canadians get well timed solutions to their tax questions, the federal government is continuous to assist CRA

name centre operations.

A Single Signal-In Portal for Authorities Providers

Canadians and companies should not have to recollect a number of passwords to entry the providers and

applications they depend on. Nonetheless, there are presently over 60 completely different Authorities of Canada methods every

requiring their very own separate log-in and passwords to entry. That’s too many.

Quick and environment friendly supply of presidency providers and applications is important to making sure Canadians and

companies are supported as meant.

Increasing Tax Transparency to Crypto-Property

Simply as crypto-assets pose monetary dangers to center class Canadians, the fast development of crypto-asset markets

poses vital dangers of tax evasion. Regulation and the worldwide trade of tax data should maintain

tempo with tax evasion threats with a purpose to guarantee a good tax system.

The OECD has agreed to a brand new reporting framework for crypto-asset transactions and enhancements to the Frequent

Reporting Customary to make sure that new digital applied sciences can’t be used to keep away from present reporting

necessities.

In direction of a More healthy, Nicotine-Free Technology

Enticed by interesting advertising and marketing, Millennials and Gen Z are selecting up new types of outdated dangerous habits, vaping almost

as incessantly because the child boomers smoked cigarettes. The federal government is taking motion to guard the subsequent

era from dangerous, cancer-causing habits.

Nothing is extra helpful than an extended and wholesome life. People who smoke might dwell about ten years lower than the

basic inhabitants. That is, partly, as a result of individuals who smoke are 25 instances extra prone to die from lung most cancers

in comparison with somebody who has by no means smoked. Treating preventable ailments places a heavy burden on our common

public well being care methods—a burden all Canadians pay for by taxes and longer wait instances.

Along with elevating revenues, a extra sturdy federal excise responsibility framework for tobacco and vaping merchandise

might assist to decrease smoking charges in direction of Canada’s goal of lower than 5 per cent tobacco use by 2035,

in addition to decrease vaping charges amongst youthful Canadians.

Bettering Profit Supply

Canadians deserve environment friendly and quick access to their federal advantages, reminiscent of Previous Age Safety and Employment

Insurance coverage. Nonetheless, the IT methods used to ship these advantages are ageing.

After years of underinvestment and deferred modernization, the federal government has taken motion in recent times to

make important IT upgrades. These will be certain that advantages are delivered shortly, reliably, and securely to the

hundreds of thousands of Canadians gathering advantages immediately, in addition to to those that will acquire advantages within the many years to

come.

The federal government additionally stays dedicated to implementing an ePayroll answer which would scale back the reporting

burden on Canadian companies, particularly small companies, whereas modernizing and enhancing how advantages are

supplied by the Employment Insurance coverage and tax methods.

Canada Youngster Profit for Grieving Households

Grieving households shouldn’t be apprehensive about their funds throughout probably the most tough of life circumstances.

Nonetheless, some households who’ve misplaced a toddler might presently obtain correspondence from the federal government requiring

them to repay any Canada Youngster Profit quantity acquired after their kid’s demise.

To assist mother and father who’ve misplaced a toddler, the federal government is offering new assist by the Canada Youngster

Profit to make sure they will give attention to what issues most—therapeutic.

This proposed change is predicted to price $15 million over 5 years, beginning in 2024-25, and $4 million per

12 months ongoing.

8.3 Efficient, Environment friendly Authorities

To focus spending on what issues most—investing in Canadians, unlocking alternative for youthful Canadians, and

restoring equity for each era—the federal government should make sure the operations of presidency are price

efficient.

As our nation grows and demographics shift, reminiscent of Millennials just lately overtaking child boomers because the

largest age group, the federal government should adapt to the altering wants of Canadians. That is why the federal government

is constantly evaluating demand for providers and applications, and adjusting investments accordingly—guaranteeing

Canadians have the assist they want, once they want it.

Funds 2024 broadcasts new measures to make sure the efficient operation of federal authorities applications and

providers, and guaranteeing that Canadians’ tax {dollars} are getting used effectively on the applications that matter

most to them.

Accountable Authorities Spending

Funds 2023 and the 2023 Fall Financial Assertion introduced a complete of $15.8 billion in financial savings over

5 years, and $4.8 billion ongoing, to be refocused in direction of the priorities that matter most to Canadians

immediately, together with well being care, dental care, and investments in Canada’s financial plan.

Over the previous 12 months, the federal government carried out the primary section of refocusing authorities spending, figuring out

areas of duplication, low worth for cash, or lack of alignment with authorities priorities, with a selected

give attention to journey and consulting. Care was taken to make sure that departments and companies might meet their

reallocation targets with out impacting direct advantages and repair supply to Canadians; direct transfers to

different orders of presidency and Indigenous communities; and the Canadian Armed Forces. Outcomes of this primary

section are outlined within the Most important Estimates, 2024-25 and the 2024-25 Departmental Plans.

Canadians know the way vital it’s to responsibly handle a funds whereas on the identical time contending with rising

prices, and so they rightly count on the federal government to do the identical. This measure won’t impression the supply of

advantages to Canadians and shall be carried out in a method that continues to assist regional illustration and a

numerous public service workforce.

Going ahead, the federal government will proceed to overview spending throughout departments and on key initiatives to

guarantee the federal government operates successfully and effectively for Canadians. Ongoing critiques of presidency spending

and programming are an vital element of managing public funds in a prudent and accountable method.

Strengthening Integrity within the Public Service

The federal government is taking motion to implement and uphold the best requirements of procurement to make sure sound

stewardship of public funds. This work is important to making sure Canadians belief that federal establishments are

environment friendly and efficient. As a part of this work, the federal government has just lately carried out further sturdy

requirements to strengthen oversight and maintain public servants to the best of moral requirements.

On March 20, 2024, the Minister of Public Providers and Procurement and the President of the Treasury Board

introduced a sequence of recent actions to strengthen the federal government’s procurement and battle of curiosity

regimes:

These actions will guarantee transparency in contracting and leverage information analytics to determine and instantly

take motion to resolve any potential anomalies in billing. These modifications may also be certain that public servants

clearly perceive and abide by their duties with respect to partaking in exterior employment.

Authorities Procurement to Increase Innovation

Public procurement is usually a device to drive innovation and assist Canadian companies bringing new, cutting-edge

options to market. Federal buying energy can and must be leveraged to higher assist small companies and

innovators to develop the economic system and create extra good jobs for Canadians.

A proposal for targets shall be outlined within the 2024 Fall Financial Assertion.

Strengthening Cyber Safety

Cyber safety is extra vital than ever as Canadians more and more work together with and obtain advantages from

the federal government through digital providers. The federal government is strengthening its instruments to keep up digital providers,

defend Canadians’ data, and enhance the resilience of federal companies within the face of rising

cyber threats.

Deposit Insurance coverage Overview

The federal deposit insurance coverage framework protects the steadiness of the monetary system in Canada by defending

Canadians’ financial savings and guaranteeing entry to monetary providers within the unlikely occasion of a financial institution failure.

Sustaining the effectiveness of the deposit insurance coverage framework requires ongoing evaluation to adapt to the

evolving monetary system and market.

Predictable Capital Funding for Federal Property

Federal actual property and knowledge expertise methods are integral to the whole lot the federal government does, from

delivering applications and providers to Canadians, to supporting the economic system and communities, and realizing broader

authorities aims of accessibility and lowering emissions. Predictable capital funding for Public Providers

and Procurement Canada to handle these property gives long-term worth and higher allows the federal government to

serve Canadians.

Asylum System Stability and Integrity

All over the world, the variety of folks displaced by political instability, battle, poverty, and local weather

change continues to rise. In line with the UN Refugee Company, in 2022, the worldwide variety of new particular person

asylum functions elevated by 83 per cent in comparison with 2021. Canada is just not immune to those dynamics, and extra

than ever earlier than, folks come to Canada searching for security and stability.

Canada’s asylum system, together with the processes and guidelines guiding the work of the border officers,

immigration officers, and members of the Immigration and Refugee Board who course of, examine, and adjudicate

asylum claims, has struggled to maintain up with the unprecedented variety of asylum claims. This has resulted in

longer durations of uncertainty for these in legit want of safety and delayed removals of these with

denied claims.

To uphold the integrity and equity of the asylum system:

| 2023-2024 | 2024-2025 | 2025-2026 | 2026-2027 | 2027-2028 | 2028-2029 | Complete | |

|---|---|---|---|---|---|---|---|

| 8.1. Tax Equity | 0 | -6,715 | -3,015 | -5 | -3,285 | -4,670 | -17,690 |

| Bettering Tax Equity | 0 | -6,900 | -3,370 | -375 | -3,660 | -5,050 | -19,355 |

| A Tax Break for Entrepreneurs | 0 | 185 | 355 | 370 | 375 | 380 | 1,665 |

| 8.2. Modernizing Canada’s Tax System and Higher Providers for

Canadians |

0 | 6 | -153 | -263 | -252 | -185 | -847 |

| Automated Tax Submitting for Low-Revenue

Canadians1 |

0 | 10 | 11 | 11 | 11 | 11 | 54 |

| Decreasing CRA Name Centre Wait Occasions | 0 | 249 | 87 | 0 | 0 | 0 | 336 |

| A Single Signal-In Portal for Authorities Providers | 0 | 6 | 7 | 8 | 2 | 2 | 25 |

| Increasing Tax Transparency to Crypto-Property1 | 0 | 6 | 6 | 11 | 15 | 12 | 52 |

| Towards a More healthy, Nicotine-Free Technology | 0 | -325 | -350 | -340 | -330 | -320 | -1,665 |

| Bettering Profit Supply2 | 0 | 60 | 87 | 51 | 53 | 113 | 364 |

|

Much less: Funds From CPP Account

|

0 | -2 | -5 | -7 | -7 | -7 | -27 |

| Canada Youngster Profit for Grieving Households | 0 | 1 | 3 | 3 | 4 | 4 | 15 |

| 8.3. Efficient, Environment friendly Authorities | 0 | 141 | 336 | 176 | 237 | 188 | 1,077 |

| Strengthening Cyber Safety | 0 | 14 | 14 | 15 | 3 | 3 | 49 |

|

Much less: Funds Sourced from Present Departmental

|

0 | -1 | -1 | -1 | 0 | 0 | -3 |

|

Much less: Prices to be Recovered

|

0 | 0 | -4 | -2 | -1 | -1 | -8 |

| Predictable Capital Funding for Federal Property | 0 | 44 | 114 | 23 | 120 | 66 | 368 |

| Asylum System Stability and Integrity | 0 | 83 | 213 | 142 | 150 | 156 | 743 |

|

Much less: Funds Sourced from Present Departmental

|

0 | 0 | 0 | 0 | -36 | -36 | -72 |

| Extra Investments – Tax Equity for Each Technology | 35 | 77 | -162 | -179 | -220 | -238 | -687 |

| Manipulating Bankrupt Standing | 0 | -85 | -85 | -85 | -85 | -85 | -425 |

| Funds 2024 broadcasts the federal government’s intention to amend the

Revenue Tax Act to deal with planning that entails the manipulation of the bankrupt standing of an bancrupt company as outlined in “Tax Measures: Supplementary Information”. |

|||||||

| CRA Funding to Administer Beforehand Introduced Measures | 0 | 19 | 18 | 17 | 14 | 14 | 81 |

| Funding proposed for the CRA and the CBSA to manage

beforehand introduced tax and different measures together with the modifications to the disbursement quota for charities, the federal gas cost within the 4 Atlantic provinces, the vaping excise responsibility framework, and the short-term leases measure. |

|||||||

| Adjustments to the Different Minimal Tax Reform | 35 | 131 | 122 | 113 | 113 | 108 | 622 |

| Funds 2024 broadcasts the federal government’s intention to revise

the Funds 2023 Different Minimal Tax proposal as outlined in “Tax Measures: Supplementary Data”. |

|||||||

| Bettering Potential to Handle Aggressive Tax Planning Schemes | 0 | 3 | 4 | 4 | 4 | 4 | 18 |

|

Much less: Projected Tax Income

|

0 | -100 | -100 | -100 | -100 | -100 | -500 |

| Funding proposed for FIN to enhance the integrity of the tax

system. The ensuing enhance in improvement of tax laws is estimated to offer further federal revenues for the fiscal framework totaling $500 million over 5 years. |

|||||||

| Enhancing the Safety Posture of the Privy Council Workplace | 0 | 8 | 9 | 9 | 9 | 5 | 40 |

| Funding proposed for PCO to boost bodily and cyber

safety and broaden entry to safe communication applied sciences for senior leaders within the authorities. |

|||||||

| Public Service Occupational Well being | 0 | 8 | 8 | 8 | 0 | 0 | 23 |

| Funding proposed for HC for the Public Service Occupational

Well being Program to make sure federal organizations meet occupational well being obligations beneath the Canada Labour Code. |

|||||||

| Expediting Entry to Data | 0 | 22 | 28 | 28 | 3 | 3 | 84 |

| Funding proposed for TBS and LAC to keep up the Entry to

Data and Privateness regime. |

|||||||

| Investing in Working the Canadian Coast Guard Fleet of the Future | 0 | 49 | 78 | 86 | 92 | 93 | 397 |

| Funding proposed for DFO to make sure the Canadian Coast Guard

has the required coaching capability, seagoing crew, assist employees, and provisions to function its future marine vessel fleet. |

|||||||

| Authorities Human Assets and Pay Technique | 0 | 135 | 0 | 0 | 0 | 0 | 135 |

| Funding proposed for PSPC and TBS to enhance public service

human assets and pay methods, together with persevering with work on a possible subsequent era pay answer. |

|||||||

| An Accessible, Various, Equitable and Inclusive Federal Public Service | 0 | 8 | 7 | 1 | 1 | 1 | 17 |

|

Much less: Funds Sourced from Present Departmental

|

0 | -1 | 0 | 0 | 0 | 0 | -1 |

| Funding proposed for TBS and PSC to assist the Workplace of

Public Service Accessibility, the Federal Internship Program for Canadians with Disabilities, and enhance recruitment and evaluation processes for individuals with disabilities. |

|||||||

| Help for the Workplace of the Public Sector Integrity Commissioner | 0 | 1 | 1 | 1 | 1 | 1 | 5 |

|

Much less: Funds Sourced from Present Departmental

|

0 | 0 | 0 | 0 | 0 | 0 | -1 |

| Funding proposed for the OPSIC to proceed to ship on its

mandate of investigating disclosures and complaints beneath the federal authorities employee whistleblower regime. |

|||||||

| Employment Insurance coverage Revenues for Measures Included in Funds 2024 | 0 | -119 | -250 | -261 | -271 | -281 | -1,182 |

| Consists of Employment Insurance coverage income for Extending Non permanent

Help for Seasonal Staff in part 4.2, Bettering Profit Supply in part 8.2, and Employment and Social Growth Canada Lease Value Adjustment in Desk A1.16. |

|||||||

| Chapter 8 – Internet Fiscal Impression | 35 | -6,492 | -2,995 | -271 | -3,520 | -4,905 | -18,147 |

|

Observe: Numbers might not add resulting from rounding. A glossary of abbreviations used on this desk

1 Administrative prices for the Canada Income Company.

2 Measure partially reimbursed by elevated Employment Insurance coverage premiums. |

|||||||