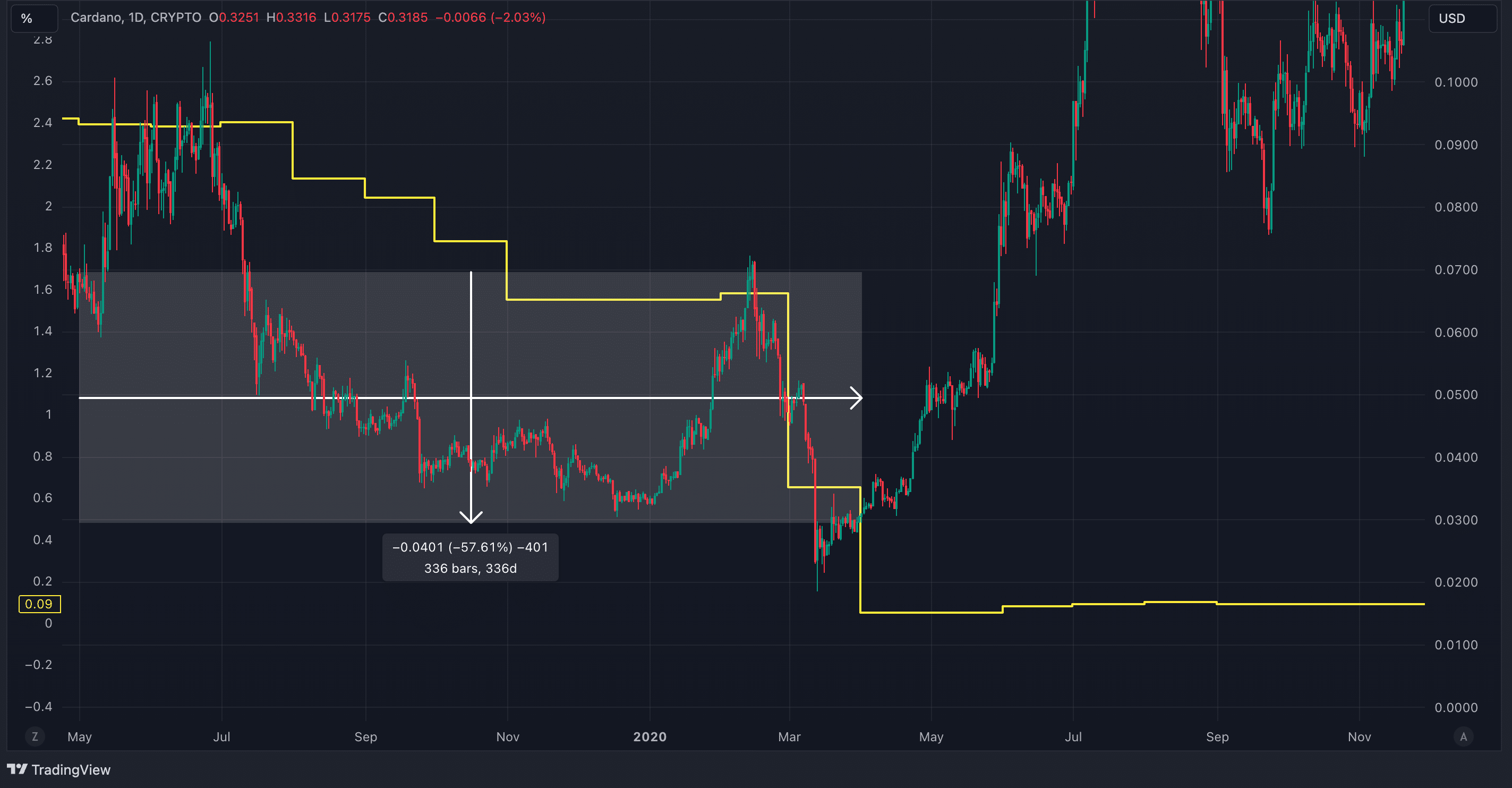

Cardano dropped 57% when the Federal Reserve reduce charges again in 2019. With one other fee reduce on the horizon, the cryptocurrency faces an identical setup that would carry main draw back.

Cardano prepares for September decline

In Might 2019, the Federal Reserve initiated its first fee reduce, decreasing charges from 2.42% to 2.39%. Charges at the moment have been a lot decrease than at the moment, and the general public debt stood at $22 trillion. Right now, debt has elevated to almost $35 trillion, and rates of interest now stand at 5.33%, greater than double the 2019 ranges.

When the charges began to fall in 2019, Cardano skilled a sudden drop. After a quick interval of restoration, the downtrend continued for months till early 2020. An uptrend emerged later, however the market downturn through the COVID-19 pandemic coincided with additional fee cuts. Regardless of uncertainties across the precise hyperlink between fee cuts and crypto declines, Cardano and the broader market noticed a transparent lower in worth.

An identical state of affairs may unfold at the moment. Crypto has proven correlations with conventional finance prior to now, together with through the 2019 fee reduce. The Federal Reserve’s upcoming assembly is more likely to end in a fee reduce based mostly on CME knowledge. If the market follows the 2019 sample, Cardano may face a multi-month decline, which may final till the top of the yr, earlier than recovering in early 2025. A repeat of the earlier development may push Cardano’s worth right down to round $0.15.

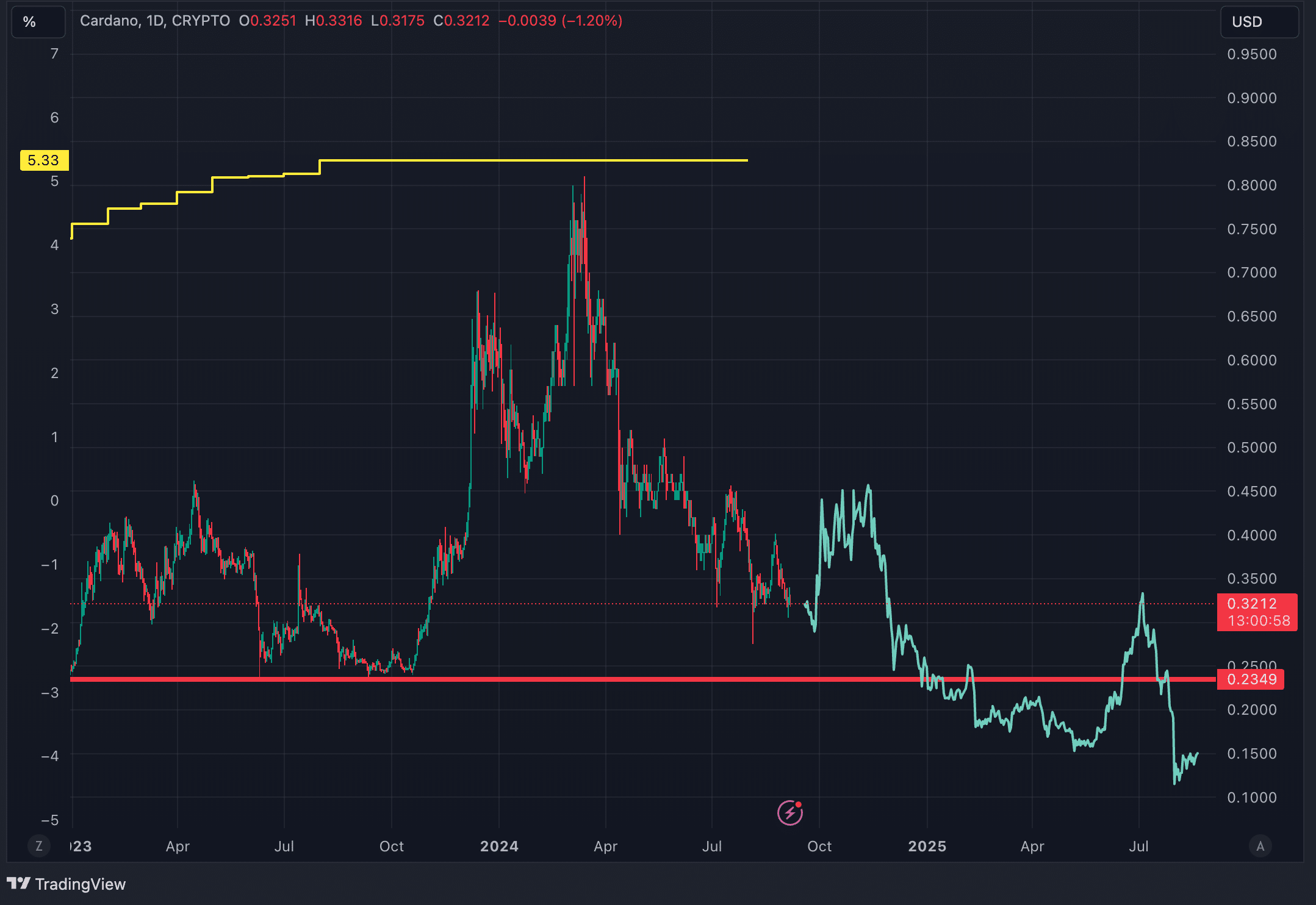

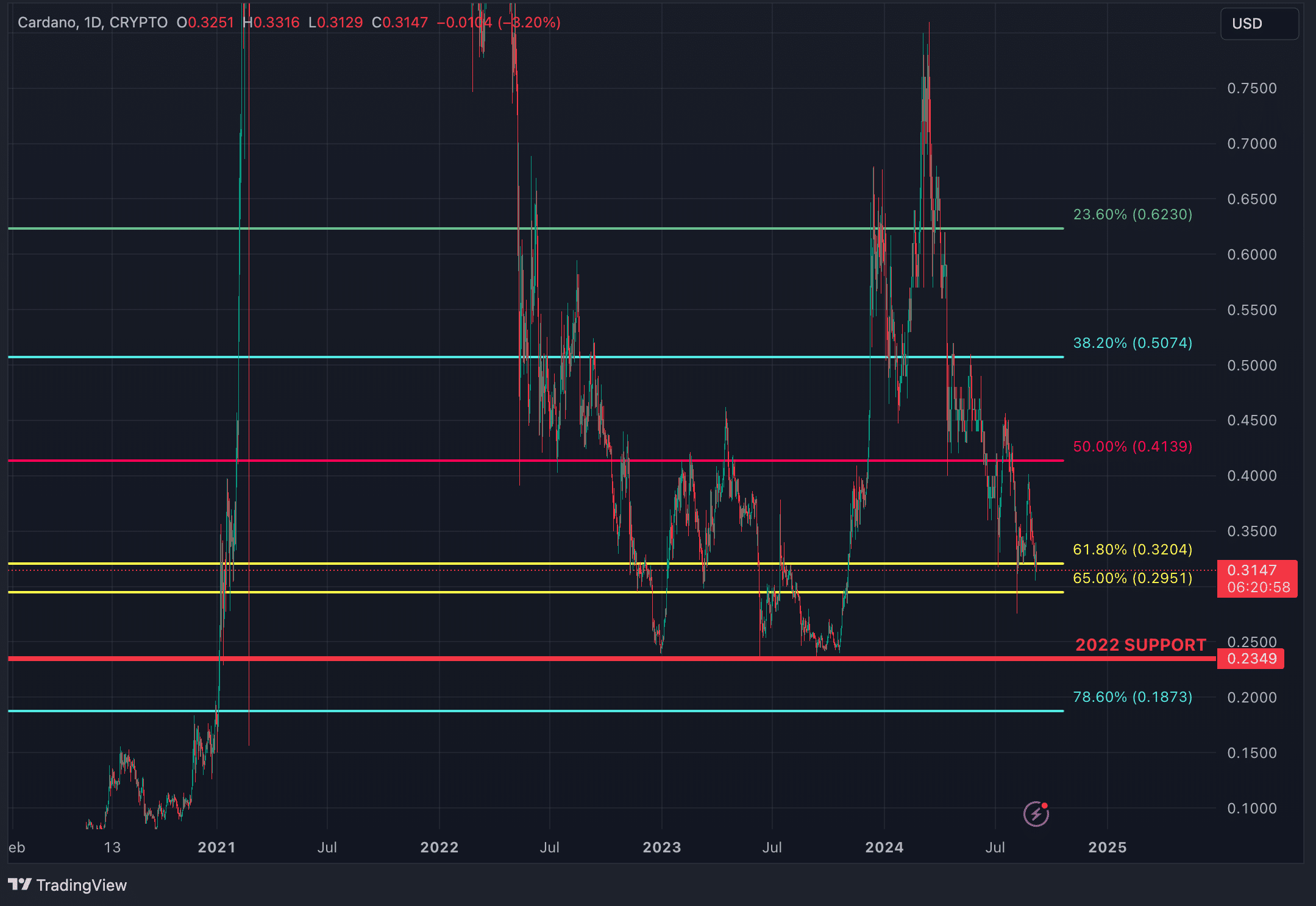

Moreover, September has typically confirmed to be a troublesome month for each shares and crypto. In September 2020, throughout a halving yr, Cardano additionally confronted a downtrend. Coupled with the present 10% drop because the begin of this month, these elements may drive Cardano towards a deeper fall within the weeks and months forward beneath its 2022 assist line at $0.2349.

Cardano’s bearish momentum grows with SRSI, MACD, and VRVP

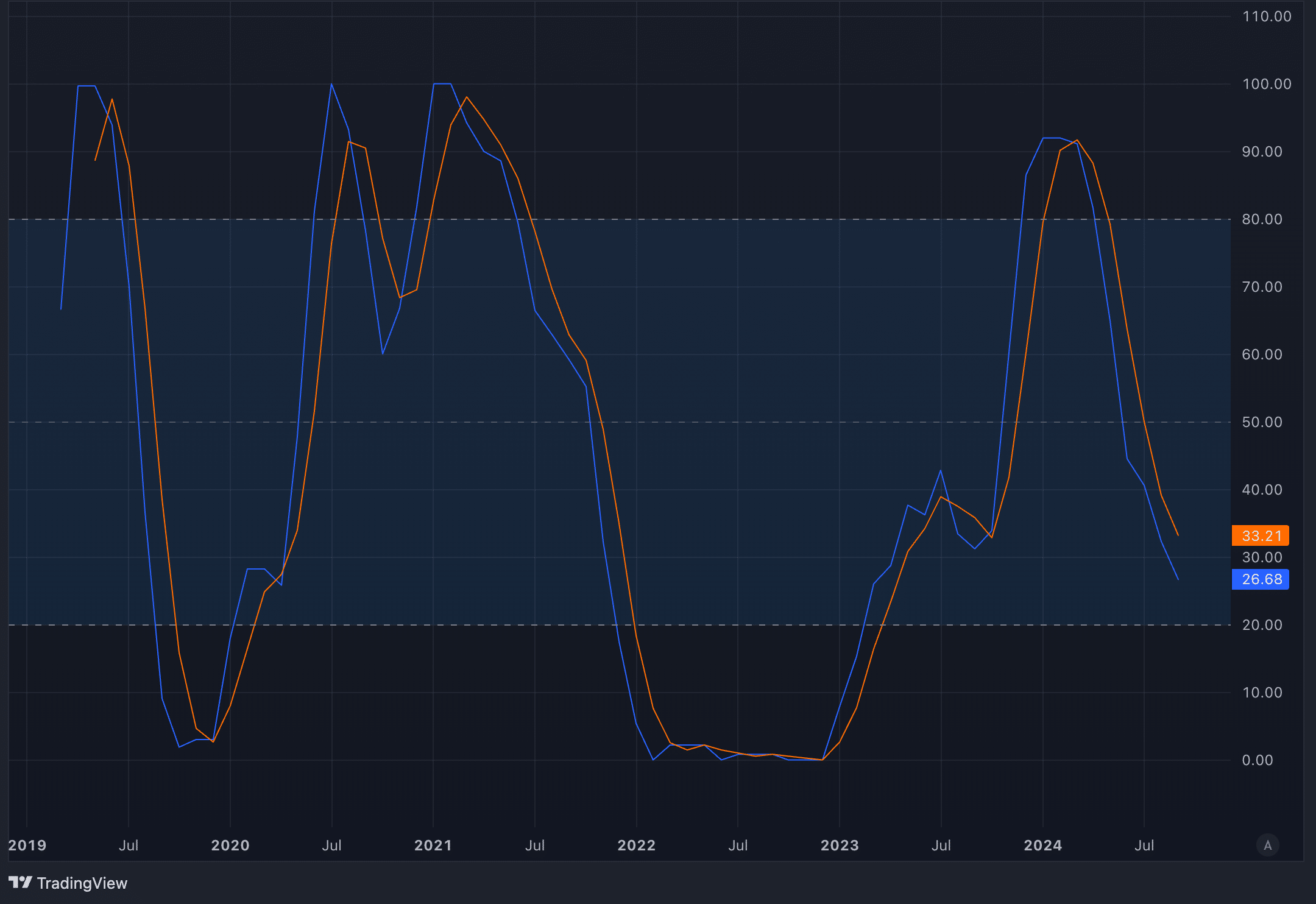

Many merchants deal with short-term actions, however stepping again for a longer-term view may give a greater sense of the larger image. Cardano’s month-to-month Stochastic RSI (SRSI) and MACD are flashing warning indicators that shouldn’t be ignored, and each are portray a tough image for ADA.

The SRSI tracks momentum by taking a look at an asset’s worth vary over time. The dimensions goes from 0 to 100, with something beneath 20 displaying oversold circumstances. Since March 2024, the SRSI has been sliding, and it’s now closing in on that oversold area.

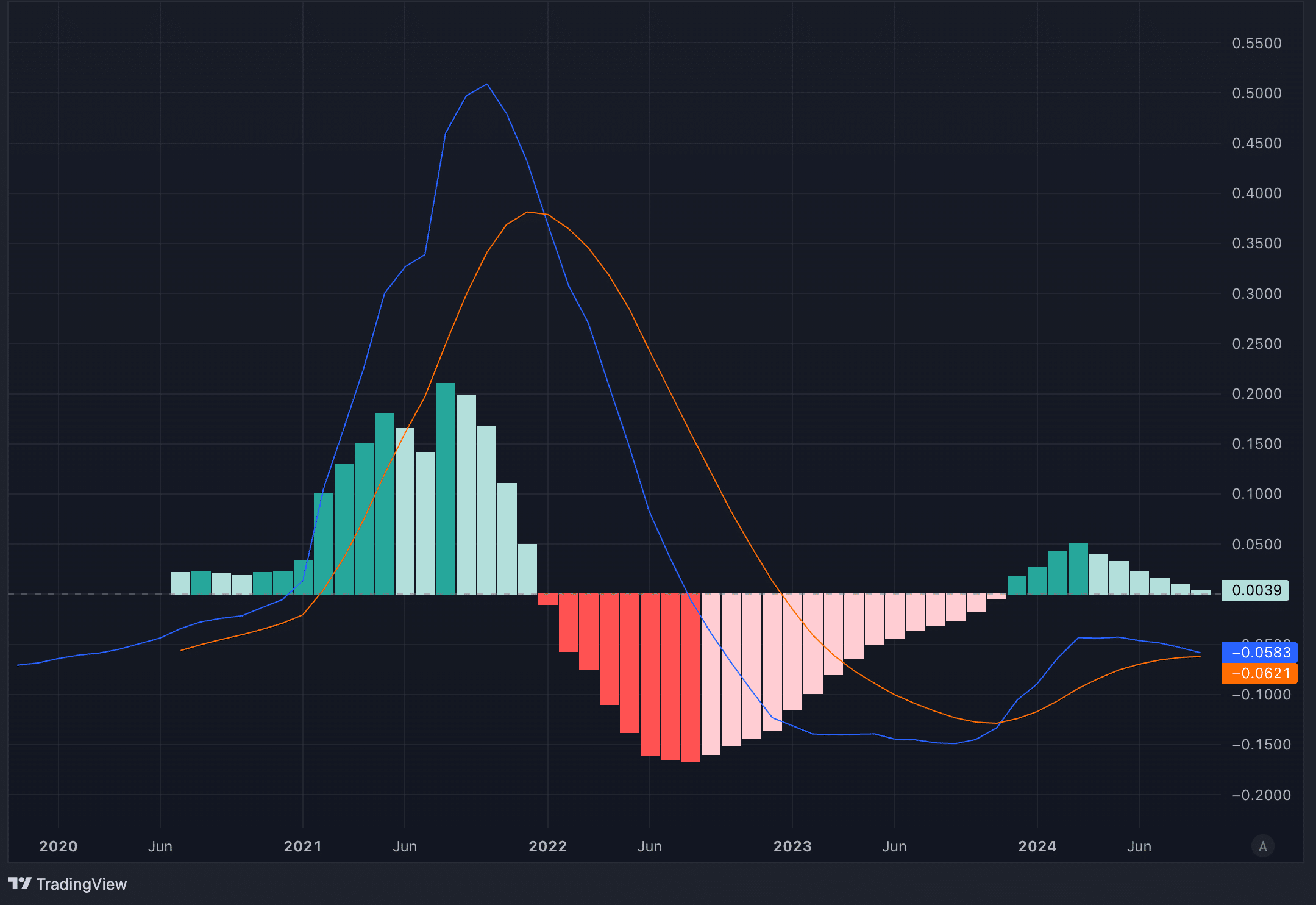

The MACD, in the meantime, is displaying comparable bearish vibes. On the month-to-month chart, the MACD line has already crossed beneath the sign line, which is an indication of downward strain. The histogram, which exhibits the hole between the 2 strains, is about to flip pink, additionally pointing to a rising bearish momentum.

Alongside the bearish alerts from the Stochastic RSI and MACD, the Seen Vary Quantity Profile (VRVP) provides much more detrimental strain to the outlook. The VRVP exhibits the place most buying and selling volumes occurred at varied worth ranges. In Cardano’s case, the quantity bars inside the present worth vary are fairly skinny, which signifies weak assist. The largest quantity bar begins on the $0.15 degree, suggesting a powerful assist zone there. Beneath the present worth, there’s a niche within the quantity profile, which implies if Cardano continues to fall, there’s little buying and selling exercise to decelerate the drop till it reaches that $0.15 zone.

Is Cardano’s 2022 assist line robust sufficient to carry?

Regardless of the bearish indicators, a few elements may stop Cardano from dropping sharply. In the intervening time, the value sits inside a macro Fibonacci golden pocket, drawn from the all-time low to the latest excessive in March 2024. This zone, between $0.2951 and $0.3204, has acted as assist for now. Nonetheless, when taking a look at different Fibonacci retracements from totally different factors, ADA has already fallen beneath the 78.6% retracement on each one among them. This might elevate doubts in regards to the energy of the present golden pocket, as there’s a risk it might not maintain up in the long run.

A stronger assist degree, nonetheless, lies at $0.2349, a line that was revered through the 2022 bear market. However, with ADA at the moment round $0.315, a drop to that assist would nonetheless characterize a 25% decline, which might be removed from ideally suited.

Strategic concerns

In our view, there may very well be a useless cat bounce earlier than the September 18 Fed assembly. Nonetheless, after that, ADA is more likely to face a 2-3 month downtrend till the Fed slows the tempo of its fee cuts. A extra cautious technique could be to attend for ADA to drop beneath the $0.2951 golden pocket earlier than shorting. This provides a safer entry level in comparison with shorting instantly proper now, as Cardano may see a short-term uptrend whereas holding above the golden pocket. If the value falls beneath this degree, shorting right down to $0.2349 turns into a extra calculated transfer.

Disclosure: This text doesn’t characterize funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.