Because the S&P 500 and Nasdaq 100 attain new highs, the broader U.S. market displays a cautious optimism, intently monitoring upcoming financial indicators like June’s CPI information. In such a local weather, figuring out undervalued small-cap shares with potential for progress turns into notably compelling.

High 10 Undervalued Small Caps With Insider Shopping for In The US

|

Identify |

PE |

PS |

Low cost to Honest Worth |

Worth Ranking |

|---|---|---|---|---|

|

Hanover Bancorp |

8.5x |

1.9x |

48.47% |

★★★★★☆ |

|

PCB Bancorp |

9.1x |

2.4x |

43.64% |

★★★★★☆ |

|

Thryv Holdings |

NA |

0.7x |

31.22% |

★★★★★☆ |

|

AtriCure |

NA |

2.7x |

48.44% |

★★★★★☆ |

|

Titan Equipment |

3.9x |

0.1x |

25.84% |

★★★★★☆ |

|

Columbus McKinnon |

21.2x |

1.0x |

48.48% |

★★★★☆☆ |

|

Franklin Monetary Companies |

8.8x |

1.8x |

37.54% |

★★★★☆☆ |

|

Papa John’s Worldwide |

19.2x |

0.7x |

38.07% |

★★★★☆☆ |

|

Chatham Lodging Belief |

NA |

1.4x |

15.84% |

★★★★☆☆ |

|

Group West Bancshares |

18.7x |

2.9x |

42.25% |

★★★☆☆☆ |

Click on right here to see the complete checklist of 65 shares from our Undervalued US Small Caps With Insider Shopping for screener.

Under we highlight a few our favorites from our unique screener.

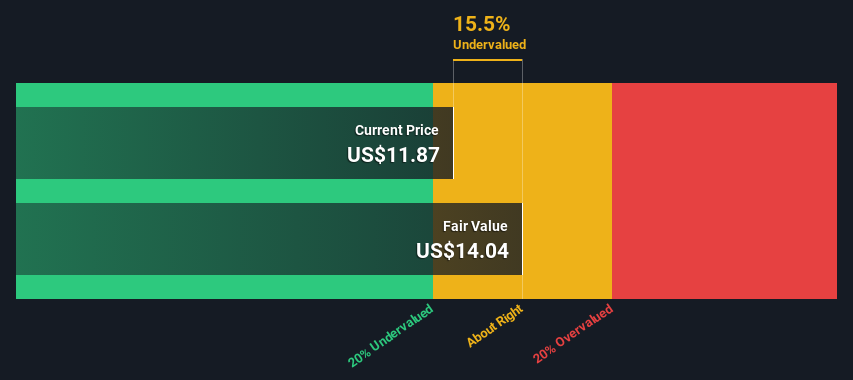

Merely Wall St Worth Ranking: ★★★☆☆☆

Overview: Chimera Funding operates by investing, on a leveraged foundation, in a diversified portfolio of mortgage property.

Operations: The entity generates income primarily by investments in mortgage property, evidenced by a current gross revenue of $260.12 million on revenues of $291.99 million, reflecting a gross revenue margin of roughly 89.08%. Over the most recent interval, working bills amounted to $54.35 million, impacting the web earnings which stood at $124.44 million, translating to a web earnings margin of round 42.62%.

PE: 9.6x

Chimera Funding, reflecting a strategic shift with its current 1-for-3 reverse inventory break up and diminished share depend, goals to reinforce shareholder worth amidst difficult forecasts of a 3.9% earnings decline over the subsequent three years. Regardless of these hurdles, insider confidence stays sturdy as evidenced by substantial share repurchases totaling $105.88 million since March 2020. Moreover, the agency has demonstrated monetary agility by securing $65 million by senior unsecured notes this Might, bolstering its capital construction for future endeavors.

Merely Wall St Worth Ranking: ★★★★☆☆

Overview: Leggett & Platt is a diversified producer specializing in engineered elements and merchandise for bedding, furnishings, and numerous industrial markets, with a market capitalization of roughly $4.65 billion.

Operations: The corporate generates income primarily from three segments: Bedding Merchandise ($1.91 billion), Specialised Merchandise ($1.28 billion), and Furnishings, Flooring & Textile Merchandise ($1.46 billion). Gross revenue margins have proven variability over the intervals, with current figures round 17.83% to 18.07%, reflecting price of products offered and operational efficiencies inside these segments.

PE: -10.4x

Regardless of current volatility, Leggett & Platt’s insider confidence shines by with important share purchases, signaling sturdy perception in its potential. This reassurance comes amidst a backdrop of strategic shifts together with a CEO transition and energetic pursuit of acquisitions aimed toward long-term progress. Financially, the corporate is adjusting with a diminished dividend however maintains sturdy gross sales forecasts between US$4.35 billion to US$4.65 billion for 2024, reflecting resilience and adaptableness in difficult markets.

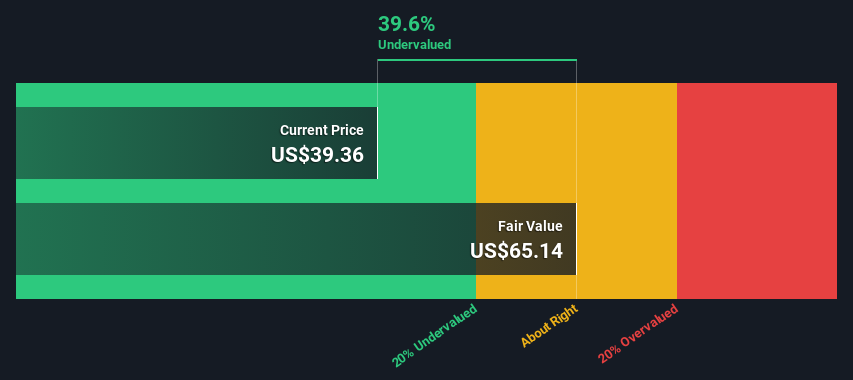

Merely Wall St Worth Ranking: ★★★★★☆

Overview: Shutterstock operates as a worldwide supplier of inventory pictures, inventory footage, inventory music, and enhancing instruments with a market cap of roughly $2.39 billion.

Operations: This entity generates income primarily by its function as an Web Data Supplier, recording $873.62 million in its newest reporting interval. Over current quarters, it has maintained a gross revenue margin round 59%, with a notable improve to roughly 61% in essentially the most present information obtainable.

PE: 15.1x

Just lately, Shutterstock has proven indicators of being underpriced relative to its potential. With Jaime Teevan becoming a member of the board, bringing a sturdy AI background from Microsoft, the corporate is poised to reinforce its information and ML providers. Insider confidence is clear as they’ve just lately bought shares, signaling perception in long-term worth. Moreover, inclusion in a number of Russell indexes underscores its stable market place. Regardless of a slight dip in Q1 earnings to US$16.12 million from US$32.84 million year-over-year, strategic management and revolutionary partnerships are anticipated to drive future progress in the direction of double-digit will increase by 2027.

The place To Now?

In search of Different Investments?

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to deliver you long-term targeted evaluation pushed by elementary information. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Firms mentioned on this article embody NYSE:CIM NYSE:LEG and NYSE:SSTK.

Have suggestions on this text? Involved concerning the content material? Get in contact with us immediately. Alternatively, electronic mail editorial-team@simplywallst.com