Coinbase reported almost $2.3 billion in income in its This fall 2024 Shareholder Letter. The agency set bold objectives for itself, hoping to drive income and utility, and its inventory worth shot up.

Coinbase additionally opened its report by stating that the Trump administration unlocked “unprecedented” alternatives, and claimed the corporate will actively work to form US crypto regulation.

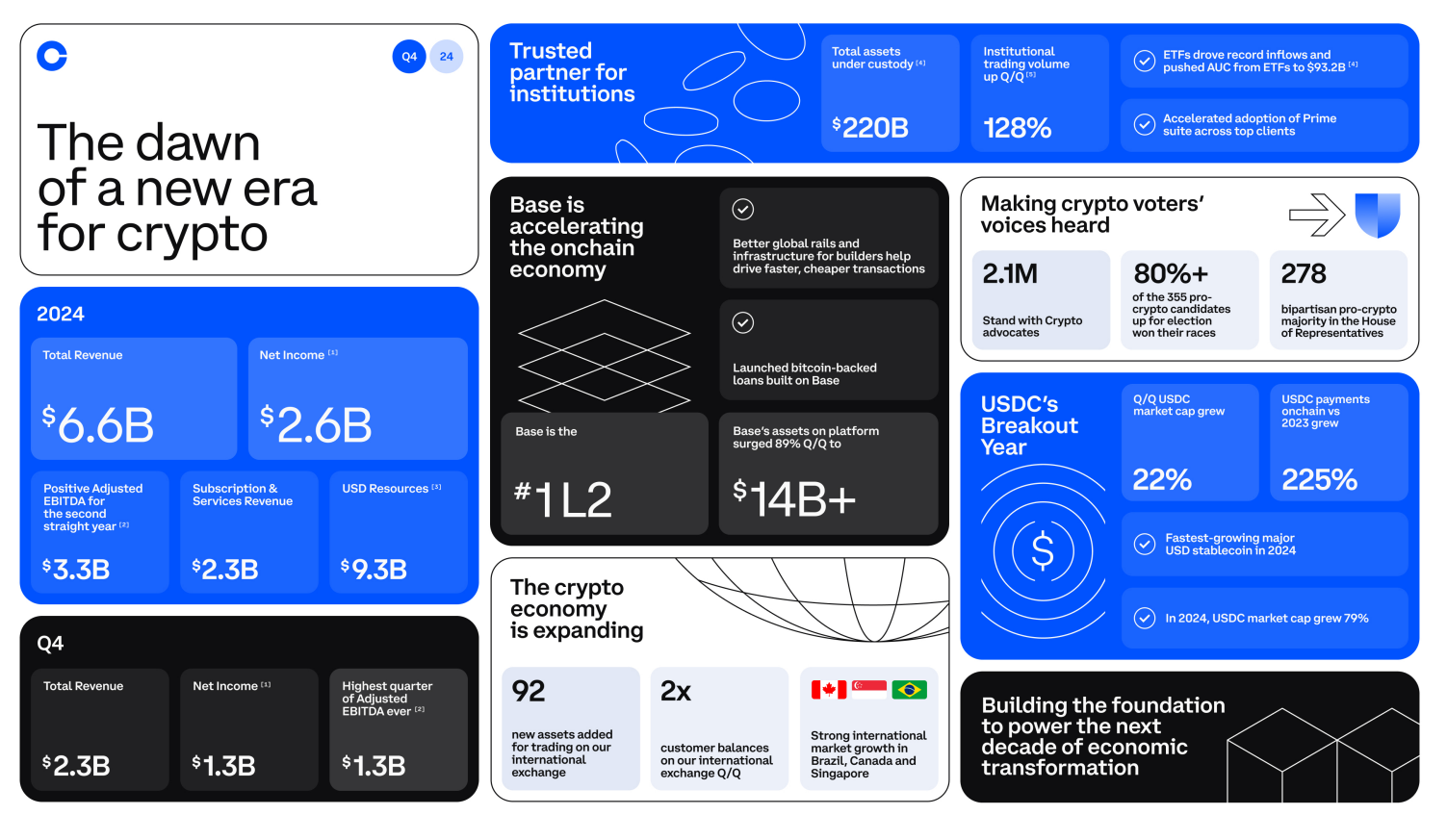

Coinbase Reviews Main Monetary Success

Coinbase, one of many world’s main crypto exchanges, is feeling bullish proper now. It’s making headway into Argentina and rebuilding relationships in India, opening new markets.

Not too long ago, two meme cash jumped after a list, dispelling rumors that its listings misplaced relevance. At this time, Coinbase revealed its This fall 2024 Shareholder Letter, and it’s setting bold objectives:

“It’s the dawn of a new era for crypto. That means it’s time to double down on what we’ve always focused on: building. Our goals in 2025 are to drive revenue, drive utility, and scale our foundations. We believe the opportunity in front of us right now is unprecedented, and that we are well positioned to meet the moment,” it claimed.

Coinbase has good motive to purpose excessive. In its This fall letter, the alternate boasted $2.3 billion in income. Centralized exchanges, usually, had a really worthwhile quarter, however Coinbase nonetheless stands out.

With $1.3 billion in web revenue, it revamped $6.6 billion in complete income all year long. After posting these figures, Coinbase’s inventory worth jumped as excessive as 10%.

Coinbase’s Shareholder Letter didn’t solely cite bullish market elements, nonetheless. It additionally paid particular consideration to political concerns.

Brian Armstrong, the agency’s founder and CEO, has been taking lively efforts to achieve out to President Trump. He even proactively signaled his willingness to adjust to potential new crypto laws. That is already paying dividends.

The alternate has been at struggle with the FDIC over Operation Choke Level 2.0, and its fortunes right here have dramatically modified. Since Trump despatched his Crypto Czar to analyze potential foul play, the federal authorities has taken the allegations very critically.

Final week, Coinbase’s CLO testified on it earlier than Congress, which might’ve been far-fetched just a few months in the past.

After all, Coinbase’s Shareholder Letter didn’t dive too deep into this relationship; it merely praised Trump within the first few sentences.

The report primarily coated firm fundamentals: revenues, bills, future tasks, and so on. Nevertheless, it paid particular consideration to US regulation, claiming that Coinbase will actively work to form it. As of now, that purpose seems to be very achievable.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.