The crypto lending market is displaying indicators of life once more. Centralized finance (CeFi) and decentralized finance (DeFi) platforms are experiencing a resurgence, with the latter main.

This rise follows a devastating collapse that noticed main gamers like Celsius, Genesis, and BlockFi crumble. This left traders reeling and battered belief within the sector.

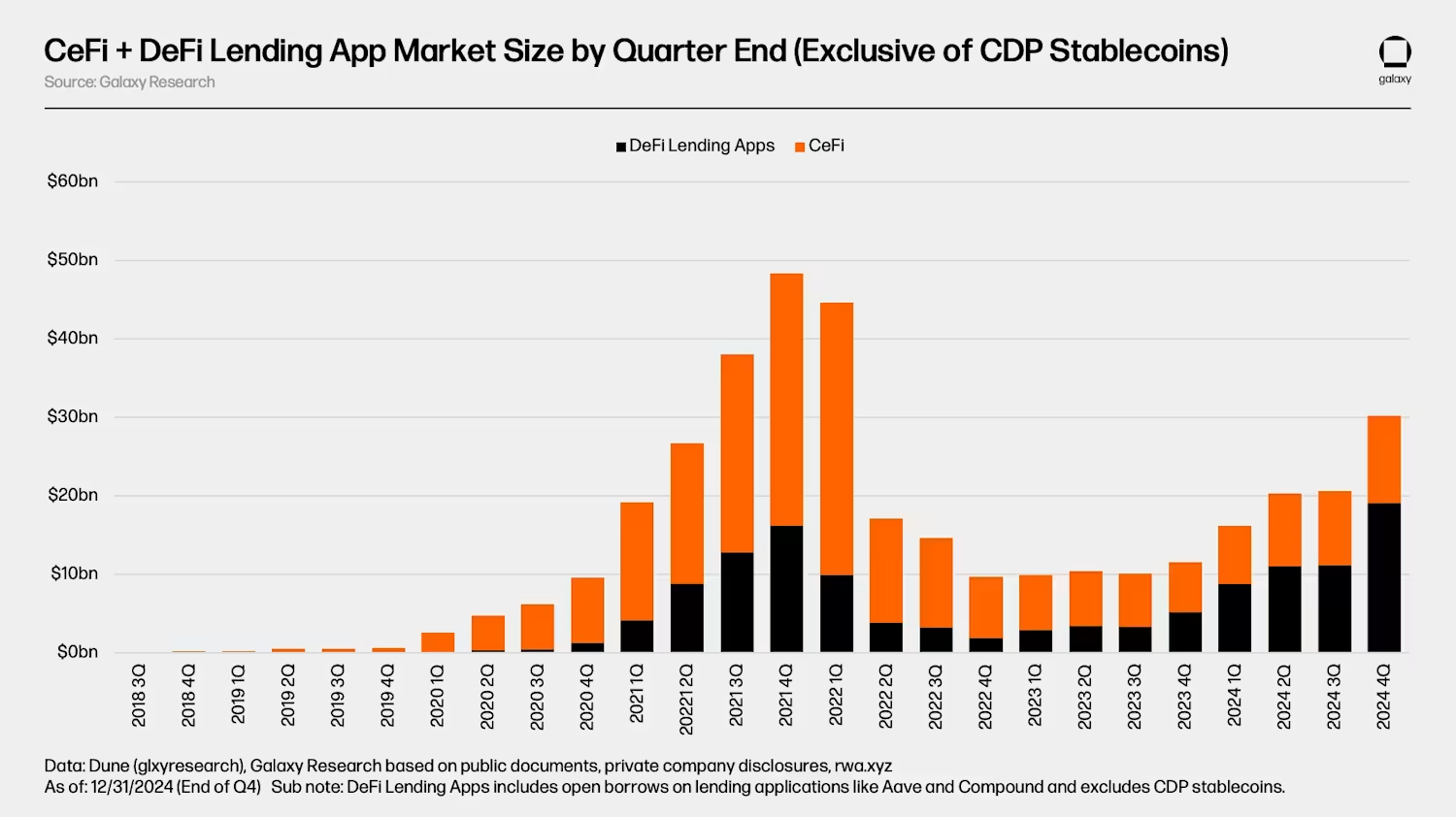

In line with a latest report by Galaxy Digital, the overall dimension of excellent CeFi borrows as of This autumn 2024 was $11.2 billion. This represented a 73% rise from the bear market lows when it reached $6.4 billion.

Regardless of this constructive progress, the CeFi lending market stays considerably beneath its earlier highs.

“This is largely due to the lack of recovery in CeFi lending after the 2022 bear market and the decimation of the largest lenders and borrowers in the market,” the report learn.

The whole market dimension is down by 68% from its peak of $34.8 billion. The collapse of main lending platforms is the first issue behind this sharp decline, which led to a significant lack of confidence and a corresponding drop in mortgage volumes.

Notably, the restoration in CeFi lending can also be marked by a consolidation of market share. The highest three lenders—Tether, Galaxy, and Ledn—management 89% of the market as of This autumn 2024. Beforehand, in 2022, the then-top three lenders, together with Genesis, BlockFi, and Celsius, held 75% of the market share.

Collectively, these gamers are driving CeFi’s restoration, although they face rising competitors from DeFi protocols. Galaxy Digital emphasised that DeFi lending has skilled a a lot stronger restoration. Within the bull run of 2020 to 2021, DeFi lending apps made up simply 34% of the market. But, by This autumn 2024, it accounted for 63%.

“Most CeFi firms do not offer yield products to US clients since 2022. DeFi platforms often don’t comply with these regulations nor require KYC, which could be a factor,” Ledn’s co-founder Mauricio Di Bartolomeo posted.

The expansion can also be demonstrated by the truth that DeFi borrowing has reached a brand new peak, 18% larger than the earlier bull market peak. DeFi lending apps like Aave (AAVE) and Compound (COMP) survived the bear market with out collapse, benefiting from their decentralized nature and powerful danger administration. In truth, DeFi lending surged to 959% from This autumn 2022 to This autumn 2024.

“Aave and Compound, has seen strong growth from the bear market bottom of $1.8 billion in open borrows. There were $19.1 billion in open borrows across 20 lending applications and 12 blockchains at the conclusion of Q4 2024,” Galaxy famous.

The rise has contributed considerably to the general enchancment within the crypto lending market. Excluding CDP stablecoins, the crypto lending market noticed a 214% restoration from This autumn 2022 to This autumn 2024.

“The total market has expanded to $30.2 billion, mostly driven by DeFi lending app expansion,” the report famous.

As CeFi lending continues to stabilize beneath the management of some massive gamers, DeFi platforms have emerged because the true leaders within the restoration. Their decentralized and permissionless nature offers a robust basis for progress in a market nonetheless recovering from earlier turbulence. Regardless of challenges, it has seen substantial progress, highlighting the resilience of the crypto lending area within the face of adversity.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.