Ethereum ETFs have closed yet one more week within the purple, recording internet outflows amid continued investor hesitation.

Notably, there was no single week of internet inflows because the finish of February, highlighting waning institutional curiosity in ETH-related merchandise.

Ethereum ETFs Face Regular Outflows

Ethereum-backed ETFs have recorded their seventh consecutive week of internet outflows, highlighting sustained institutional hesitance towards the asset.

This week alone, internet outflows from spot ETH ETFs totaled $82.47 million, marking a 39% surge from the $49 million recorded in outflows the earlier week.

With the regular decline in institutional presence within the ETH market, the promoting strain on the coin has soared.

Over the previous week, ETH’s worth has declined by 11%. The regular outflows from the funds backed by the coin counsel that the downward momentum could persist, growing the chance of a worth drop under the $1,500 mark.

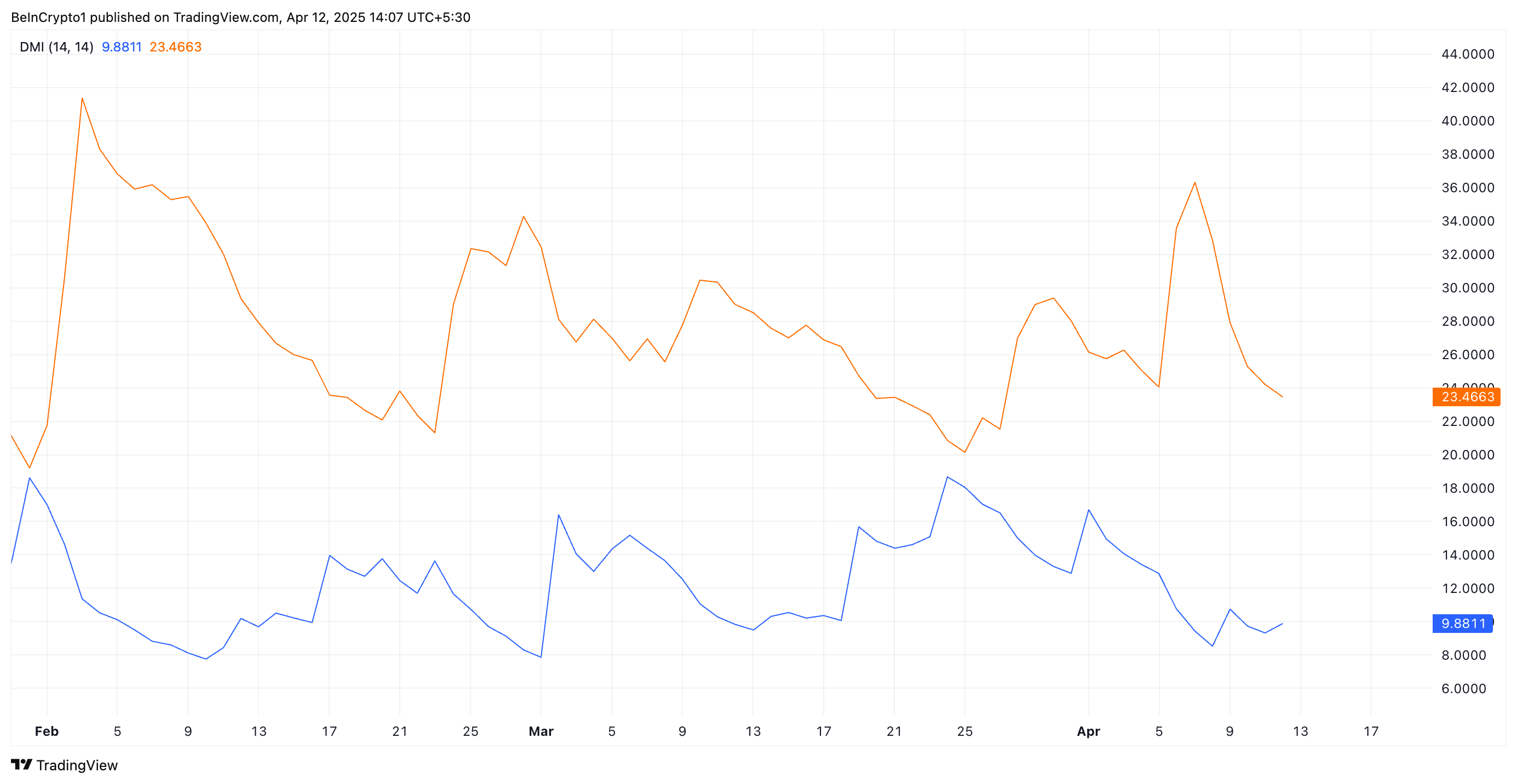

On the value chart, technical indicators stay bearish, confirming the mounting strain from the promoting aspect of the market. For instance, at press time, readings from ETH’s Directional Motion Index (DMI) present its constructive directional index (+DI) resting under the detrimental directional index (-DI).

The DMI indicator measures the energy of an asset’s worth development. It consists of two traces: the +DI, which represents upward worth motion, and the -DI, which represents downward worth motion.

As with ETH, when the +DI rests under the -DI, the market is in a bearish development, with downward worth motion dominating the market sentiment.

Ethereum’s Value May Drop Under $1,500

The shortage of institutional capital might delay any vital rebound in ETH worth, additional dampening short-term prospects for restoration. If demand leans additional, ETH might get away of its slim vary and observe a downward development.

The altcoin might fall under $1,500 on this state of affairs to succeed in $1,395.

Nevertheless, if ETH witnesses a constructive shift in sentiment and demand spikes, its worth might climb to $2,114.

Disclaimer

In step with the Belief Undertaking tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.