Ethereum (ETH) spot exchange-traded funds (ETFs) grew to become tradeable on July 23. Nevertheless, regardless of preliminary enthusiasm, these funding funds have struggled to keep up investor curiosity.

In current weeks, ETH ETFs have confronted substantial internet outflows, with just one week of inflows recorded since their launch.

Ethereum ETFs Document Regular Outflows

In line with information from SosoValue, ETH spot ETFs recorded a internet outflow of $341.35 million of their first week of buying and selling, marking the most important outflow up to now. The second week noticed a diminished outflow of $169.35 million, indicating that whereas investor curiosity continued to say no, the tempo of withdrawals slowed barely.

Throughout the two weeks, the whole internet property plummeted from $9.24 billion to $8.33 billion. This decline was because of funds withdrawal from these ETFs as ETH worth plugged. Between July 23 and August 8, the worth of the main altcoin dropped by 7%.

Though ETH’s worth declined additional within the third week, the ETFs recorded their first and solely inflows, totaling $104.76 million. Apparently, regardless of this constructive influx, the whole internet property in these funds dropped by one other 13%.

By the tip of that week, the mixed internet worth of all property held by US Ethereum spot ETFs stood at $7.28 billion. This stays the one week of internet inflows these funds have seen since their launch.

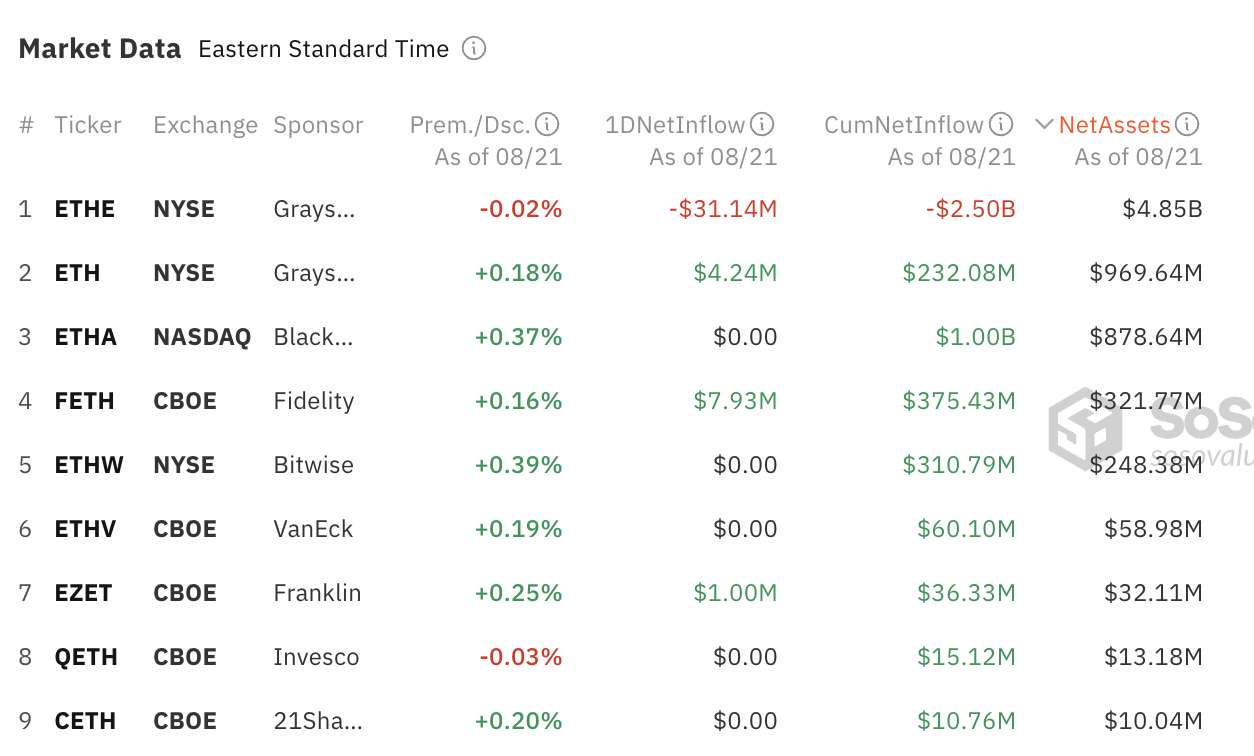

Outflows have amounted to $38 million to date this week, with complete internet property at $7.38 billion. This represents 2.3% of ETH’s market capitalization.

On Wednesday, BlackRock’s iShares Ethereum Belief (ETHA) surpassed $1 billion in cumulative internet inflows, making it the one fund to succeed in that milestone. In line with SoSoValue information, this surpasses the mixed inflows of the following three highest ETFs.

Learn extra: Tips on how to Put money into Ethereum ETFs?

Nevertheless, ETHA’s internet property rank third, behind Grayscale’s mini Ether belief (ETH) and Ethereum belief (ETHE), which have complete property of $4.85 billion and $969.64 million, respectively. ETHA holds complete property of $878.64 million.

ETH Value Prediction: Coin Flashes Purchase Sign

At press time, ETH is buying and selling at $2,627, reflecting a 1% worth improve over the previous 24 hours, whereas its buying and selling quantity has surged by 9%.

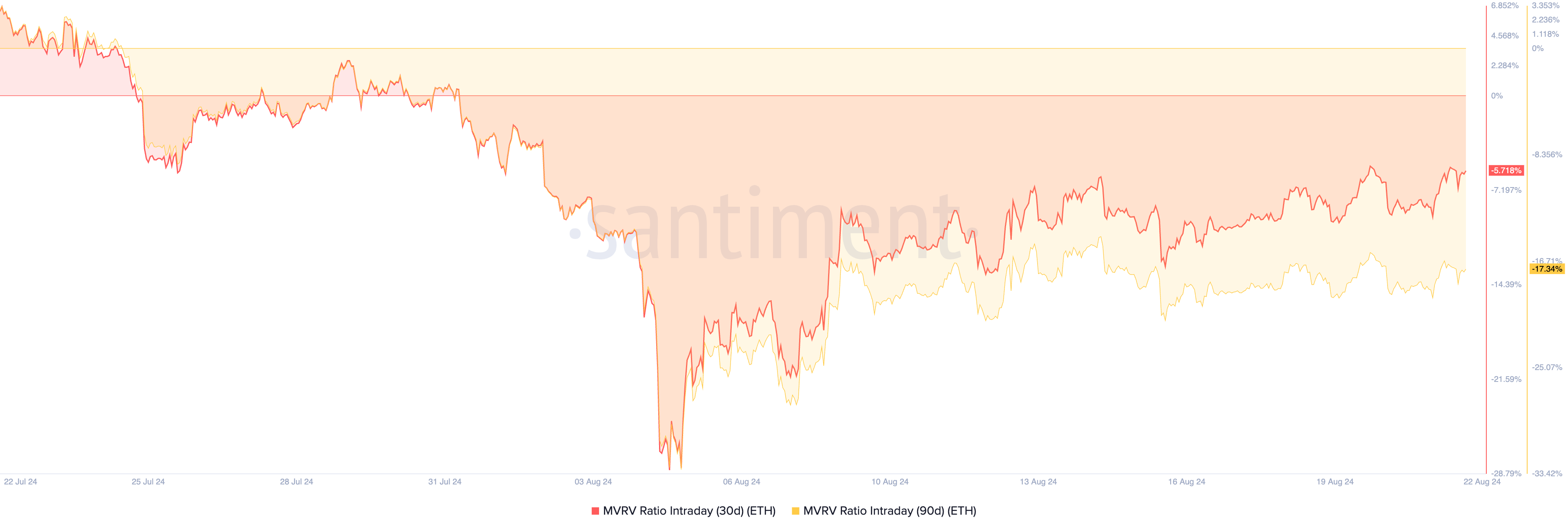

ETH’s battle to stabilize above the $3,000 mark presents a possible shopping for alternative, indicated by its unfavourable market worth to realized worth (MVRV) ratio. In line with Santiment, the token’s 30-day and 90-day MVRV ratios stand at -5.71% and -17.34%, respectively, suggesting the asset could also be undervalued.

The MVRV ratio measures whether or not an asset is overvalued, undervalued, or pretty valued. When the ratio is under one, it signifies the asset’s market worth is lower than its realized worth, suggesting it could be undervalued. This creates a shopping for alternative for merchants trying to capitalize on the “dip.”

If ETH begins an uptrend, consumers who enter on the present market worth might notice beneficial properties as the worth climbs towards $2,868.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

Nevertheless, they threat being put “under the money” if a downtrend happens and the worth drops to $2,579. An investor is “under the money” when the asset’s market worth falls under the acquisition worth, resulting in potential losses.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.