The U.S. SEC has granted the ultimate go-ahead for the primary spot ETH ETFs in america. Buying and selling is about to start tomorrow, July 23.

At the moment, July 22, the U.S. Securities and Change Fee accepted the securities filings of a number of spot Ethereum (ETH) exchange-traded funds, clearing them for buying and selling beginning on Tuesday, as scheduled.

The SEC permitted ETH ETF merchandise from a complete of eight issuers, together with asset administration giants Constancy, Blackrock and VanEck, in addition to 21Shares, Bitwise and others.

The SEC first permitted functions for the above ETH ETFs on the finish of Might, however corporations have been nonetheless ready for his or her S-1 filings — the registration of recent securities — to be permitted to ensure that buying and selling to formally begin. Final week, the SEC knowledgeable issuers that they would wish to finalize their S-1 paperwork by July 17 with a purpose to obtain approval for buying and selling to begin on July 23.

How will the worth of ETH react?

A report from Kaiko Analysis printed at the moment prompt that the outlook for the worth of ETH after the spot ETFs launch is unclear. The agency famous that when futures-based ETH ETFs launched final yr, the demand was “underwhelming.”

The value of ETH has dropped about 2.5% over the previous 24 hours, at present buying and selling close to $3,400. Earlier at the moment, analysts from IntoTheBlock famous that the Ethereum worth faces crucial resistance round $3,500 ranges.

Usually, as with spot Bitcoin (BTC) ETFs, analysts — and the business extra broadly — see the launch of a spot ETF product as a bullish signal for wider adoption. Since ETFs are traded on conventional exchanges by way of brokerage accounts, a wider swathe of extra conventional buyers now have entry to the 2 largest cryptocurrencies by market cap by way of a automobile that they’re already comfy buying and selling.

First Bitcoin, now Ethereum

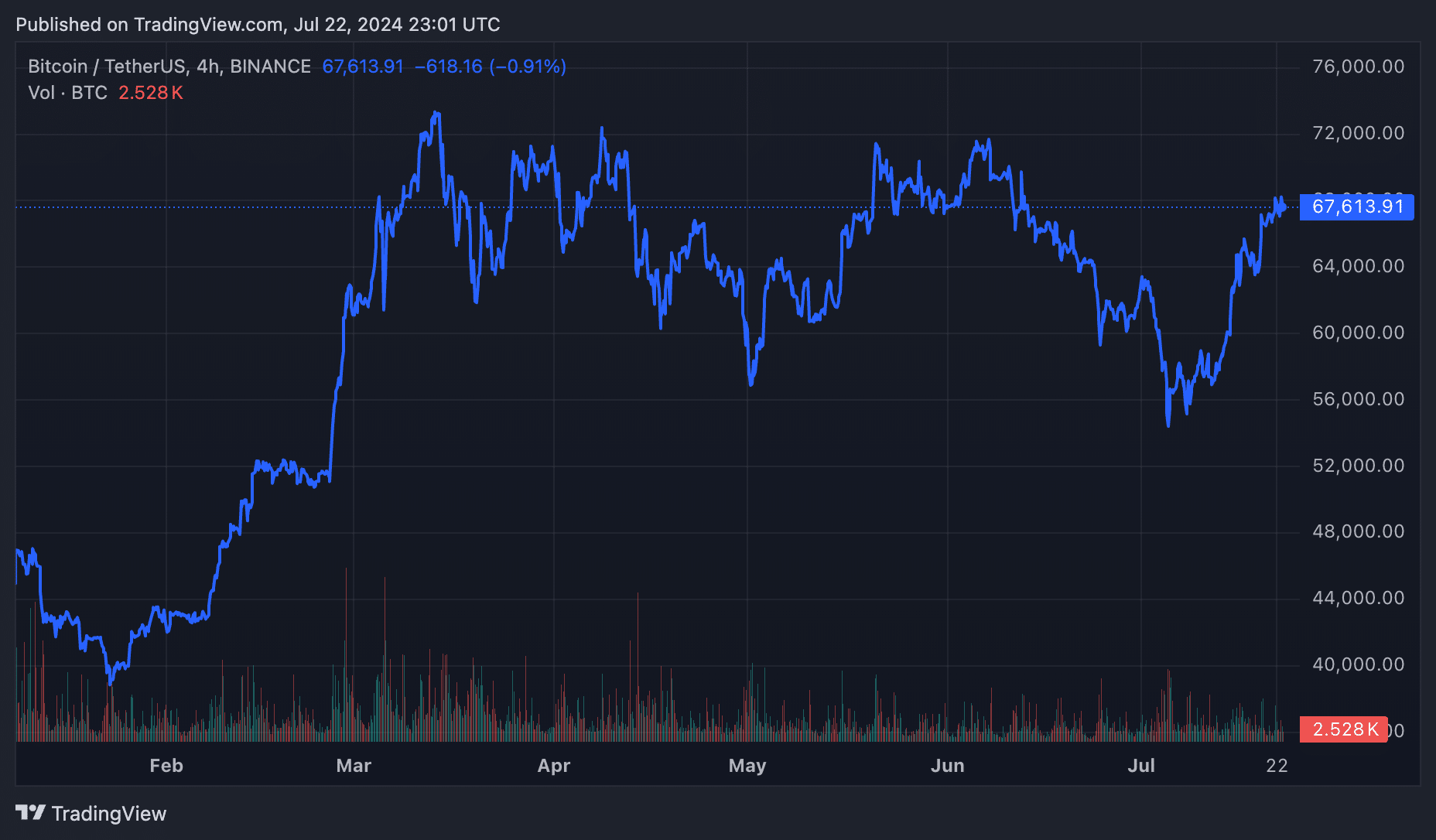

Spot Bitcoin ETFs have been permitted for buying and selling within the U.S. in January and, since then, have seen document inflows. Because the launch of spot BTC ETF buying and selling, the worth of Bitcoin has elevated virtually 50%, at present buying and selling close to $67,700.