Ethereum (ETH) value is up over 3% within the final 24 hours, exhibiting indicators of restoration because the yr ends. Not like Solana and Bitcoin, which reached new all-time highs in 2024, ETH fell wanting attaining this milestone.

Key indicators like RSI and DMI counsel that bullish momentum is constructing, with ETH nearing a important resistance at $3,523. Whether or not the altcoin can break greater or retest decrease help ranges will outline its short-term value trajectory.

ETH RSI Is Going Up

Ethereum Relative Power Index (RSI) is presently at 56.2, reflecting a gradual restoration after dropping beneath 20 on December 20. This rebound signifies that purchasing strain has regularly returned, lifting ETH out of oversold situations and right into a neutral-to-slightly-bullish zone.

An RSI of 56.2 means that momentum is leaning extra towards the constructive facet, signaling the opportunity of a light upward motion within the ETH value because it stabilizes.

The RSI is a momentum indicator that measures the pace and energy of value actions on a scale from 0 to 100. Values above 70 point out overbought situations, typically signaling a possible value pullback, whereas values beneath 30 counsel oversold situations, hinting at a attainable restoration.

With Ethereum RSI at 56.2, it stays in a impartial zone however is near coming into bullish territory. Within the brief time period, this might imply ETH has room for reasonable positive aspects, though an absence of sturdy momentum may restrict important upward motion until shopping for strain intensifies additional.

Ethereum DMI Hints at Bullish Shift

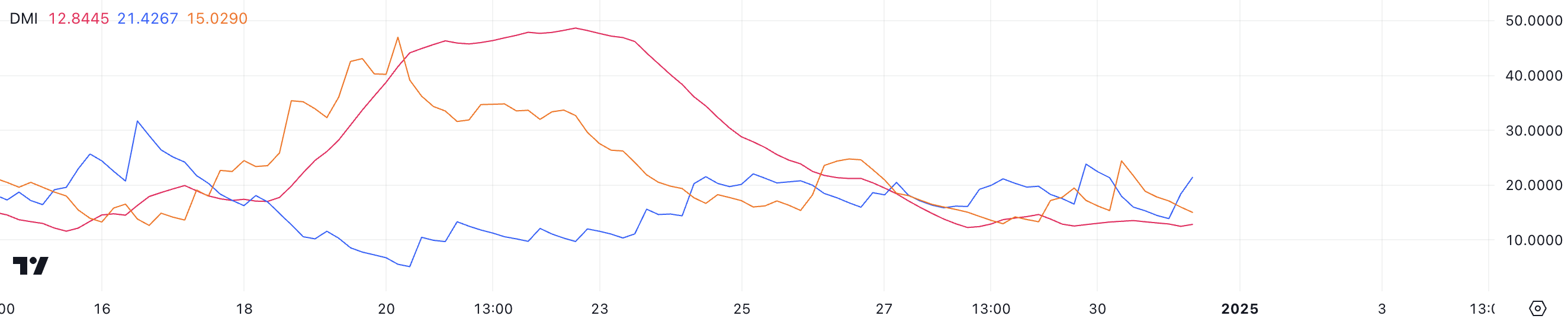

ETH DMI chart signifies that its ADX is presently at 12.8, remaining beneath 20 since December 27. This low ADX studying means that the development energy is weak, reflecting an absence of sturdy momentum in both course.

Nevertheless, the latest crossover of the +DI above the -DI, with the +DI rising to 21.4 and the -DI at 15, reveals that purchasing strain has began to dominate over promoting strain. This setup signifies the early levels of a possible uptrend, though the weak ADX alerts that the development is just not but firmly established.

The Common Directional Index (ADX) measures the energy of a development, no matter its course, on a scale of 0 to 100. Values above 25 point out a powerful development, whereas readings beneath 20 counsel weak or absent development energy. The +DI (Directional Indicator) tracks shopping for strain, whereas the -DI tracks promoting strain.

With the +DI crossing above the -DI and exhibiting the next worth, bullish momentum is starting to construct. Nevertheless, for ETH’s uptrend to realize traction, the ADX would want to rise above 20 to substantiate stronger development momentum. Within the brief time period, ETH may even see gradual positive aspects, however sustained upward motion will rely upon a rise in total development energy.

ETH Value Prediction: A Potential 16% Upside

If a powerful uptrend materializes, ETH value might check the resistance at $3,523, marking a major milestone in its restoration efforts.

A breakout above this stage might pave the best way for additional positive aspects, with targets at $3,827 and doubtlessly $3,987, a stage ETH hasn’t examined since December 17.

However, if the present momentum fails to type a powerful uptrend, Ethereum value might revisit help at $3,300, a stage it examined on December 27 and December 30.

Failure to carry this help might result in additional declines, with the subsequent targets at $3,218 and $3,096.

Disclaimer

Consistent with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.