Ethereum (ETH) spot exchange-traded funds (ETFs) have witnessed a big outflow of $163 million this week. This comes because the bullish sentiment trailing the main altcoin begins to wane, making it a battle for the coin’s value to interrupt by way of the $3,400 resistance stage.

As ETH’s value faces bearish stress, it could start to shed extra of its good points within the coming weeks. This evaluation explains why.

Ethereum Shopping for Strain Faces Dip

In line with information from SosoValue, Ethereum ETF outflows this week have totaled $163 million. This represents the third-highest weekly internet outflows since these funds grew to become tradeable on July 23.

Notably, this pattern of Ethereum ETF outflows follows a exceptional surge in inflows, which hit a record-breaking $515.17 million in weekly inflows — the best since their launch. This spike in inflows was fueled by Donald Trump’s victory within the November 5 US election, which triggered a parabolic rally within the crypto market.

Nevertheless, ETH’s value has begun to battle as bearish sentiment in opposition to it good points momentum. BeInCrypto reported earlier that the ETH/BTC ratio, which measures Ethereum’s value efficiency in opposition to Bitcoin, has fallen to its lowest level since March 2021. This comes as profit-taking exercise intensifies among the many altcoin holders, paving the best way for the bears to regain market management.

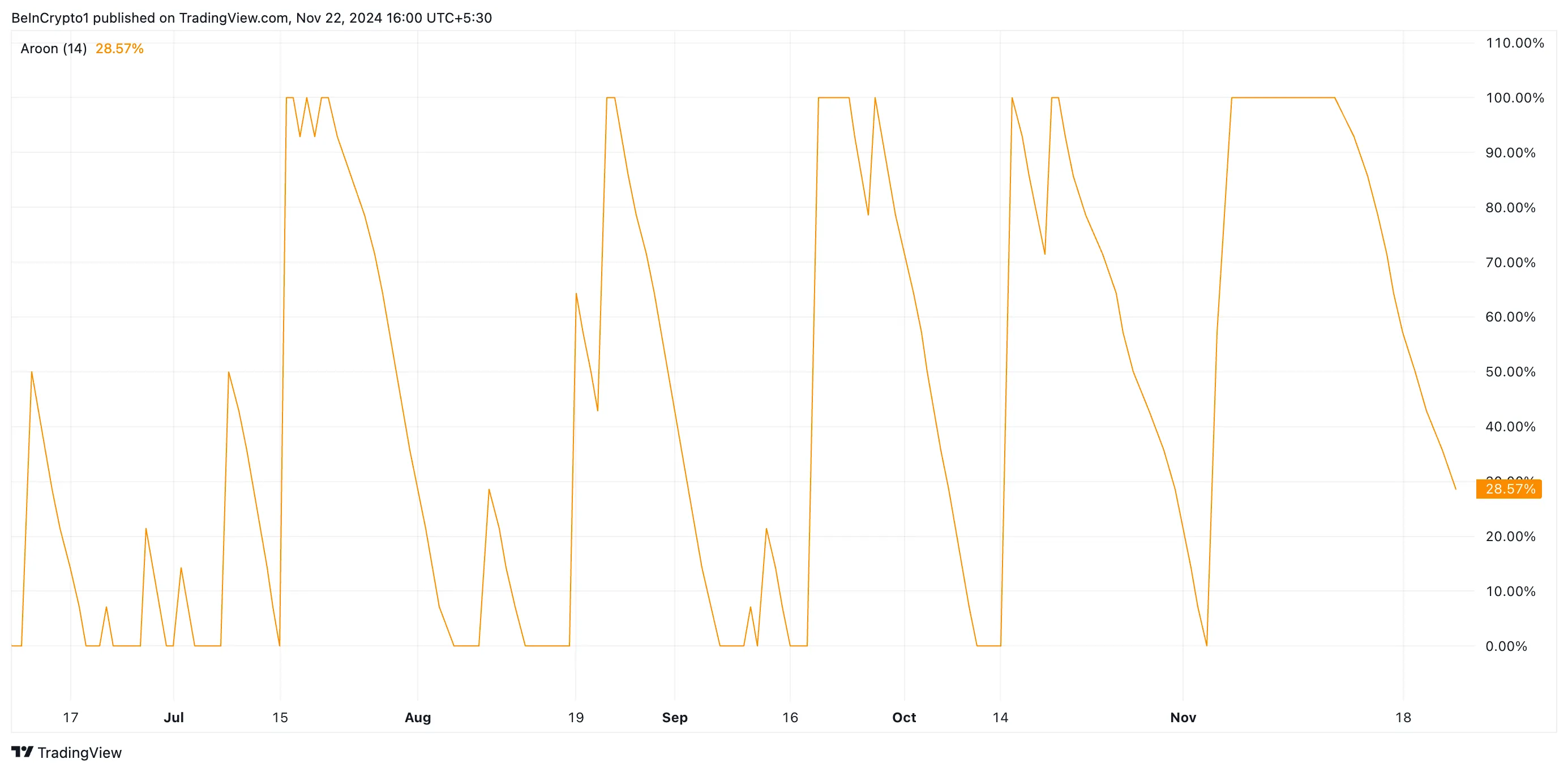

Furthermore, Ethereum’s falling Aroon Up Line confirms the weakening bullish presence out there. At press time, the coin’s Aroon Up Line is downward at 28.57%.

The Aroon indicator identifies developments and their energy. It consists of two traces: Aroon Up and Aroon Down. Aroon Up measures the time since a brand new 25-period excessive, whereas Aroon Down measures the time since a brand new 25-period low.

When the Aroon Up Line falls, it indicators a weakening uptrend or the potential for a pattern reversal. This happens when the worth is taking longer to achieve new highs, indicating a lack of momentum. A falling Aroon Up line is interpreted as a bearish sign, suggesting that the bullish momentum is fading and a possible downtrend could also be underway.

ETH Value Prediction: Is a Bull Flag Forming?

Curiously, an evaluation of the ETH/USD one-day chart has revealed {that a} bull flag could also be underway. This sample usually precedes a continuation of an uptrend.

A bull flag consists of a speedy value improve (the flagpole) adopted by a interval of consolidation (the flag). As soon as the worth breaks above the flag’s resistance stage, it indicators a possible resumption of the uptrend.

ETH’s profitable break above the higher line of the horizontal channel at $3,997 will affirm the uptrend; if this occurs, the coin’s value might rally towards $3,534. Nevertheless, if shopping for stress declines additional, ETH’s value might plummet to $3,262, invalidating the bullish outlook above.

Disclaimer

In keeping with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.