Initially launched as a parody of crypto hypothesis, Dogecoin has since turn out to be the sort of speculative asset it was meant to mock — largely because of Elon Musk’s affect. His social media exercise and public endorsements have performed a central and ongoing position in shaping DOGE’s trajectory.

BeInCrypto spoke with Erwin Voloder, Head of Coverage of the European Blockchain Affiliation, to debate how Musk blurred the traces between parody and promotion, main folks to assign real-world worth to a meme and producing moral issues alongside the way in which.

The Genesis of Dogecoin

Towards the tip of 2013, software program engineers Billy Markus and Jackson Palmer joined forces to create Dogecoin, the primary meme coin in crypto historical past. Its major objective was to function a lighthearted parody of the chaotic crypto hype.

Born from the “Doge” web meme, which prominently featured a Shiba Inu, the meme coin was supposed as a humorous jab on the usually illogical nature of crypto hypothesis.

Regardless of its satirical origins, Dogecoin rapidly gained a devoted on-line following—a lot in order that even Tesla CEO Elon Musk turned drawn to it.

Right now, he’s thought of a key determine in the neighborhood, and Dogecoin, opposite to its preliminary philosophy, has turn out to be a speculative asset.

“Musk’s involvement transformed Dogecoin from a satirical internet token into a speculative asset class by bestowing it with perceived legitimacy and entertainment value. His tweets and appearances turned Dogecoin into a cultural product rather than a financial one—a kind of performance art with real economic consequences. The irony is that a coin created to mock irrational investing became the poster child of irrational investing,” Voloder informed BeInCrypto.

Along with symbolic endorsements, Musk has exerted concrete affect. A primary instance is Tesla’s early 2022 resolution to just accept Dogecoin for choose merchandise, considerably strengthening its place and indicating its sensible potential.

Musk additionally didn’t hesitate to make use of social media to convey his love for Dogecoin.

How Did Musk’s Tweets Affect Dogecoin’s Market?

All through the years, Elon Musk, a prolific Twitter consumer even earlier than he purchased the platform, has shared quite a few posts referencing Dogecoin. Every of those tweets has considerably impacted the meme coin’s visibility and worth efficiency.

When Musk referred to Dogecoin in an April 2019 tweet as his favourite cryptocurrency, the market went berserk. In two days, the coin’s worth went from $0.002 on April 1 to as excessive as $0.004.

Two years later, Musk’s X posts declaring “Dogecoin is the people’s crypto” triggered an in a single day buying and selling quantity surge of over 50%.

Quickly sufficient, retail buyers began to comply with Musk’s endorsements mindlessly. Nevertheless it wasn’t all butterflies and roses. Musks’s unpredictable pronouncements additionally got here with excessive volatility.

“Musk blurred the line between parody and promotion, which led people to assign real-world value to a meme. Without him, it may have remained a niche internet joke but with him, it became a symbol of speculative absurdity,” Voloder stated.

When Musk referred to as Dogecoin ‘a hustle’ on Saturday Night time Stay in Could 2021, the coin misplaced greater than a 3rd of its worth in a number of hours.

“Dogecoin has no clear roadmap, no underlying yield or utility, and limited development activity, meaning its valuation is especially sentiment-driven. In such an environment, a single individual’s actions can drive or destroy market perception, particularly when that individual is one of the world’s most followed and wealthiest people,” he added.

Then, in January 2025, President Trump appointed Musk as the pinnacle of a newly created company tasked with chopping federal spending.

Musk referred to as it the Division of Authorities Effectivity, or D.O.G.E. for brief. The title was intentional, and the web broke accordingly.

D.O.G.E. and the Worth Plunge: What’s the Correlation?

President Trump launched the D.O.G.E. division by govt order on his first day on the job. After D.O.G.E. launched its official authorities web site, Dogecoin’s worth surged by 13% in quarter-hour, breaking its earlier short-term downtrend.

But, for the reason that official institution of the Division of Authorities Effectivity, DOGE’s worth has been freefalling. Whereas valued at $0.36 on January 20, its worth has since fallen to $0.15 at the moment.

Findings from a current Finbold report have additionally revealed that Musk may now be having the alternative impact on Dogecoin’s worth and sentiment.

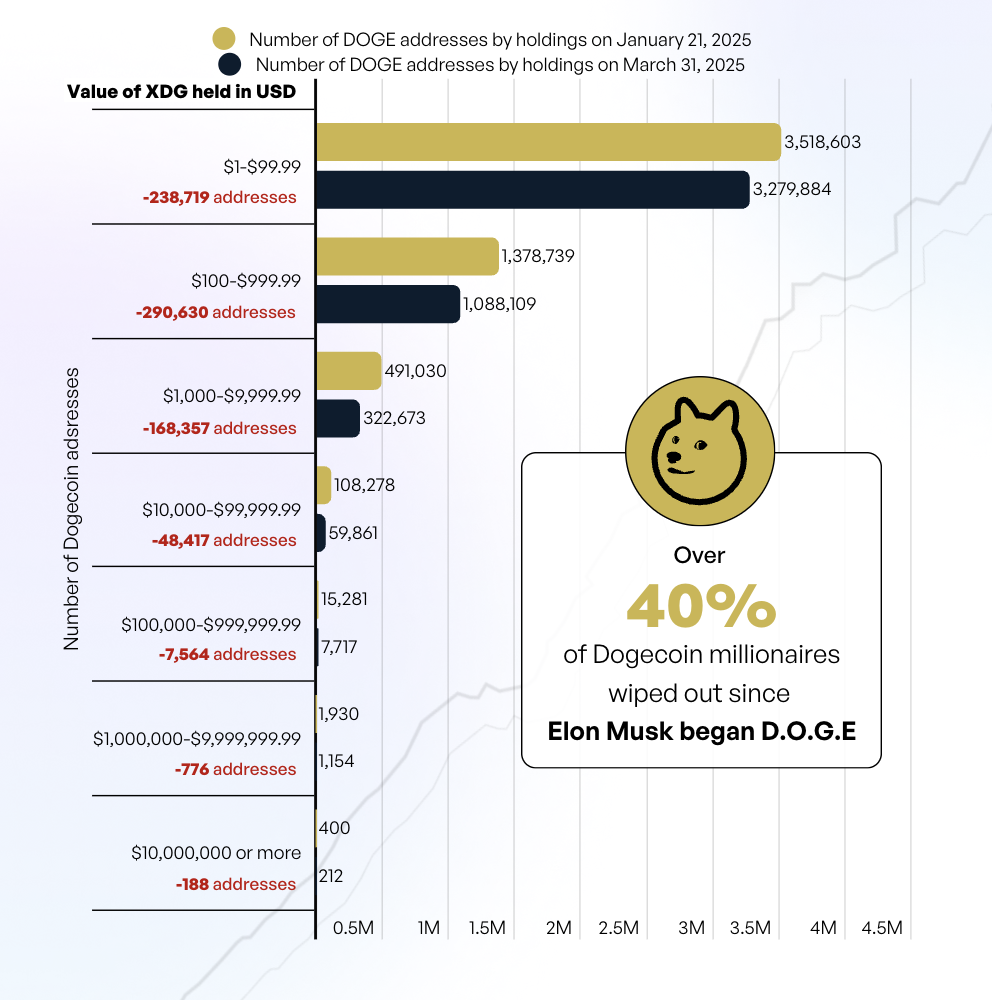

In response to the info, the variety of Dogecoin millionaire addresses has plunged by over 41% between January 21 and March 31. In simply over two months, the cryptocurrency has decreased by 964 addresses.

Notably, the report indicated a large proportional decline within the variety of the wealthiest Dogecoin addresses. The rely of addresses holding $1 million to $9.99 million decreased by 40.21% in Q1 2025.

Much more considerably, the variety of addresses holding over $10 million plummeted by 47%, from 400 to 212.

In brief, Dogecoin whales are dumping the token.

“Musk’s influence remains a key variable in Dogecoin’s valuation, and the timing of the drop in high-value addresses closely aligns with his D.O.G.E. announcement, suggesting a correlation. However, attributing the entire reversal to Musk overlooks broader macro factors like rising interest rates, tighter crypto regulation, and waning retail enthusiasm post-2021,” Voloder defined.

Regardless of the issue of assessing the exact affect of Elon Musk’s D.O.G.E. management on Dogecoin’s efficiency, his vital affect on the cryptocurrency has turn out to be evident.

The moral issues accompanying Musk’s affect have additionally turn out to be tough to disregard.

The Moral Considerations of a Billionaire’s Affect

In response to Voloder, the Dogecoin case illustrates the perils of parasocial investing, a conduct wherein folks mistakenly assign credibility to well-known personalities primarily based on their superstar standing or charisma.

It additional reveals the damaging results of uncritical reliance on endorsements, doubtlessly resulting in substantial monetary losses for retail buyers.

The ethics of a billionaire influencing a unstable market like cryptocurrency additionally current vital complexities.

“On one hand, Musk has the right to express personal views and participate in public discourse, including around assets like Dogecoin. On the other, his outsized influence means that his commentary can trigger real financial harm or euphoria in retail investors who often lack access to sophisticated risk models. Ethically, when you wield that kind of influence, there’s a strong argument for assuming a higher standard of responsibility—especially in a market with minimal guardrails,” Voloder informed BeInCrypto.

Given the unregulated nature of the cryptocurrency business, it’s at the moment difficult to pinpoint the diploma to which Musk’s actions may be held accountable.

Does Musk’s Affect Represent Market Manipulation?

Though introduced as private opinions, Musk’s tweets demonstrably have an effect on Dogecoin’s worth, making a authorized grey space relating to potential market manipulation below US securities and commodities legal guidelines.

“Under SEC rules, market manipulation involves intentional conduct designed to deceive or defraud investors by controlling or artificially affecting market prices. While Dogecoin is not officially deemed a security, and thus outside the SEC’s traditional remit, the CFTC could still scrutinize it under its anti-manipulation powers for commodities,” Voloder defined.

The Dogecoin case isn’t the primary time a high-profile determine has influenced markets in ways in which had been manipulative, although not explicitly unlawful.

Voloder highlighted two situations at completely different factors within the twentieth century: when outstanding banker JP Morgan steered markets through the panic of 1907 and investor George Soros broke the Financial institution of England in 1992.

Although their maneuvers had been technically authorized, they managed to sway market outcomes. Nevertheless, this was the twentieth century, and their affect was proportionally a lot smaller.

“The difference today is that social media provides instantaneous reach to millions of investors, amplifying the potential impact. So even if Musk’s tweets are framed as personal musings, their predictable effect on price can be seen as a form of market signaling—intentional or not,” Voloder informed BeInCrypto.

The truth is, the SEC and authorized specialists are already debating Elon Musk’s potential affect on Dogecoin’s monetary market actions.

A $258 Billion Lawsuit

Elon Musk at the moment faces a $258 billion class motion lawsuit for working a Dogecoin pyramid scheme.

The lawsuit, filed in June 2022, claims that Musk deliberately promoted Dogecoin by way of his tweets, public appearances, and media interactions, creating hype and driving up demand.

In response to the plaintiffs, this synthetic inflation of Dogecoin’s worth allowed Musk and his firms to revenue whereas leaving different buyers with substantial losses when the value inevitably declined.

Because of the SEC’s unclear authorized classification of cryptocurrencies like Dogecoin, Voloder anticipates a tough path for these claims in courtroom. However, the lawsuit signifies elevated consideration to market manipulation by influential figures.

“Still, the lawsuit signals increased legal pressure to define where promotional enthusiasm ends and financial misconduct begins. If regulators or courts decide Musk knowingly manipulated the market or misled investors, he could face civil penalties or be forced into settlements. The SEC’s earlier scrutiny of Musk’s Tesla tweets, resulting in a consent decree, shows that regulators are willing to act when market-moving speech crosses certain lines,” Voloder defined.

Musk’s affect on Dogecoin continues unabated, and the long-term results on the Dogecoin neighborhood stay a topic of debate.

The speedy 40% lower in Dogecoin whale addresses inside two months has raised questions in regards to the meme coin’s future power and resilience.

Nevertheless, DOGE’s basic power nonetheless stays intact – it’s neighborhood.

“While the initial hype has faded, Dogecoin still retains a loyal base of enthusiasts, many of whom appreciate its meme-driven culture, low transaction fees, and iconic branding. But the big speculative crowd that initially drove its [all-time high] has largely left the field in absence of sustained bullish narratives or meaningful tech upgrades,” Voloder concluded.

Sooner or later, merchants might be watching to see if Dogecoin’s ‘cult following’ finally dwindles or if a powerful neighborhood will maintain the ‘OG meme coin’.

Disclaimer

Following the Belief Venture tips, this function article presents opinions and views from business specialists or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm info independently and seek the advice of with knowledgeable earlier than making selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.