Hyperliquid is among the most worthwhile platforms in crypto proper now, but its worth has been struggling, dropping over 8% within the final 24 hours and greater than 24% previously seven days. Regardless of its sturdy fundamentals, bearish momentum has saved HYPE at its lowest ranges since December 2024.

Nonetheless, the community’s rising income has outpaced Solana, Ethereum, and Raydium. This means underlying power that might gasoline a rebound if market situations shift. If HYPE breaks resistance at $14.65, it may set off a rally towards $20 and even $25.87, however failure to reclaim momentum may ship it beneath $12.

Hyperliquid RSI Has Been Impartial Since March 4

Hyperliquid’s RSI (Relative Energy Index) is at present at 32.59, remaining in impartial territory since March 4. Suspicious high-leverage trades are elevating cash laundering issues, resulting in the continuing correction.

The RSI is a momentum oscillator that measures the pace and alter of worth actions on a scale from 0 to 100, with values above 70 indicating overbought situations and beneath 30 signaling oversold situations.

An RSI between 30 and 50 suggests weak momentum, usually aligning with a downtrend or consolidation part.

HYPE’s RSI has now stayed beneath 50 for 9 consecutive days, reinforcing the dearth of bullish momentum. With the present studying at 32.59, the asset is approaching oversold territory however hasn’t but reached excessive ranges.

This means that promoting stress stays dominant, but when RSI turns upward and crosses 50, it may sign the beginning of a stronger restoration.

Till then, Hyperliquid stays in a weak place, with worth motion struggling to achieve upward traction.

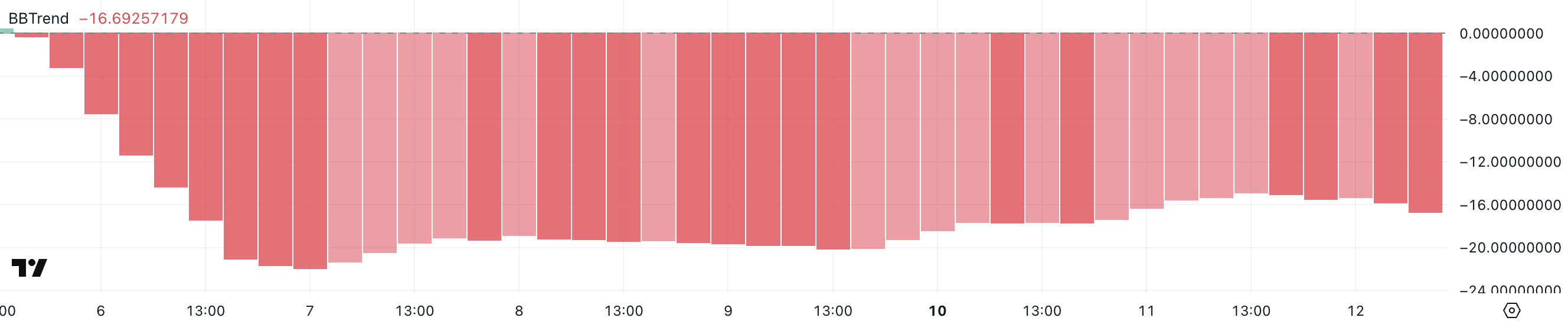

HYPE BBTrend Has Been Adverse For One Week

Hyperliquid’s BBTrend is at present at -16.69, remaining detrimental since March 5 and staying beneath -10 for the previous six days.

BBTrend (Bollinger Band Pattern) is an indicator that measures worth momentum relative to Bollinger Bands, serving to establish bullish or bearish traits.

Values above 10 point out sturdy upward momentum, whereas values beneath -10 counsel sturdy downward stress.

With HYPE BBTrend at -16.69, the bearish pattern stays dominant, reinforcing the current promoting stress.

Staying beneath -10 for a number of days means that draw back momentum has been persistent, limiting any important restoration makes an attempt.

If the BBTrend begins shifting towards 0, it may point out a weakening downtrend, however for now, Hyperliquid stays in a clearly bearish part.

Can HYPE Reclaim $20 In March?

Hyperliquid is at present buying and selling at its lowest ranges since December 2024, with its EMA strains signaling a powerful bearish sentiment.

Quick-term EMAs stay nicely beneath long-term ones, with giant gaps between them indicating sturdy draw back momentum. If the correction continues, HYPE may drop beneath $12, marking its lowest worth in over three months.

Nonetheless, Hyperliquid income has surged previous $11 million within the final seven days, outperforming main gamers like Pump, Solana, Ethereum, and Raydium.

If momentum returns, HYPE may take a look at the $14.65 resistance, with a possible rally towards $17 if damaged. A stronger uptrend may push the worth above $20, doubtlessly testing $21 and even $25.87 within the coming days.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.