The worldwide crypto market cap shed a further $150 billion to shut the week at $1.92 trillion. This marked the primary time in a month the valuation dropped under $2 trillion.

Listed here are among the main cryptocurrencies to look at this week, following their important value actions final week:

JUP battles at $0.70

Final week, Jupiter (JUP) recorded days of features and losses, because it battled the $0.70 territory. Nonetheless, bearish stress prevailed amid a failing market, resulting in a 6% weekly hunch and shutting at $0.6979.

At present, JUP trades between the decrease and center Bollinger Bands. The value sits above $0.6383 (decrease band), which gives help. Nonetheless, it stays under the 20-day transferring common ($0.7752), indicating resistance overhead.

On the DMI, the +DI at 13.15 exhibits weak shopping for stress, whereas the -DI at 24.86 highlights stronger promoting stress.

Nonetheless, the +DI seems to be rising as Jupiter begins the brand new week bullish, with the -DI dropping. This implies a possible shift towards patrons. The ADX at 21.71 exhibits a reasonably robust development however nonetheless lacks clear directional conviction.

This week, buyers ought to look ahead to a decisive break above the center band or under the decrease band for clearer momentum in both path.

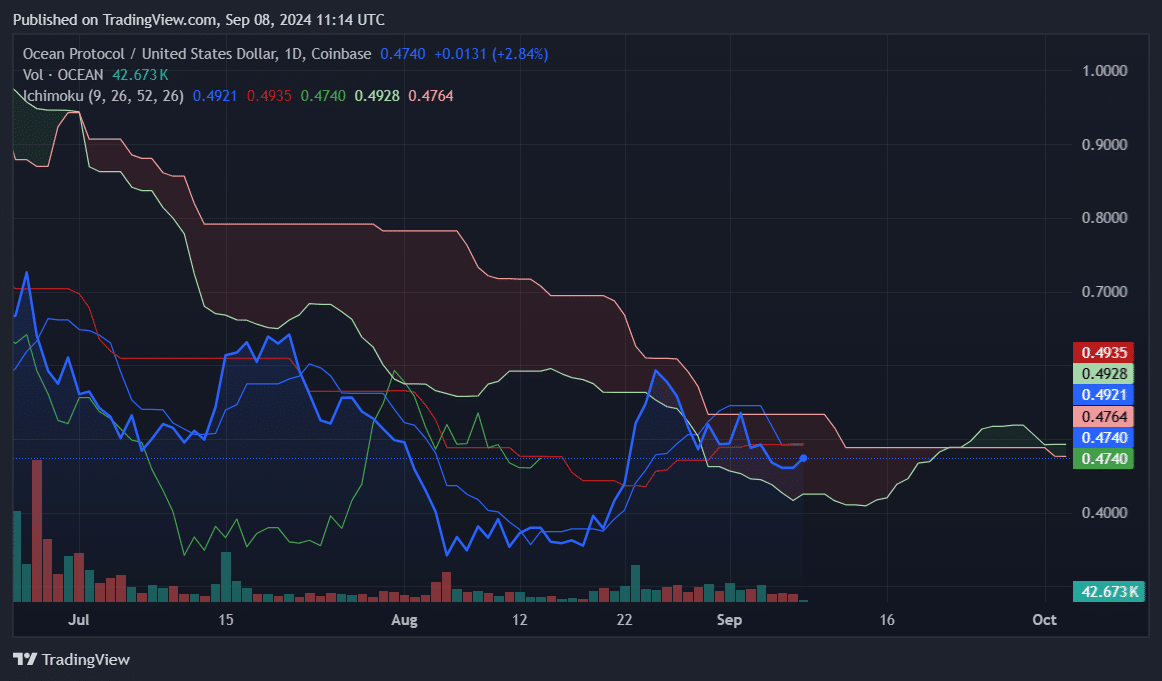

OCEAN faces volatility

Ocean Protocol (OCEAN) had a unstable week. After gaining 9% on Sept. 1 and a couple of, it rapidly reversed course, shedding these features in a pointy 8.82% drop on Sept. 3. It continued to say no, ending the week at $0.4609, a 6.1% weekly drop.

At present, OCEAN trades under the Ichimoku Cloud, with resistance at $0.4935 (Senkou Span B). The cloud’s bearish construction suggests continued downward stress. Nonetheless, OCEAN is hovering close to the flat Kijun-Sen ($0.4921) and Tenkan-Sen ($0.4740), indicating some potential consolidation.

OCEAN additionally begins the week on a bullish notice. If the value breaks above the cloud, it might problem increased ranges, with $0.4935 performing as key resistance.

A break under the Kijun-Sen might sign additional declines towards $0.46.

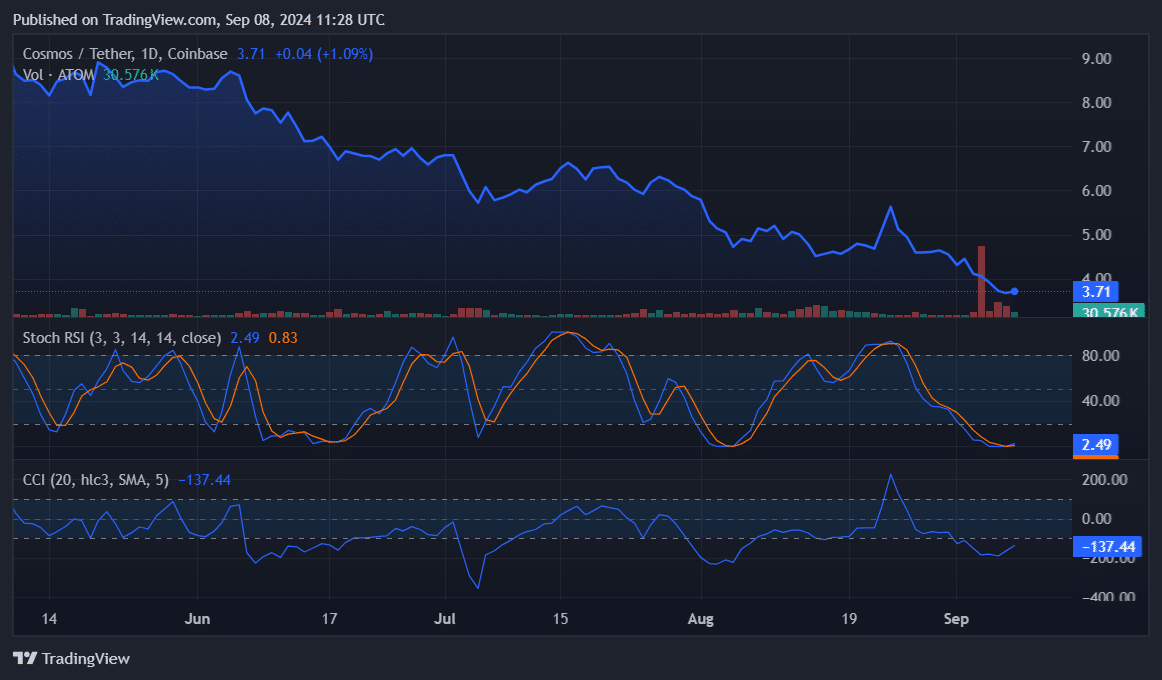

ATOM collapses 18%

Cosmos (ATOM) struggled final week, experiencing an 18.8% drop and shutting at $3.67. The persistent bearish momentum saved costs low.

The Stoch RSI’s Ok line is at 2.49, whereas the D line has dropped to 0.83, signaling that ATOM is deeply oversold. This might point out a possible rebound if patrons step in. Nonetheless, the present development stays bearish.

A CCI at -137.44 additionally confirms the oversold circumstances. Readings under -100 recommend that the promoting stress is robust, however this will additionally trace at a attainable reversal if the development weakens.

ATOM might try and stabilize within the new week, however the oversold indicators recommend a possible short-term rebound. If bearish sentiment persists, ATOM might check decrease help ranges round $3.50.