As the primary week of October 2024 wraps up, a number of Synthetic Intelligence (AI) cash are making waves with standout value performances and growing investor curiosity.

On this evaluation, BeInCrypto highlights the highest three AI cash dominating the market, analyzing the important thing drivers behind their rise and what may very well be on the horizon within the coming weeks.

DIA

DIA is an organization specializing in cross-chain oracles for Web3. It delivers providers like digital asset value feeds, adjustable NFT ground value feeds, multi-chain randomness for DeFi and GameFi purposes, and the creation of bespoke oracles for decentralized apps.

DIA surged 47.79% over the previous seven days, rating it among the many top-performing synthetic intelligence cash throughout this era. Its value skyrocketed from $0.41 on September 29 to $0.92 by October 1, marking a formidable 124% achieve. Following this surge, the worth corrected again to $0.59.

Regardless of this retracement, DIA’s Exponential Transferring Common (EMA) traces stay bullish. The short-term EMAs proceed to remain above the long-term ones, signaling that the bullish pattern remains to be intact, though it has weakened in comparison with the sooner peak.

Learn extra: How Will Synthetic Intelligence (AI) Remodel Crypto?

The DIA’s Relative Energy Index (RSI) at present stands at 44.68, which suggests it’s neither overbought nor oversold. RSI is a momentum indicator that ranges from 0 to 100 and is used to gauge whether or not an asset is overbought (above 70) or oversold (under 30) territory.

With DIA’s RSI at 44.68, it signifies that the asset is in a impartial zone, exhibiting regular motion with out excessive stress in both path. This degree suggests there may be nonetheless potential room for upward development earlier than hitting an overbought situation. That means that DIA may have extra upside momentum forward.

Zero1 Labs (DEAI)

DEAI is the token from Zero1 Labs, a platform devoted to growing decentralized synthetic intelligence purposes. Zero1 Labs affords Keymaker, an open platform that features a DeAI (Decentralized Synthetic Intelligence) toolset, API, and dApp Retailer, together with Cypher, a blockchain optimized for AI and huge language fashions, with a give attention to information governance and possession. The platform is designed to simplify the creation and monetization of DeAI apps.

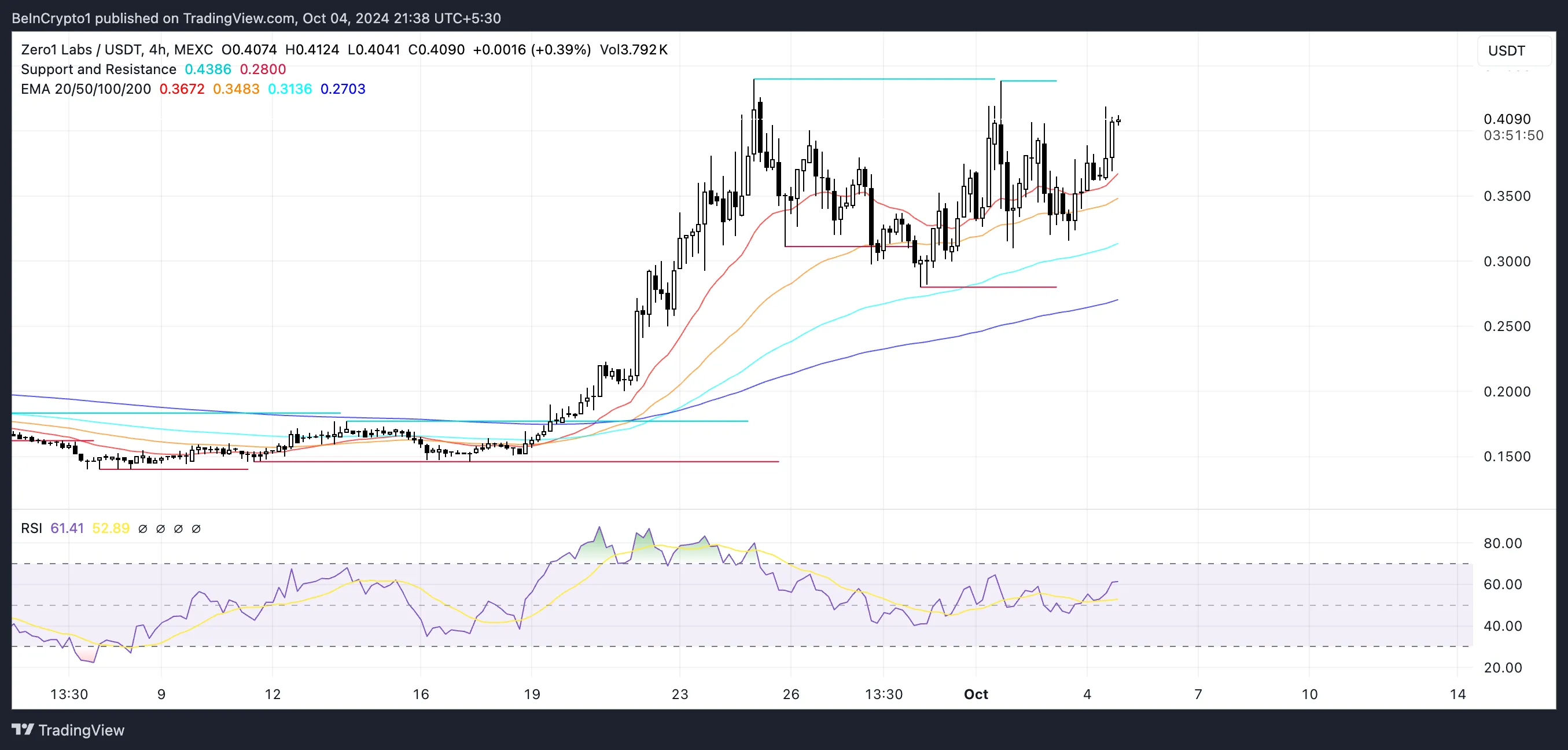

DEAI value surged 14.05% within the final week, at present sitting at $0.41. DEAI EMA traces are strongly bullish, with the short-term traces all above the long-term traces. In addition they present a long way between them, which exhibits the uptrend is sustainable.

DEAI at present exhibits help at $0.31, and its subsequent resistance is at $0.43, which ought to be examined quickly. Its relative Energy Index (RSI) at present stands at 61.41. That signifies that whereas it’s nearing the overbought threshold of 70, it nonetheless has some room for potential development.

With DEAI’s RSI approaching 70, the token exhibits indicators of energy and upward momentum. Nevertheless, it may very well be nearing some extent the place features may sluggish or a correction might happen. Whereas there may be nonetheless room for development, this momentum might not final for much longer because it inches nearer to the overbought zone.

Lambda (LAMB)

LAMB is the coin of Lambda, a storage community that defines itself because the “leading omnichain modular storage”, supporting DeFi and synthetic intelligence purposes. LAMB value adopted the identical pattern from DIA and DEAI, surging from $0.0016 on September 27 to $0.0030 on September 30. That represents an 87,5% development in simply three days.

It then dropped to $0.0023, however its value chart nonetheless exhibits a rising potential for the following few days. LAMB EMA traces nonetheless look bullish, though the space between its two short-term traces just isn’t as large as earlier than. This might point out that the present uptrend is much less sturdy.

Learn extra: How To Put money into Synthetic Intelligence (AI) Cryptocurrencies?

LAMB’s RSI at present sits at 50.33, signaling that the asset is in a impartial place, neither overbought nor oversold. This leaves ample room for development because it signifies that LAMB just isn’t dealing with extreme shopping for stress but.

If the present uptrend continues, LAMB may quickly retest the $0.0030 resistance degree, presenting a possible 32% improve alternative. With its RSI comfortably within the center, there may be house for additional upward momentum earlier than any vital resistance is encountered.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.