Excellent news for householders, unhealthy information for patrons: Residence costs continued to surge within the fourth quarter of 2023 within the majority of main U.S. metros, and a few markets even posted double-digit good points.

The nationwide median worth for an current single-family dwelling jumped 3.5% from a yr prior, reaching $391,700, based on Nationwide Affiliation of REALTORS® knowledge. Final month, NAR reported that December dwelling costs reached an all-time excessive. About 85 million householders noticed good points in housing wealth in December as their fairness continued to climb. However though householders are sitting on a wholesome nest egg, “many home buyers have been shocked at high housing costs, with a typical monthly mortgage payment rising from $1,000 three years ago to more than $2,000 last year,” says NAR Chief Economist Lawrence Yun. “This doubling in housing costs … contributes to the sense of dissatisfaction about the economy.”

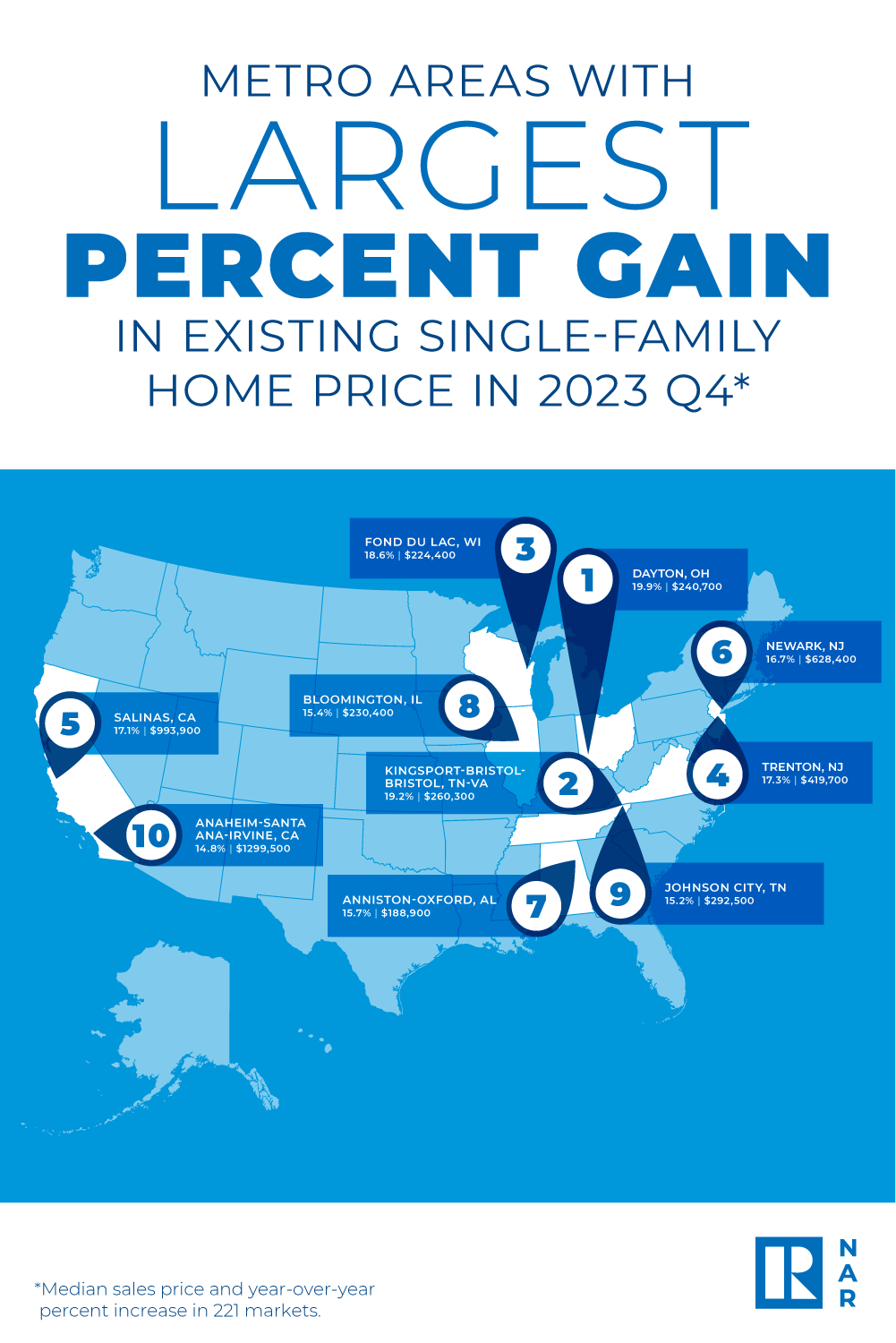

Would-be dwelling patrons have various price range concerns, relying on the world of the nation they dwell in. Costs for current single-family properties rose in additional than 85% of the 221 markets NAR tracked within the fourth quarter of 2023. Fifteen p.c—or 34 of the tracked markets—even posted double-digit worth good points, up from 11% within the third quarter. The highest 10 metro areas with the biggest year-over-year median worth will increase within the fourth quarter of 2023 all recorded good points of not less than 14.8%, NAR stories.

California stays the state with the very best dwelling costs within the nation. Eight of the ten priciest markets within the fourth quarter of 2023 have been situated within the Golden State. NAR’s report reveals the next have been the costliest housing markets within the fourth quarter:

- San Jose-Sunnyvale-Santa Clara, Calif.: $1,750,300; 11%

- Anaheim-Santa Ana-Irvine, Calif.: $1,299,500; 14.8%

- San Francisco-Oakland-Hayward, Calif.: $1,251,000; 4.3%

- City Honolulu: $1,069,400; -1.9%

- Salinas, Calif.: $993,900; 17.1%

- San Diego-Carlsbad, Calif.: $931,600; 8.7%

- Oxnard-Thousand Oaks-Ventura, Calif.: $916,800; 7.9%

- San Luis Obispo-Paso Robles, Calif.: $912,100; 5.7%

- Los Angeles-Lengthy Seashore-Glendale, Calif.: $884,400; 6.7%

- Boulder, Colo.: $849,400; 11.8%

Affordability Pressures Proceed, However Could Be Bettering

The common month-to-month mortgage fee on a typical current single-family dwelling, assuming a 20% down fee, was $2,163 within the fourth quarter, NAR’s knowledge reveals. That marks a ten% enhance in comparison with a yr in the past. Mortgage charges have risen over the previous yr, reaching a peak of practically 8% within the fall. Charges have since receded, settling within the mid-6% vary over current weeks.

As mortgage charges decline, housing affordability is bettering, NAR’s report reveals. Nonetheless, within the fourth quarter, a household wanted a qualifying earnings of not less than $100,000 to afford a ten% down fee mortgage in about 47% of the metro markets NAR tracked.

Nationwide, gross sales have been pretty restrained over the previous few months attributable to restricted housing stock, Yun says. The scarcity has been holding upward strain on dwelling costs in lots of markets. Costs are anticipated to stay elevated, at the same time as gross sales could quickly decide up heading into spring: “Increased homebuilding, along with lower mortgage rates, will not only improve housing affordability but also help bring more homes onto the market in 2024,” Yun says.