Based on the newest report from CryptoQuant, stablecoin liquidity has crossed new data, largely as a result of Tether and Circle. Ripple entered the area with its new RLUSD token.

Heightened stablecoin exercise on centralized exchanges additionally alerts bullish exercise for Bitcoin.

Tether and Circle Dominate the Stablecoin Market

The report notably highlights a bullish perspective, claiming that stablecoin liquidity has reached new heights.

“Crypto market liquidity, measured by stablecoin value, hit a record high in late September. The total market cap of major USD-backed stablecoins is now $169 billion, up 31% or $40 billion year-to-date. Increased stablecoin market cap typically correlates with higher Bitcoin and crypto prices by boosting market liquidity,” CryptoQuant report claimed.

Learn Extra: What Is a Stablecoin? A Newbie’s Information

The report paid particular consideration to Tether (USDT) and Circle (USDC) for apparent causes. These two property, notably USDT, maintain an awesome dominance over the stablecoin market. Notably, these main firms alone account for over 90% of the whole stablecoin market cap.

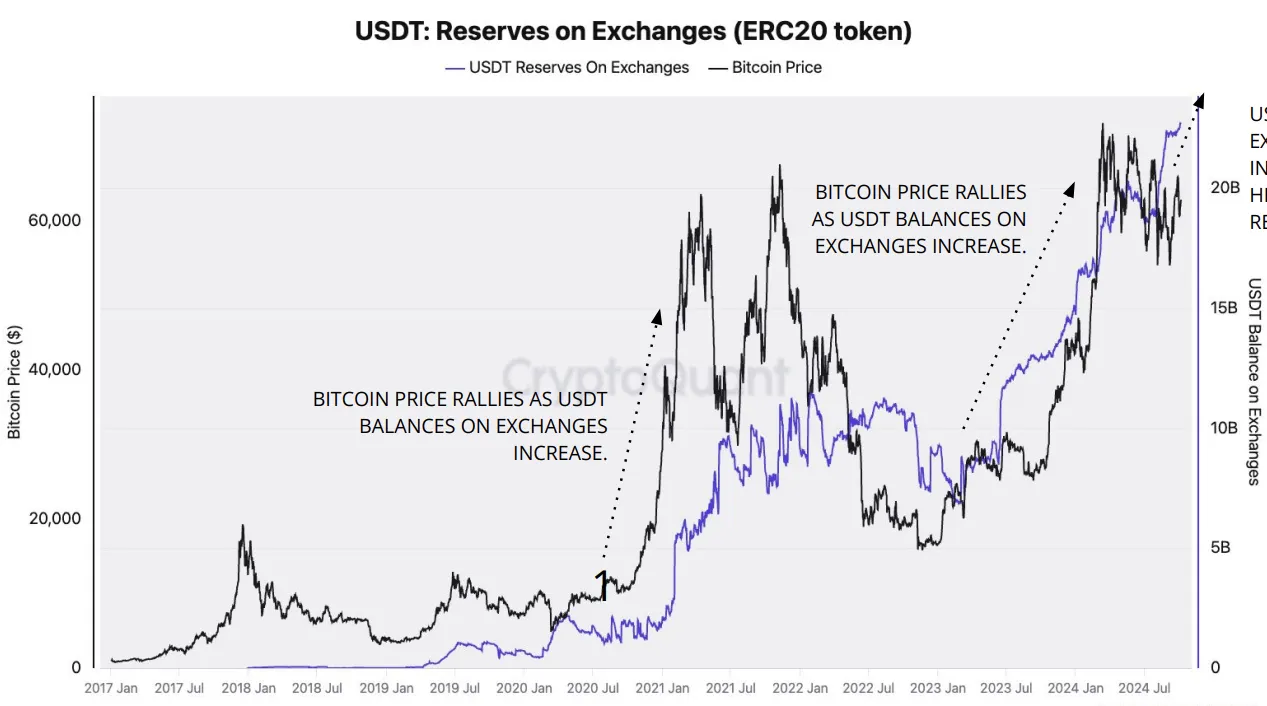

The expansion of those property on centralized exchanges is especially reassuring for markets. Stablecoins are often used as intermediaries for Bitcoin purchases on crypto exchanges, and their liquidity development is positively correlated with Bitcoin value jumps.

Ripple’s New Challenger

Nonetheless, these two property may face challenges in persevering with their dominance. The brand new EU stablecoin laws have notably threatened Tether’s maintain over the European market, which could possibly be an enormous alternative. Ripple has already been planning its personal stablecoin launch for months, and it started minting the brand new RLUSD in late September.

Learn Extra: A Information to the Greatest Stablecoins in 2024

RLUSD has grown to a market cap of $47 million, and it operates on each Ethereum and Ripple’s XRPL community. Moreover, in line with additional evaluation, RLUSD is especially well-suited for XRPL. These embody a excessive quantity of visitors in USD and Chinese language Yuan and infrastructure for remittances.

It’s presently unclear how profitable RLUSD is perhaps at breaking into the stablecoin market. Nonetheless, it could purchase a substantial chunk of market share if it focuses on the EU stablecoin laws.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.