Solana (SOL) could face a possible roadblock after a bullish breakout earlier this month. On July 19, the altcoin rallied previous the higher line of its symmetrical triangle, inside which it had traded since March 18.

Nevertheless, with waning shopping for stress amid rising bearish sentiments, Solana is retracing and nearing the vital breakout stage.

Solana Makes Transfer To Retest Key Breakout Stage

SOL started buying and selling throughout the symmetrical triangle channel on March 18. This sample is shaped when an asset’s value trades between two converging strains. It usually signifies a interval of value consolidation out there as patrons and sellers battle for management.

When an asset’s value breaks out of this sample, whether or not upward or downward, it alerts the tip of the present development and the start of a brand new one, both bearish or bullish.

SOL broke above this sample on July 19 and continued its uptrend. Nevertheless, on July 29, patrons exhaustion set in, inflicting its value to peak at $182.52. The coin reversed its development and has since trended downward. At press time, SOL trades at $168.93, declining by 7% since then.

As of this writing, SOL is in a downtrend and poised to retest the breakout stage. Usually, a pullback to retest the breakout line could be a wholesome section earlier than the brand new uptrend resumes.

Nevertheless, the preliminary breakout could have been a false sign, and the value is reverting again to the earlier development, which in SOL’s case would imply consolidating inside a variety.

Within the SOL market, the bearish bias towards the altcoin is gaining momentum. For instance, the dots that make up its Parabolic Cease and Reverse (SAR) indicator presently lie above its value.

This indicator tracks an asset’s value traits and potential reversal spots. When its dots are above the asset’s value, the market is alleged to be in a decline. It signifies that the asset’s value has been falling, and the downtrend could proceed.

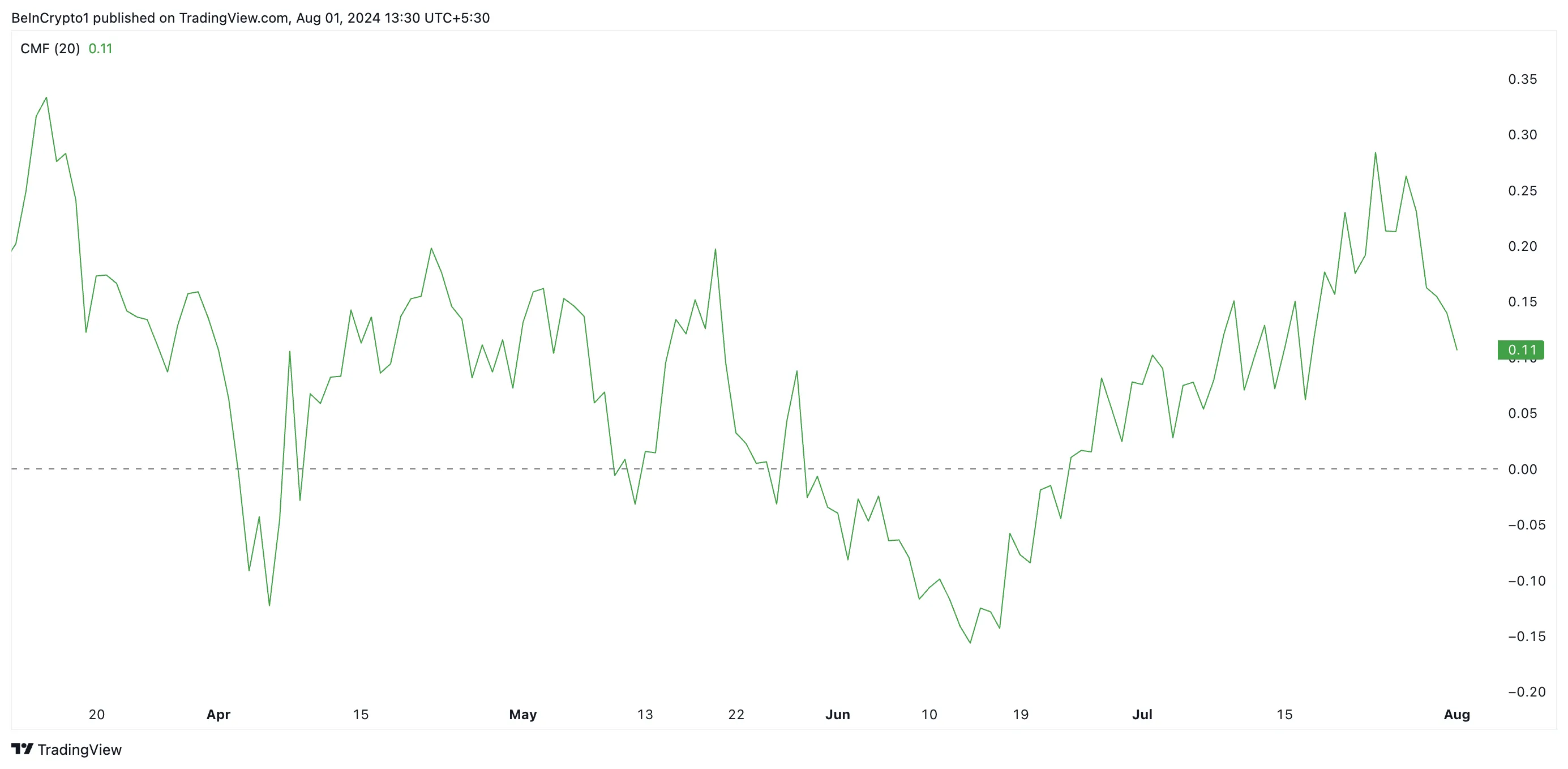

Additional, readings from SOL’s Chaikin Cash Floe (CMF) reveal a lower in liquidity influx into the market. The indicator measures the circulate of cash into and out of the market.

When it begins to fall, it means there’s much less capital influx, a notable precursor to a sustained value decline.

SOL Worth Prediction: A Rally Above $200 within the Books if Retest Is Profitable

If the downtrend persists, SOL’s value could fall beneath the breakout stage and resume trending throughout the symmetrical triangle sample. SOL’s subsequent value goal can be $154.22 if this occurs.

Nevertheless, analysts have opined {that a} rally in SOL’s value is imminent. Brian Quinlivan, Lead Analyst at Santiment, instructed BeinCrypto that the coin’s present muted value efficiency may be associated to its considerably constructive correlation with Bitcoin (BTC), which has solely elevated by 1% over the previous week.

Solana’s dialogue charge has surprisingly been pretty impartial, even throughout its massive rally between July 4th and July twenty seventh. The shortage of FOMO may point out an extra rally is in retailer as soon as Bitcoin will get its legs and exhibits a minor bounce itself as soon as once more, Quinlivan famous.

If the coin efficiently retests the breakout line and resumes its uptrend, its value could climb towards $200.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.