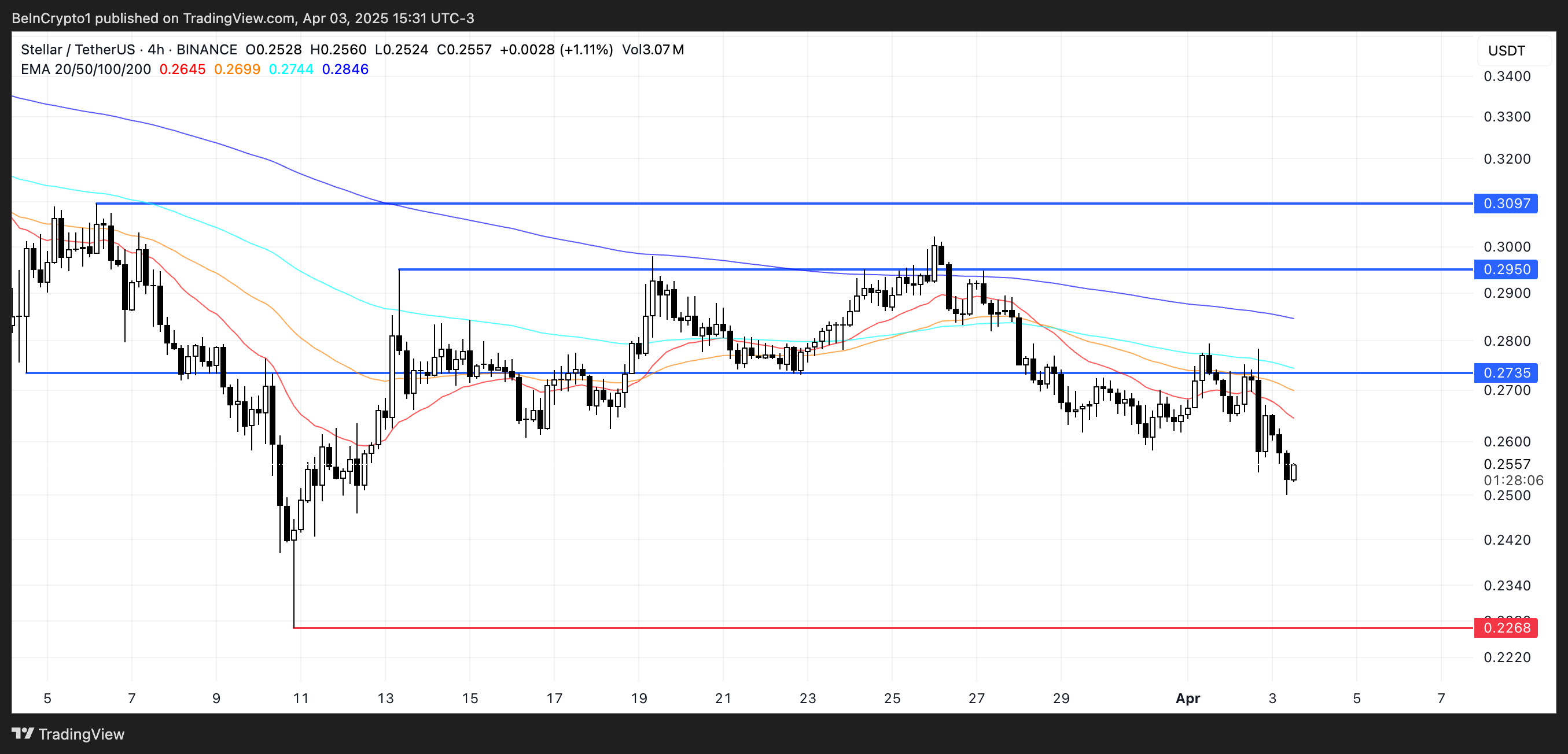

Stellar (XLM) is down greater than 5% on Thursday, with its market capitalization dropping to $8 billion. XLM technical indicators are flashing robust bearish indicators, suggesting continued downward momentum that might take a look at important help ranges round $0.22.

Whereas a reversal situation stays potential with resistance targets at $0.27, $0.29, and $0.30, such an upside transfer would require a considerable shift in market sentiment.

XLM RSI Reveals Sellers Are In Management

Stellar’s Relative Energy Index (RSI) has dropped sharply to 38.99, down from 59.54 simply two days in the past—signaling a notable shift in momentum.

The RSI is a extensively used momentum oscillator that measures the pace and magnitude of current worth modifications, sometimes ranging between 0 and 100.

Readings above 70 counsel overbought situations, whereas ranges under 30 point out oversold territory. A studying between 30 and 50 usually displays bearish momentum however isn’t but excessive sufficient to set off a right away reversal.

With Stellar’s RSI now under the important thing midpoint of fifty and approaching the oversold threshold, the present studying of 38.99 means that sellers are gaining management.

Whereas it’s not but in oversold territory, it does sign weakening shopping for strain and rising draw back danger.

If the RSI continues to fall, XLM might face additional worth declines until consumers step in quickly to stabilize the pattern and forestall a slide into extra deeply oversold ranges.

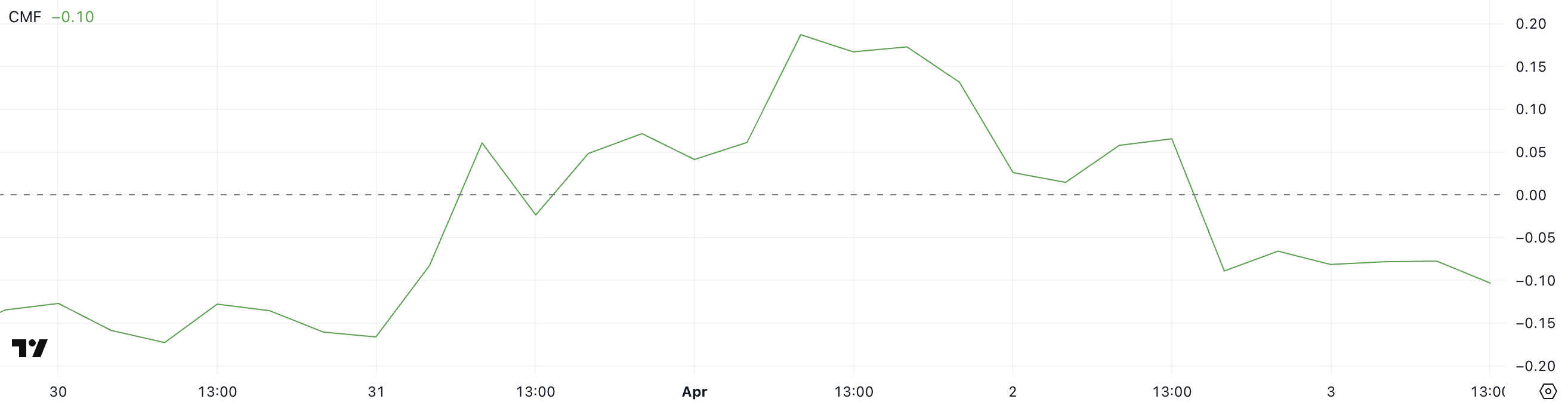

Stellar CMF Closely Dropped Since April 1

Stellar’s Chaikin Cash Circulation (CMF) has plunged to -10, a pointy decline from 0.19 simply two days in the past, signaling a major shift in capital circulation dynamics.

The CMF is an indicator that measures the volume-weighted common of accumulation and distribution over a set interval—basically monitoring whether or not cash is flowing into or out of an asset.

Optimistic values counsel shopping for strain and accumulation, whereas unfavorable values level to promoting strain and capital outflow.

With XLM’s CMF now deep in unfavorable territory at -10, it signifies that sellers are firmly in management and substantial capital is leaving the asset.

This degree of unfavorable circulation can put downward strain on worth, particularly if it aligns with different bearish technical indicators. Until shopping for quantity returns to offset this outflow, XLM might proceed to weaken within the close to time period.

Will Stellar Fall To 5-Month Lows?

Stellar worth motion presents regarding indicators as EMA indicators level to a powerful bearish pattern with vital draw back potential.

Technical evaluation suggests this downward momentum might push XLM to check important help round $0.22. It might breach this degree and fall under the psychologically necessary $0.20 threshold—a worth not seen since November 2024.

This technical deterioration warrants warning from merchants and traders as promoting strain seems to be intensifying.

Conversely, a pattern reversal situation would require a considerable shift in market sentiment. Ought to bulls regain management, XLM might problem the quick resistance at $0.27, with additional upside targets at $0.29 and the important thing $0.30 degree.

Nevertheless, this optimistic outlook faces appreciable obstacles, as solely a dramatic sentiment shift coupled with the emergence of a robust uptrend would allow such a restoration.

Till clearer bullish indicators manifest, the prevailing technical construction continues to favor the bearish case.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.