Dwelling to a booming economic system and a dynamic enterprise scene, Texas has change into a magnet for homebuyers throughout the nation. Whereas historically identified for affordability, the Texas housing market is experiencing a interval of transition. The market is demonstrating resilience and gradual enchancment in 2024.

Dwelling costs have stabilized, new listings are rising, and the market is adjusting to increased mortgage charges and financial elements influencing homebuyer conduct. The general outlook stays constructive, supported by Texas’ robust labor market and financial circumstances. Listed below are the newest developments within the Texas housing market.

How is the Texas Housing Market Doing in 2024?

Texas Dwelling Gross sales

The Texas housing market has proven a big rebound in April 2024, following a decline in March. Seasonally adjusted housing gross sales have elevated, pushed by an increase in new listings for the fourth consecutive month. This restoration has resulted in 29,212 properties bought on a seasonally adjusted foundation, marking a 5.9 p.c enhance month over month (MOM).

- San Antonio noticed the very best restoration among the many main cities, with an 8 p.c enhance in house gross sales, bouncing again from a 9.2 p.c decline.

- Dallas skilled a 4 p.c enhance in house gross sales.

- Different main cities additionally noticed slight will increase in gross sales.

This upward pattern in house gross sales signifies a powerful demand for housing throughout Texas, supported by a sturdy labor market and financial energy.

Texas Dwelling Costs

Regardless of the fluctuations in gross sales, house costs in Texas have remained secure. The median house worth within the state has held regular at roughly $340,000 for 2 consecutive months.

- Austin skilled a notable enhance of 5.1 p.c in house costs, with the median worth rising from $421,572 to $443,247.

- Houston noticed a 2.1 p.c enhance in house costs.

- Dallas had a modest 0.7 p.c enhance.

- San Antonio was the one main metropolis to expertise a decline in house costs, falling by 0.9 p.c.

The Texas Repeat Gross sales Dwelling Worth Index (Jan 2005=100) additionally confirmed constructive development, rising by 0.9 p.c MOM and 2.6 p.c yr over yr (YOY).

Texas Housing Provide

The availability of housing in Texas has been on the rise, contributing to the stabilization of the market.

- The variety of energetic listings elevated from 106,428 to 111,707, a 4.9 p.c enhance.

- New listings have been rising steadily from December to April, with a complete of 47,000 new listings in April 2024.

Among the many Large 4 cities:

- Dallas noticed a decline in new listings over the previous two months, at present at 11,523 new listings.

- Austin skilled a big enhance of 25 p.c in new listings between January and April.

- Houston added 2,788 listings (a 10.7 p.c enhance), virtually 5 occasions that of the earlier month.

- San Antonio noticed a modest enhance of 2 p.c.

The typical days on market has remained unchanged at 57 days. Nonetheless, there have been variations among the many main cities:

- Austin decreased by virtually 4 days.

- Dallas elevated by lower than at some point.

- San Antonio skilled a rise of simply over three days, now having the very best days on market at 72 days.

- Houston had the bottom days on market at 46 days.

Texas Housing Market Traits

A number of key developments are shaping the Texas housing market in 2024:

1. Rising Curiosity Charges:

- Treasury and mortgage charges have been rising for the reason that begin of the yr, though they continue to be beneath their peak 2023 ranges.

- The typical ten-year U.S. Treasury Bond yield rose by virtually 33 foundation factors to 4.54 p.c.

- The Federal Dwelling Mortgage Mortgage Company’s 30-year fixed-rate rose by 17 foundation factors to 6.99 p.c.

2. Single-Household Begins Declining:

- The variety of single-family development permits elevated by 0.9 p.c MOM, reaching 13,805 issuances.

- Development begins, nevertheless, decreased by 15.1 p.c MOM to 13,731 models, partly because of the robust efficiency in February signaling an early begin to the development season.

3. Financial Energy and Housing Demand:

- Texas’ strong labor market and financial energy proceed to help housing demand.

- Residential mortgage exercise is enhancing as extra pre-approved clients seek for properties, regardless of increased mortgage rates of interest.

- Monetary vulnerability, equivalent to rising bank card delinquencies, is focused on the decrease finish of the revenue distribution, considerably shielding the home-purchase market however impacting housing affordability.

4. Housing Affordability:

- Whereas the housing market is stabilizing, the persistent increased mortgage charges and financial elements have broader implications for housing affordability.

- Households on the decrease finish of the revenue distribution are much less more likely to be potential homebuyers, affecting the general market dynamics.

Texas Housing Market Predictions

The next knowledge supplies insights into the forecast for the Texas housing market. The typical Texas house worth is $306,756, up 1.0% over the previous yr and going to pending in round 23 days (Zillow).

Median sale worth refers back to the center worth of all house gross sales costs that occurred inside a particular time-frame, sometimes a month. In Texas, the median sale worth as of April 2024, was $331,508. Which means that half of the properties bought throughout that interval had been priced above $331,508, and the opposite half had been priced beneath.

Median checklist worth represents the center worth of all of the properties listed on the market throughout a specific time interval, often a month. The median checklist worth was $365,177. This means that half of the properties listed on the market had been priced above $365,177, and the opposite half had been priced beneath.

P.c of gross sales over checklist worth and p.c of gross sales underneath checklist worth are indicators of market competitiveness and pricing dynamics.

- P.c of gross sales over checklist worth: This determine, standing at 18.8%, signifies the proportion of properties that bought for greater than their listed worth throughout that interval. A excessive share can point out a vendor’s market, the place demand exceeds provide, resulting in aggressive bidding and better sale costs.

- P.c of gross sales underneath checklist worth: At 59.3%, this metric signifies the share of properties that bought for lower than their listed worth. The next share on this class could counsel a purchaser’s market, characterised by extra stock than demand, doubtlessly main to cost reductions and negotiations favoring consumers.

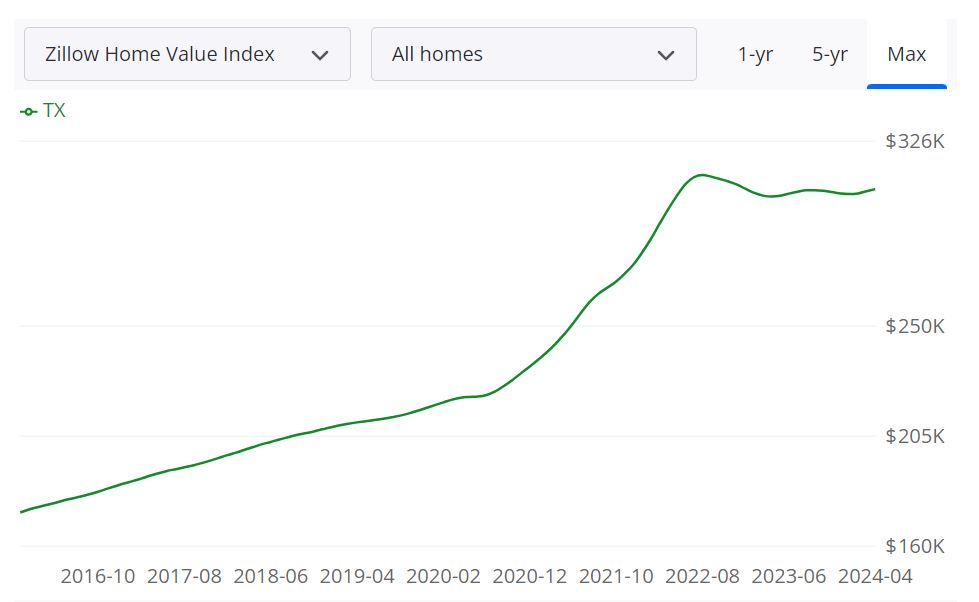

This graph by Zillow illustrates the expansion of house values within the area over the previous yr, together with a forecast suggesting this pattern will seemingly proceed for the subsequent yr.

The Texas housing market, a perennial powerhouse, is in for a interval of adjustment in 2024. Whereas the frenetic tempo of the previous few years could ease, consultants predict a market characterised by a extra balanced strategy. Let’s delve into the important thing developments shaping the Texas housing panorama this yr.

Stock on the Rise, Costs Discovering Equilibrium

One of many largest shifts will seemingly be in housing stock. For years, consumers have confronted a vendor’s market with tight provide. Nonetheless, with rising mortgage charges, some householders who had been hesitant to promote resulting from low charges could now be extra prepared to checklist their properties. This inflow of stock, coupled with a doubtlessly softening demand resulting from increased borrowing prices, may result in a extra balanced market the place consumers have extra choices.

Whereas some predict worth drops, an entire crash is unlikely. As a substitute, consultants anticipate a moderation in worth development. Texas’ robust job market and regular inhabitants enhance will proceed to gas demand, stopping a big decline. The almost definitely situation is a shift to a extra sustainable worth appreciation charge, someplace within the 2-4% vary over the subsequent few years.

Mortgage Charges: A Pivotal Issue

The trajectory of mortgage charges will likely be a significant component influencing the market. The Federal Reserve is anticipated to lift charges in 2024, although some forecasts counsel these hikes could decelerate within the latter half of the yr. A possible lower in charges may incentivize extra consumers and sellers to re-enter the market, additional contributing to a extra balanced surroundings.

Texas’ Attract: Enduring Enchantment

Texas’ inherent strengths – a sturdy economic system, low value of dwelling, and job alternatives – will proceed to draw residents. This regular inflow of latest residents will bolster demand, notably in main metros like Austin, Dallas-Fort Price, Houston, and San Antonio.

Market Variations: Sizing Up the Lone Star State

It is essential to do not forget that Texas is an unlimited state with various housing markets. Whereas some areas, notably these with a excessive focus of tech industries, might even see a slight cooling, others may expertise continued robust development. At all times seek the advice of native market knowledge and studies for a extra exact image of a particular metropolis or area.

A Marketplace for Savvy Homebuyers and Sellers

With a extra balanced market on the horizon, 2024 presents a chance for each consumers and sellers to be strategic. Patrons may have a wider vary of choices and doubtlessly extra negotiating energy. Sellers, alternatively, ought to guarantee their properties are priced competitively to draw consumers in a market with a rising stock.

The Ultimate Phrase: A Market in Transition

The Texas housing market in 2024 is poised for a interval of transition. Whereas the breakneck tempo of the latest previous could gradual, the underlying fundamentals stay robust. Affordability will likely be a key concern, and people with a long-term view will seemingly discover essentially the most success. As all the time, staying knowledgeable about native market developments and looking for skilled steerage from actual property brokers will likely be essential for navigating this housing market.

Prime Markets in Texas at Danger of Dwelling Worth Decline

Whereas the general Texas housing market stays secure, sure areas are projected to expertise important house worth declines over the subsequent yr. These areas are dealing with distinctive financial challenges which can be more likely to impression their housing markets extra severely.

- Pecos, TX – Anticipated to see a considerable decline with house costs dropping by 1.3 p.c by August 2024 and a steep 9.6 p.c by Could 2025.

- Large Spring, TX – Forecasted to lower by 2.6 p.c by August 2024 and 9.1 p.c by Could 2025.

- Lamesa, TX – Anticipated to see house costs fall by 1.2 p.c by August 2024 and 8.7 p.c by Could 2025.

- Raymondville, TX – Projected to expertise a 1.6 p.c decline by August 2024 and an 8.2 p.c lower by Could 2025.

- Alice, TX – Anticipated to see a slight decline of 0.2 p.c by August 2024 and a big 8.1 p.c drop by Could 2025.

- Beeville, TX – Dwelling costs are projected to fall by 1.4 p.c by August 2024 and 7.8 p.c by Could 2025.

- Sweetwater, TX – Anticipated to see a 0.6 p.c decline by August 2024 and a 7.4 p.c lower by Could 2025.

- Rio Grande Metropolis, TX – Anticipated to expertise a 2 p.c decline by August 2024 and 6.9 p.c by Could 2025.

- Zapata, TX – Forecasted to see house costs rise by 0.3 p.c by August 2024 however then decline by 6.6 p.c by Could 2025.

- Beaumont, TX – Projected to expertise a 1.2 p.c decline by August 2024 and 6.4 p.c by Could 2025.

- Midland, TX – Anticipated to see a 1.1 p.c decline by August 2024 and 6.3 p.c by Could 2025.

- Snyder, TX – Anticipated to see a 0.8 p.c decline by August 2024 and 6.1 p.c by Could 2025.

- Dumas, TX – Dwelling costs are projected to fall by 1.5 p.c by August 2024 and 6 p.c by Could 2025.

- Borger, TX – Anticipated to see a 0.7 p.c decline by August 2024 and 5.5 p.c by Could 2025.

- Levelland, TX – Projected to expertise a 1.2 p.c decline by August 2024 and 5.3 p.c by Could 2025.

These areas, primarily situated in smaller metropolitan areas, are anticipated to face the biggest house worth declines in Texas over the approaching yr. The financial challenges in these areas could also be extra pronounced, affecting the demand for housing and contributing to the downward stress on house costs.

In abstract, whereas the Texas housing market as a complete is demonstrating resilience and stability, sure areas are poised for important house worth declines. These developments spotlight the variability inside the state’s housing market and underscore the significance of contemplating native financial circumstances when assessing actual property alternatives. As Texas navigates these challenges, the general outlook stays constructive, bolstered by the state’s robust labor market and financial circumstances.

Prime 10 Locations to Purchase a Home in Texas

These are a few of the finest areas to purchase a house in Texas based mostly on house valuations, property taxes, homeownership charges, housing costs, and actual property developments (Area of interest.com). The rating relies on statistics from the US Census Bureau, the FBI, and different sources. Cottonwood Creek South is one of the best place in Texas to purchase a home.

1. Cottonwood Creek South, Richardson, TX: This Richardson neighborhood gives a suburban life-style near the excitement of the Dallas-Fort Price metroplex’s tech business.

2. Arapaho, Richardson, TX: Much like Cottonwood Creek South, Arapaho is one other neighborhood in Richardson providing a quieter suburban expertise with entry to the town’s facilities.

3. Lakeside Metropolis, TX: Simply south of Richardson, Lakeside Metropolis is a family-friendly city identified for its good faculties.

4. Fulshear, TX: This Fort Bend County city supplies a mixture of rural and suburban dwelling with easy accessibility to Houston. Fulshear is right if you need a quieter space whereas staying near the town.

5. Canyon Creek South, Richardson, TX: One more Richardson neighborhood on the checklist, Canyon Creek South gives a suburban setting close to the alternatives of the Dallas-Fort Price metroplex.

6. Heights Park, Richardson, TX: Rounding out the Richardson trio, Heights Park supplies a suburban environment with entry to the facilities of an enormous metropolis.

7. Shady Hole, TX: As a suburb of Austin, Shady Hole blends small-town allure with the thrill of the state capital. It is a fashionable selection for households and younger professionals.

8. Purple Lick, TX: Positioned in Bowie County, Purple Lick is a extra rural space with a small-town really feel. This can be a good choice for these looking for an inexpensive place to dwell with loads of house.

9. Woodway, TX: Located close to Waco, Woodway is a rising suburb identified for its peaceable environment and scenic Hill Nation views.

10. Timberbrook, Plano, TX: This Plano neighborhood gives a suburban life-style with easy accessibility to the facilities of each Plano and Dallas. Plano is one other main metropolis within the Dallas-Fort Price space, identified for its robust economic system and good faculties.

Prime 10 Texas Cities with Excessive Appreciation

Texas boasts a various panorama, and these 10 cities mirror that selection. These are the highest ten cities in Texas which have had the very best actual property appreciation since 2000 (Neighborhoodscout).

- Westworth Village: This might be a smaller city or an prosperous suburb that has seen important development in property values since 2000.

- Gustine: Maybe a rural city or a smaller metropolis, Gustine’s reputation surge has seemingly pushed up housing costs.

- Balmorhea: Its distinctive location close to a pure spring or leisure space is likely to be the rationale behind Balmorhea’s elevated actual property curiosity.

- Backyard Metropolis: This might be a rising metropolis or one which’s been revitalized, attracting new residents and boosting property values.

- Mico: Probably a smaller group or a hidden gem, Mico may need skilled a surge in curiosity resulting from affordability or a particular life-style issue.

- Runge: This rural city might be experiencing development resulting from its proximity to a bigger metropolis or altering financial elements.

- Granger: Much like Runge, Granger is likely to be a rising rural group benefiting from its location or new improvement.

- Encinal: Probably a historic city or one with pure magnificence, Encinal’s actual property market may need boomed resulting from its distinctive enchantment.

- Falls Metropolis: This might be a smaller metropolis present process revitalization or attracting new residents for particular causes, resulting in rising property values.

- Wingate: Probably a rural city or a lakeside group, Wingate may need seen an increase in actual property curiosity resulting from its location or altering life-style preferences.

RELATED POSTS: