Ripple (XRP) value has skilled a major rally, rising 51.33% within the final seven days and a powerful 109.09% over the previous month. This robust momentum has propelled XRP right into a bullish part, with key indicators like EMA strains supporting its upward trajectory.

Nevertheless, indicators of weakening momentum, equivalent to a declining RSI and adverse CMF, recommend that warning could also be warranted. Whether or not XRP continues to push larger or faces a steep correction will rely on how the market reacts to those shifting dynamics.

XRP RSI Is Under The Overbought Zone

XRP’s RSI has dropped to 60 after almost hitting 90 on November 16 and staying above 70 between November 15 and November 17.

This decline signifies that Ripple has moved out of the overbought zone, the place intense shopping for strain beforehand drove its value larger. The drop means that the market is cooling off, with merchants probably taking earnings after the robust rally.

The RSI measures the pace and magnitude of value adjustments, with values above 70 indicating overbought circumstances and under 30 signaling oversold ranges. At 60, XRP’s RSI displays a still-positive momentum however exhibits a extra balanced sentiment in comparison with the earlier surge.

Whereas the uptrend stays intact, the decrease RSI may point out a slower tempo of positive factors, with the opportunity of consolidation because the market stabilizes. If shopping for strain returns, XRP value may lengthen its upward motion, however an extra decline in RSI would possibly sign a weakening bullish momentum.

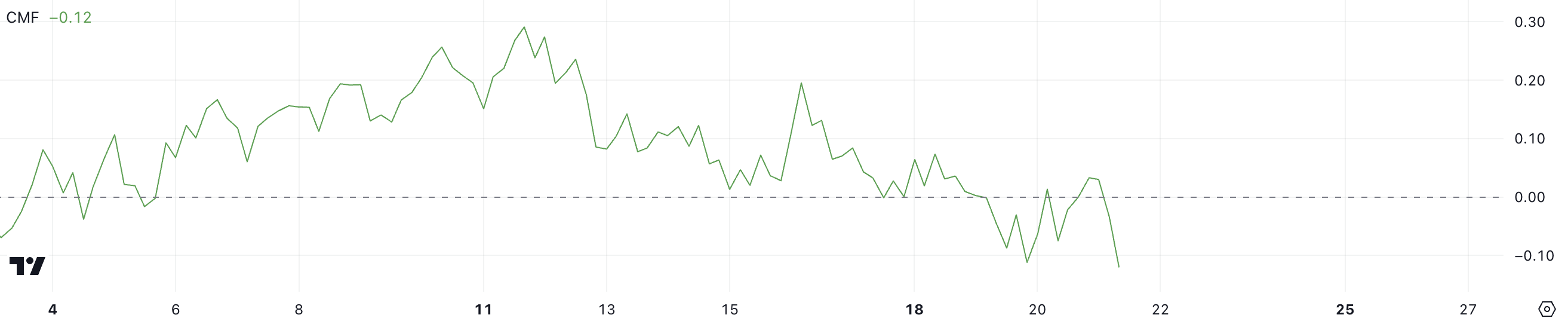

Ripple CMF Is Now Damaging After Staying Optimistic For 14 Days

XRP Chaikin Cash Move (CMF) is at present at -0.12, after exhibiting constructive ranges between November 5 and November 19. That can be its lowest degree since October 31. This shift into adverse territory displays elevated promoting strain and a possible outflow of capital from the asset.

The transition from constructive CMF values earlier this month indicators a weakening in bullish momentum as extra market members cut back publicity to Ripple.

The CMF measures the quantity and move of cash into or out of an asset, with constructive values indicating capital influx (bullish) and adverse values exhibiting capital outflow (bearish).

XRP’s CMF at -0.12 means that bearish sentiment is starting to achieve traction, probably placing strain on its value regardless of the current uptrend. If the CMF stays adverse or declines additional, it may point out sustained promoting strain, difficult Ripple’s capacity to proceed its upward motion.

Ripple Worth Prediction: Largest Worth Since 2021?

XRP’s EMA strains at present show a bullish setup, with short-term strains positioned above the long-term strains and the worth buying and selling above all of them.

Nevertheless, the narrowing distance between the worth and a few of these strains suggests a possible slowdown in bullish momentum. This might sign that the uptrend is weakening, leaving XRP value susceptible to a shift in market sentiment.

If a downtrend emerges, as indicated by the weakening RSI and adverse CMF, Ripple value may face important strain and probably drop to its help at $0.49, representing a considerable 56% correction.

Alternatively, if the uptrend regains power, XRP may climb to check the $1.27 degree and probably break by means of to $1.30, which might mark its highest value since Could 2021.

Disclaimer

According to the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.