Bitcoin (BTC) is exhibiting indicators of a possible parabolic rally in October. A mixed studying of some on-chain metrics indicators that the king coin is poised to maneuver towards the $73,000 worth mark.

This evaluation delves into these metrics and highlights what BTC holders have to know.

Bitcoin Is the Speak of the City

The spike in demand for Bitcoin Spot ETF is a notable marker of a possible rally above $70,000. Over the previous week, these funds recorded solely inflows, totaling $1.11 billion.

For context, on September 26, the Bitcoin Spot ETF inflows amounted to $366 million, representing its single-day highest since July 23. Based on SosoValue, on that day, three main ETF suppliers — BlackRock, Constancy, and Ark — recorded inflows of $118 million, $73 million, and $133 million, respectively, highlighting robust demand from US conventional traders.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Method

Moreover, shifts within the US financial setting strongly affect Bitcoin’s worth. Since its launch, the coin’s worth has been impacted by components akin to rate of interest modifications, inflation traits, employment knowledge, and choices made by monetary regulatory our bodies. On account of this, the uptick in demand or in any other case from US traders usually impacts BTC’s worth, making it crucial to trace their exercise.

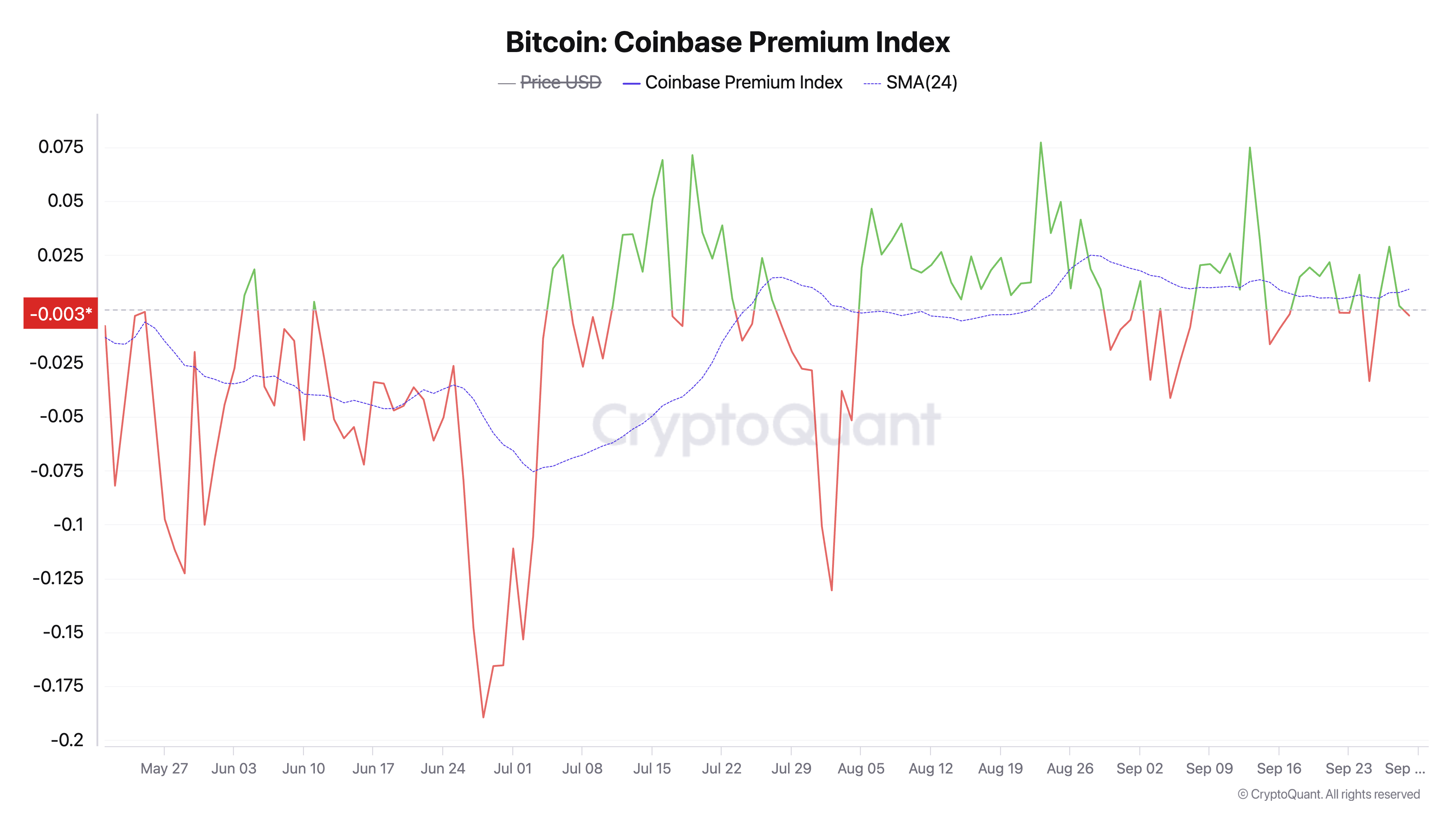

US-based retail and institutional traders have not too long ago elevated their BTC accumulation, as evidenced by its Coinbase Premium Index. In a current submit on X, Julio Moreno, Head of Analysis at CryptoQuant, famous that elevated BTC demand within the US pushed the coin’s worth towards $65,000.

If sentiment stays bullish and demand for the coin in that area continues to rise, Bitcoin’s worth could chart a course towards buying and selling above $70,000 over the following few weeks.

BTC Worth Prediction: Rising Open Curiosity Poses Dangers

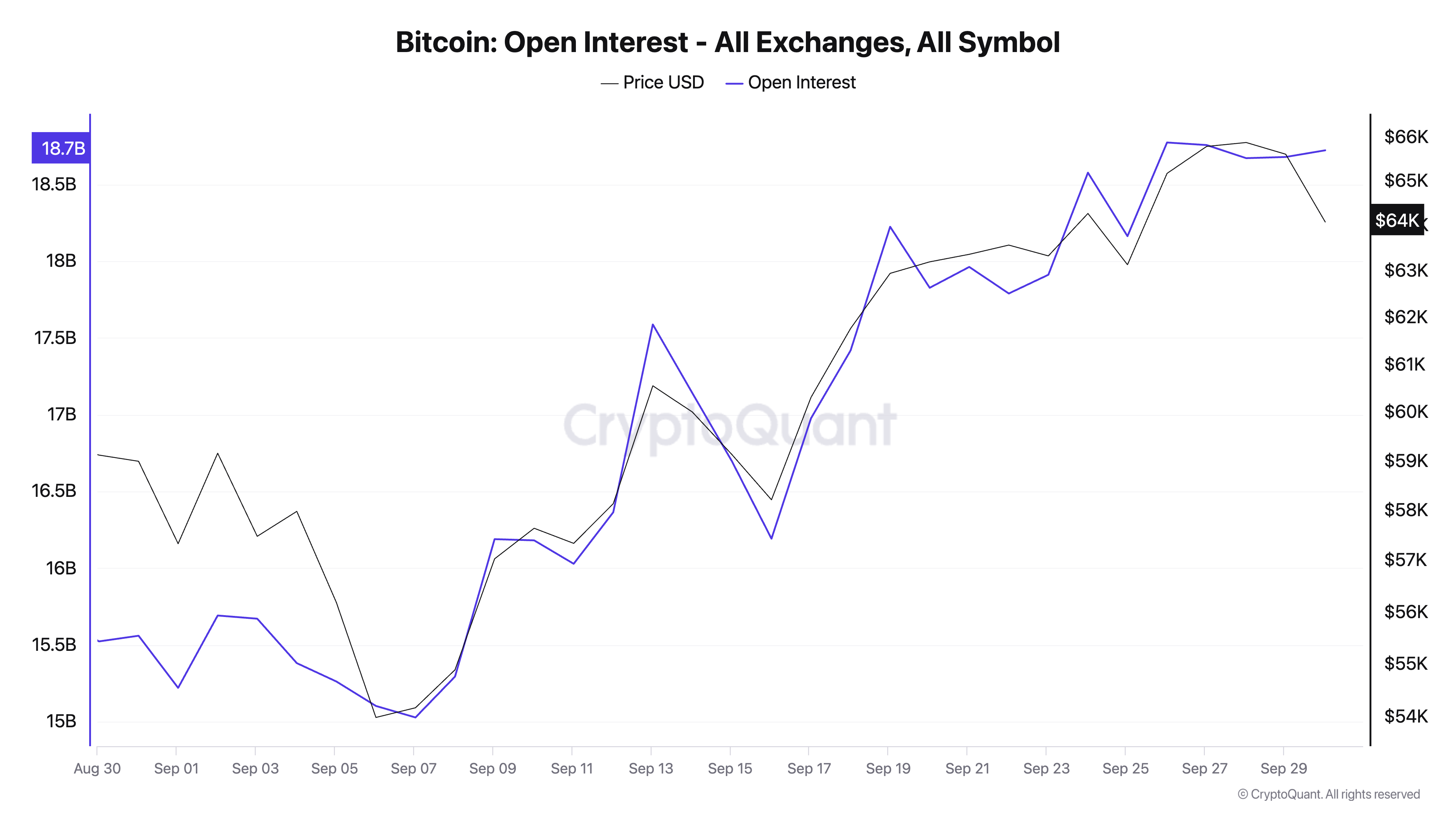

Bitcoin’s rising open curiosity is one other good indicator that its worth rally will proceed. The coin’s open curiosity measures the entire variety of excellent futures or choices contracts that haven’t been settled or closed. Per CryptoQuant’s knowledge, this at the moment stands at $19 billion, rising by 26% over the previous 30 days.

Usually, the rise in an asset’s open curiosity indicators elevated market exercise and will propel worth to new highs. Nonetheless, some analysts suppose it poses dangers to holders of lengthy positions.

“Open Interest is high, very high, with over $19.1B. We’re in a high-risk zone, and in my opinion, it’s not the best time for fresh long positions,” analyst JA Martuun mentioned in an X submit.

A mixed studying of the on-chain knowledge above factors to a sustained bullish bias towards Bitcoin. If this development is maintained, its worth will set up native help on the $64,312 worth stage and intention to breach resistance at $67,929. A profitable break above this stage will set BTC on the trail to buying and selling at $73,777. It final reached this worth stage on March 14.

Learn extra: 7 Greatest Crypto Exchanges within the USA for Bitcoin (BTC) Buying and selling

Nonetheless, Bitcoin’s Crypto Worry & Greed Index readings point out an overheated market. When the index is within the “Greed” zone, coin holders are overwhelmingly optimistic. Traditionally, this has been an indication of a possible worth correction.

If Bitcoin’s worth corrects, it might plummet by 15% to commerce at $54,302, invalidating the bullish thesis above.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.