Prime Minister Justin Trudeau’s authorities has turned to elevating taxes on companies to assist fund Canada’s funds, including headwinds to an economic system that’s already struggling to draw funding.

Article content

(Bloomberg) — Prime Minister Justin Trudeau’s government has turned to raising taxes on businesses to help fund Canada’s budget, adding headwinds to an economy that’s already struggling to attract investment.

The landscape is a contrast with the US, which is in the midst of a supply renaissance and a factory building boom. Economists warn that Canada’s higher taxes will send the wrong signal to firms thinking about expanding production — risking longer-term damage to an economy that has relied on high levels of immigration and consumption to fuel growth.

Advertisement 2

Article content material

In its most up-to-date survey of companies, the Financial institution of Canada flagged a pointy enhance in corporations’ nervousness concerning the tax burden: 42% listed taxes and regulation amongst their prime three considerations, from 27% beforehand. Business confidence is decrease than it was a 12 months in the past, and deliberate enterprise funding is weak.

“Capital has to feel like it’s welcome, whether that’s how it’s treated in terms of taxation or regulation,” Doug Porter, chief economist at Financial institution of Montreal, mentioned in an interview. “And I’m not sure capital does feel entirely welcome in Canada.”

Rising considerations by enterprise house owners comply with the introduction of a brand new funds that elevated the efficient tax fee on capital features for Canadian firms and a few people.

The federal government can also be phasing out some tax breaks on new enterprise funding, a reversal of measures launched in 2018 that have been meant to assist corporations compete with the US by permitting faster write-offs of sure property in opposition to their incomes.

The tax hikes are a part of Trudeau’s political playbook as he seeks to win again younger voters pissed off by the rising value of residing. The federal government says the adjustments are about “fairness” and asking the nation’s most profitable to contribute extra, and is allocating extra to priorities similar to boosting the provision of housing.

Article content material

Commercial 3

Article content material

In a current interview, Finance Minister Chrystia Freeland downplayed criticisms that the capital-gains enhance was sending the unsuitable message to enterprise. She pointed to a current report from the Worldwide Financial Fund that mentioned it wouldn’t considerably hurt funding or productiveness development. Authorities spending on housing is critical, and new measures similar to funding tax credit for clear power are “a really big deal” that ought to assist draw funding, she mentioned.

“Which other G-7 country you think is both investing aggressively in our own economy and in our own people, and doing it in a fiscally responsible way?” Freeland mentioned. “I don’t see anybody else doing both.”

Nonetheless, a regime of upper taxes dangers deepening a dire productiveness disaster, in keeping with some economists.

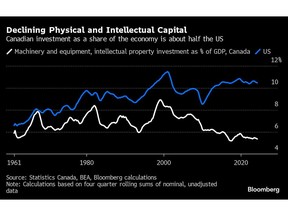

Canada’s capital inventory of equipment and tools has shrunk 2.8% since peaking in 2014 at simply over C$1 trillion ($728 billion) in actual phrases. The worth of these property — a number of the extra productive drivers of output — declined in seven of the eight final years, the one stretch of depreciation in knowledge going again to 1961.

Commercial 4

Article content material

A part of that decline may be defined by the collapse of oil costs in 2014 and 2015, Porter mentioned, which led to a structural change in how a lot capital was added in Canada. Plenty of overseas power firms divested from the Alberta oil sands, whereas some home corporations centered on repaying debt or boosting funds to shareholders reasonably than plowing cash into new initiatives.

Since then, no trade has been capable of fill the vacuum left by the oil and gasoline sector, both by way of productiveness or as a recipient of overseas direct funding. Which means fewer sources for a rising labor power. In 2022, there was C$46,883 in equipment and tools capital for each Canadian working or searching for work, 11% lower than in 2014 in actual phrases.

The Financial institution of Canada’s enterprise outlook survey reveals funding intentions have been nicely under historic averages within the second quarter. Corporations are specializing in “repairing and replacing existing capital equipment rather than investing in new capacity or products to improve productivity,” the financial institution mentioned.

The image within the US seems very totally different. The Inflation Discount and CHIPS Acts have channeled trillions into productive capability. In response, Canada has introduced billions of its personal subsidies and tax credit for choose industries, courting firms like Volkswagen AG and Stellantis NV to construct battery vegetation for electrical automobiles.

Commercial 5

Article content material

In 2023, Canadian employees doubtless obtained 40 cents of recent equipment and tools capital for each greenback obtained by their counterparts within the US, in keeping with William Robson, chief govt officer on the C.D. Howe Institute.

“We are really losing the race to equip our workers,” Robson mentioned.

The federal government factors to Canada’s marginal efficient tax benefit relative to the OECD and different superior economies, however it dangers dropping the higher hand. The tax fee on new enterprise funding is about to rise to 16.8% in 2028 from 14.5% presently. That’s in contrast with a projected 24.9% within the US in 2028 — however Donald Trump has pledged to slash company taxes if he wins energy.

Article content material