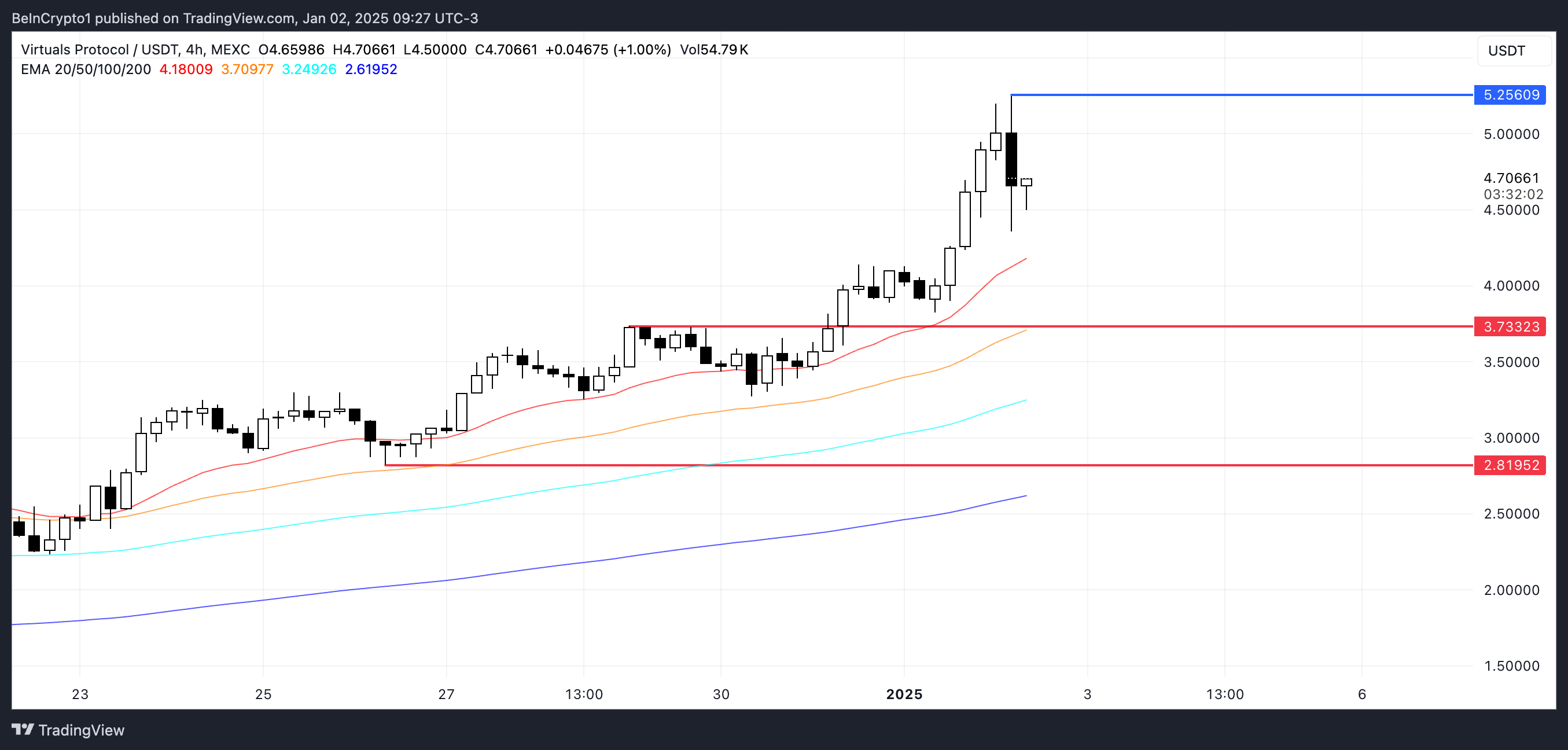

VIRTUAL worth is up 15% within the final 24 hours as hype round AI brokers continues to ramp up. The coin has been reaching new all-time highs over the previous few weeks, surpassing $5 for the primary time on January 1, 2025.

Technical indicators like RSI and BBTrend present that bullish momentum stays, however indicators of cooling recommend potential resistance forward. The energy of VIRTUAL worth present development within the coming days will decide whether or not it reclaims $5 or faces a correction to key assist ranges like $3.73.

VIRTUAL RSI Is Near Overbought

VIRTUAL Relative Energy Index (RSI) has cooled off from its latest overbought degree of 80 and is now at 67.7. This shift signifies that whereas the extreme shopping for stress has subsided, bullish momentum stays robust because the hype round synthetic intelligence on crypto continues robust.

An RSI of 67.7 locations VIRTUAL just under the overbought threshold of 70, signaling that the asset continues to be in a bullish section however approaching a degree the place warning is perhaps warranted because it nears potential resistance.

The RSI is a momentum indicator that measures the pace and energy of worth actions on a scale from 0 to 100. Readings above 70 point out overbought situations, typically signaling a possible pullback, whereas readings under 30 recommend oversold situations and the potential of a restoration.

With RSI at 67.7, it means that the VIRTUAL worth should still have room for short-term features however may face elevated promoting stress if the RSI climbs again into the overbought zone.

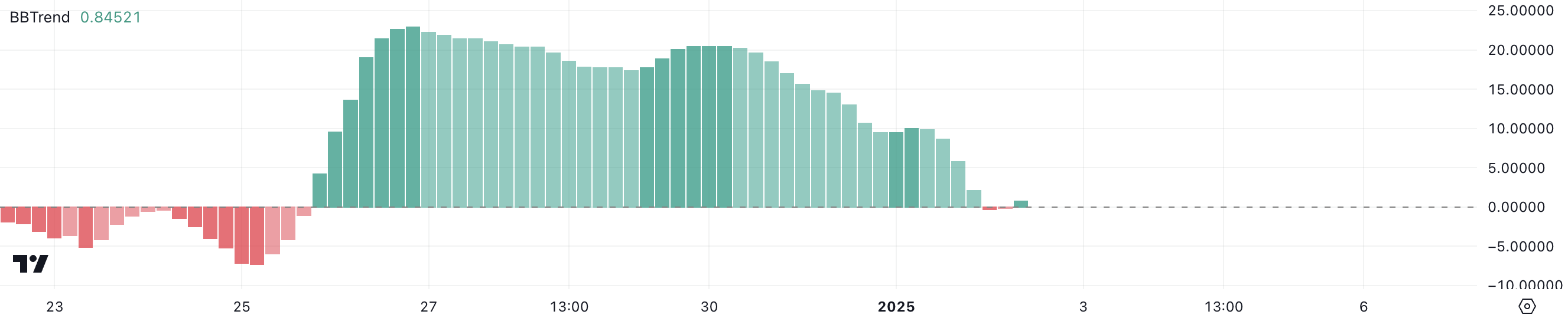

VIRTUAL BBTrend Sits Beneath Latest Ranges

VIRTUAL BBTrend was constructive and robust between December 25 and January 1, reaching a month-to-month excessive of twenty-two.9 on December 26. Nevertheless, the indicator turned damaging on January 2, dropping to -0.34, earlier than recovering barely to its present degree of 0.48.

This shift means that whereas bullish momentum has diminished, the restoration again into constructive territory signifies that promoting stress could also be easing, permitting for potential stabilization within the quick time period.

The BBTrend, derived from Bollinger Bands, measures the energy and course of a development. Constructive values point out upward momentum, whereas damaging values recommend downward momentum. With VIRTUAL’s BBTrend now hovering at 0.84, it indicators a modestly constructive however weak development, implying that whereas the market sentiment has not absolutely turned bearish, there isn’t sufficient energy to drive a big rally.

Within the quick time period, this might imply that VIRTUAL worth could consolidate or see solely restricted upward motion until stronger momentum builds to bolster a clearer development course.

VIRTUAL Value Prediction: Will It Recuperate $5 Ranges?

VIRTUAL worth has been setting new all-time highs over the previous few days, surpassing $5 for the primary time on January 1, 2025.

If the present uptrend strengthens, VIRTUAL worth may reclaim the $5 degree and probably take a look at increased targets round $5.25, signaling continued bullish momentum. Such a transfer would additional cement VIRTUAL as the most important AI crypto available in the market.

Nevertheless, as indicated by the BBTrend, the present uptrend reveals indicators of dropping energy, elevating the potential of a reversal. If a correction happens, VIRTUAL worth may take a look at the assist degree at $3.73, and failure to carry this assist may result in a sharper decline towards $2.81.

Disclaimer

In keeping with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.