Virtuals Protocol (VIRTUAL) surged 15% following Binance’s itemizing announcement, briefly reigniting bullish sentiment across the AI-linked token. Nevertheless, the rally could also be masking deeper issues in regards to the challenge’s fundamentals and long-term viability.

On-chain information reveals weak consumer exercise and declining protocol engagement, elevating questions on whether or not the worth transfer is sustainable.

VIRTUAL’s Binance-Fueled Rally Masks Weak On-Chain Fundamentals

Regardless of the current value surge fueled by the announcement of a Binance itemizing, on-chain information means that Virtuals Protocol (VIRTUAL) is dealing with important challenges when it comes to consumer adoption and protocol exercise.

Whereas market sentiment briefly turned bullish, the underlying metrics level to weakening fundamentals, casting doubt on the rally’s sustainability.

Knowledge from April 10 reveals that every day income for VIRTUAL crypto AI brokers amounted to simply $7,677, whereas the protocol itself generated solely $137 on the identical day—an underwhelming determine for a platform as soon as valued at virtually $5 billion in market cap.

This monetary stagnation has not gone unnoticed; Grayscale just lately eliminated Virtuals Protocol from its Q2 2025 “Assets Under Consideration” checklist, signaling a decline in institutional confidence.

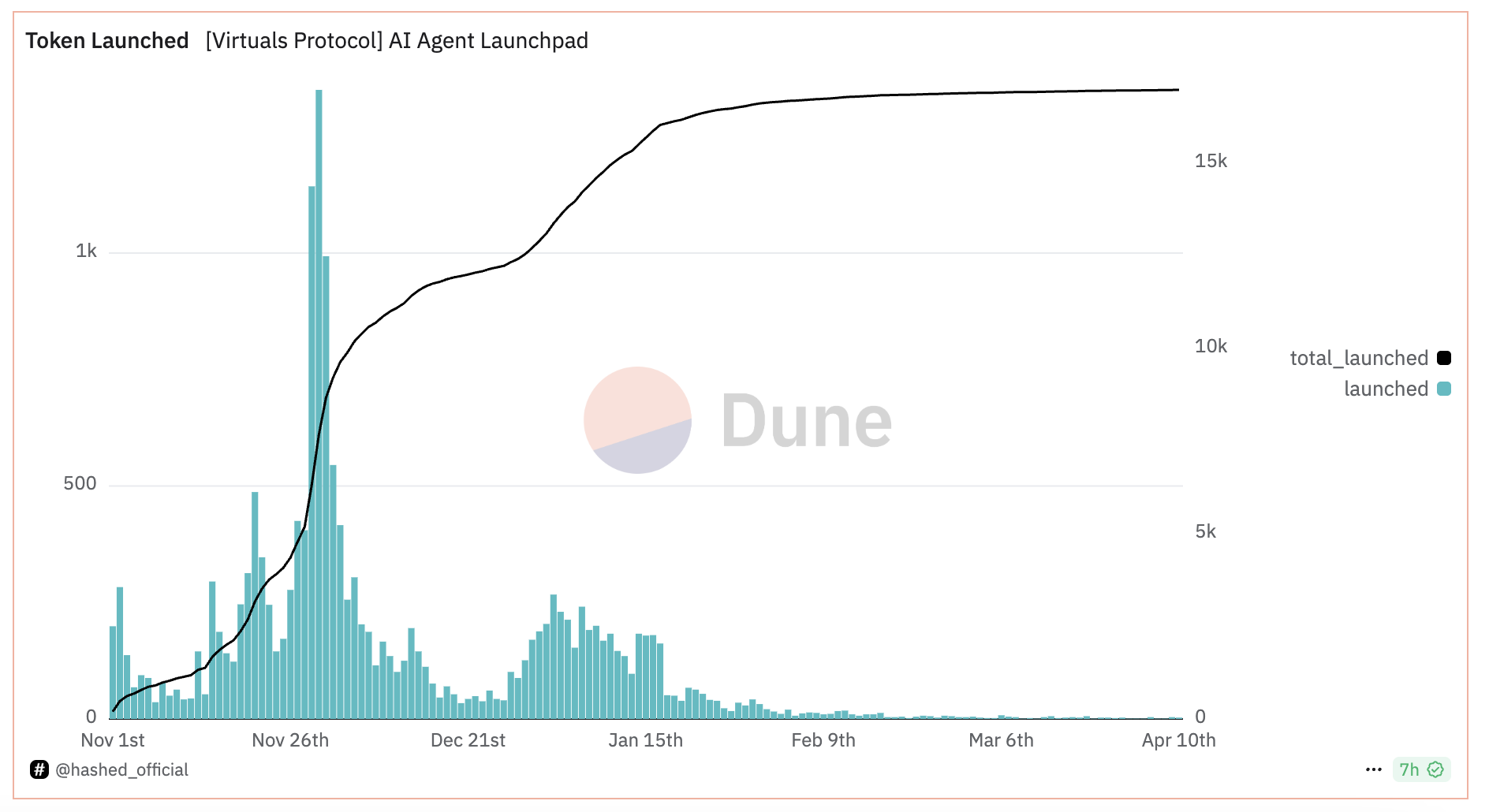

Additional on-chain evaluation reveals a pointy drop in exercise. Since March 16, the variety of new tokens launched on the protocol has fallen dramatically to simply 1 to 4 per day.

This marks a steep decline from VIRTUAL’s all-time excessive of 1,350 agent launches in a single day on November 30, 2024.

The slowdown in token technology displays waning curiosity from builders and customers alike, regardless of the current price-driven hype.

Altogether, these traits recommend that the present momentum round VIRTUAL could also be pushed extra by the Binance itemizing information than by any actual resurgence in platform utilization or innovation.

With out significant enhancements in on-chain engagement and protocol income, the surge dangers being short-lived—doubtlessly setting the stage for a correction as soon as the itemizing pleasure fades.

Momentum Builds, However Key Indicators Present Warning for VIRTUAL

VIRTUAL’s RSI has jumped to 64.85 from 40.55 in simply 24 hours, signaling a powerful uptick in shopping for momentum after the Binance itemizing information.

The Relative Power Index (RSI) is a momentum indicator starting from 0 to 100. Readings above 70 recommend overbought situations, whereas under 30 signifies oversold territory.

With VIRTUAL’s RSI nearing 70—however not crossing it—it reveals rising power, although it hasn’t reached overbought ranges since March 24, hinting at restricted follow-through behind the current surge.

The Ichimoku Cloud for VIRTUAL reveals a short-term breakout try, however underlying resistance stays sturdy.

The value has simply pierced into the purple cloud, indicating an early check of a bearish zone that always acts as overhead resistance.

The Main Span A (inexperienced cloud boundary) remains to be under the Main Span B (purple boundary), confirming the cloud is bearish general.

Nevertheless, the upward transfer that pushed value into the cloud hints at potential pattern reversal makes an attempt if momentum continues.

The Tenkan-sen (blue line) has crossed above the Kijun-sen (purple line), a short-term bullish sign. However with value nonetheless inside the cloud and never clearly above it, affirmation of a full pattern reversal is missing.

Will VIRTUAL Worth Rally Proceed?

Binance founder CZ just lately said that solely 0.05% of AI brokers actually want tokens, a remark that casts doubt on the long-term utility of many AI-linked tasks—together with VIRTUAL.

Technically, VIRTUAL’s EMA strains nonetheless mirror bearish momentum, with short-term averages sitting under the longer-term ones.

If bullish sentiment holds, nevertheless, the token may check resistance at $0.619.

A breakout from that degree might open the door for strikes towards $0.747, and within the case of sturdy follow-through, even an increase to $0.84.

If the current rally fades, VIRTUAL value dangers falling to its quick assist close to $0.516.

Shedding that degree may speed up draw back stress, doubtlessly dragging the worth all the way down to $0.411—a degree that may sign a transparent rejection of the present uptrend try.

Disclaimer

According to the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.