On December 10, Ripple’s (XRP) value quickly slipped under $2, sparking hypothesis that its extended uptrend is likely to be ending. Nevertheless, the bearish issues have been short-lived. XRP has rebounded strongly, recording an 8% upswing previously 24 hours.

Apparently, a number of under-the-radar indicators counsel that XRP’s rally for the 12 months should have room to develop. Right here’s how.

Ripple Stakeholders Ship Extra Tokens into Circulation

The Imply Greenback Invested Age (MDIA) is an on-chain metric that implies XRP’s value might proceed to commerce greater. MDIA represents the typical age of all tokens on a blockchain, weighted by their buy worth.

A rising MDIA signifies that cash, usually held by key stakeholders, have remained stagnant. Traditionally, this inactivity has made it troublesome for the altcoin’s value to achieve momentum. At the moment, nonetheless, XRP’s MDIA has dropped to a notably low stage. This metric, which displays the median age of transacted tokens, indicators the recirculation of beforehand dormant belongings.

In contrast to a excessive MDIA, which means stagnation, a low MDIA is taken into account a bullish sign. The lower exhibits that dormant XRP tokens have returned to circulation, boosting buying and selling exercise and liquidity.

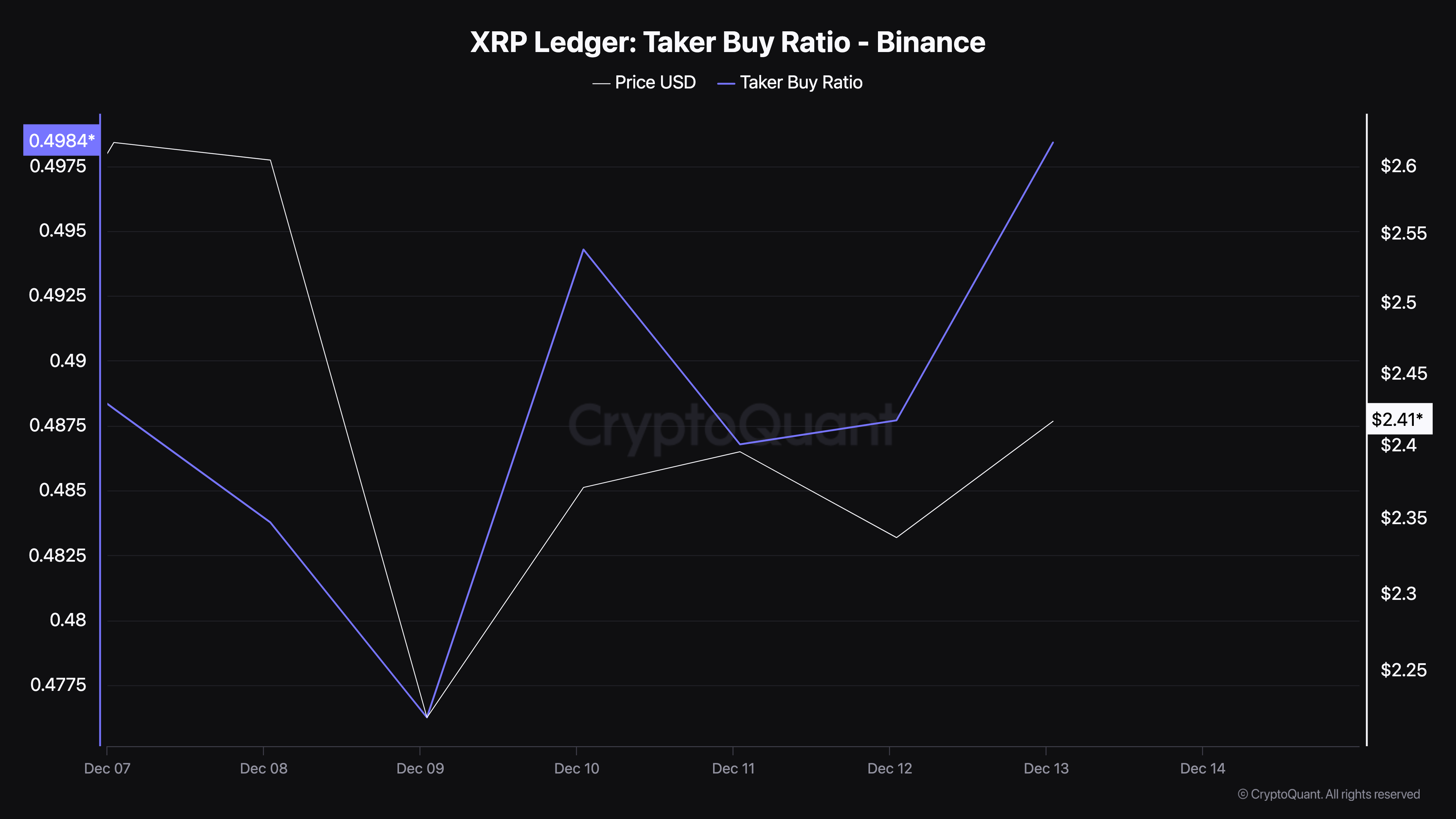

Other than the MDIAs, the Taker Purchase Ratio additionally suggests the potential for additional XRP value good points. This ratio measures the proportion of purchase orders crammed in comparison with whole trades within the derivatives market.

A Taker Purchase Ratio above 0.5 displays rising bullish sentiment, suggesting that consumers are gaining management. In keeping with knowledge from CryptoQuant, the metric has climbed to 0.55, highlighting a big bounce in shopping for strain round XRP.

If this pattern continues, it might sign sturdy market optimism, probably pushing XRP to new value ranges within the coming classes. Nevertheless, a dip under this threshold would point out bearish sentiment, warranting warning.

XRP Worth Prediction: Bulls Are in Management Once more

On the 4-hour chart, XRP’s value had briefly dropped under the 20 and 50 Exponential Transferring Averages (EMA) on December 12. The EMA is a technical indicator that measures developments.

When the worth falls under these indicators, it usually indicators a bearish pattern, whereas an increase above them signifies bullish momentum. The current downturn recommended a possible additional correction for XRP.

As of now, nonetheless, bulls have regained management, pushing the worth again above these traces. This shift signifies a return of bullish momentum, with XRP probably climbing to $2.90 within the brief time period.

If shopping for strain intensifies, it might rally towards $3.50. On the flip facet, if the variety of dormant tokens flowing into circulation drops, this may not occur, and the token might decline to $1.93.

Disclaimer

According to the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.