XRP gained solely 2% up to now week, signaling weak momentum and fading curiosity from consumers within the brief time period.Technical indicators just like the RSI, Ichimoku Cloud, and EMA traces are all beginning to replicate elevated bearish strain. Right here’s a breakdown of what the charts are saying and what may come subsequent for XRP.

XRP RSI Exhibits Consumers Are Shedding Management

XRP’s Relative Power Index (RSI) has declined to 46.34, a noticeable drop from 57.30 simply in the future in the past. This sharp transfer suggests a transparent shift in momentum, with shopping for strain cooling off considerably within the brief time period.

When the RSI drops this rapidly, it might probably usually point out that merchants are taking earnings or starting to rotate out of a place, particularly after a interval of modest positive aspects.

Whereas XRP hasn’t entered oversold territory but, the drop under the 50 mark is often considered as a bearish sign, pointing to a possible shift in sentiment from bullish to impartial or bearish.

The RSI, or Relative Power Index, is a broadly used technical indicator that helps merchants gauge the energy of a value pattern. It ranges from 0 to 100, with readings above 70 thought-about overbought and readings under 30 thought-about oversold.

When the RSI is above 50, momentum is often bullish, whereas ranges under 50 replicate growing bearishness. With XRP now sitting at 46.34, it suggests the asset is dropping upward momentum and could also be liable to additional draw back until shopping for curiosity returns quickly.

If promoting strain continues and RSI traits decrease, XRP may take a look at key help ranges within the close to future.

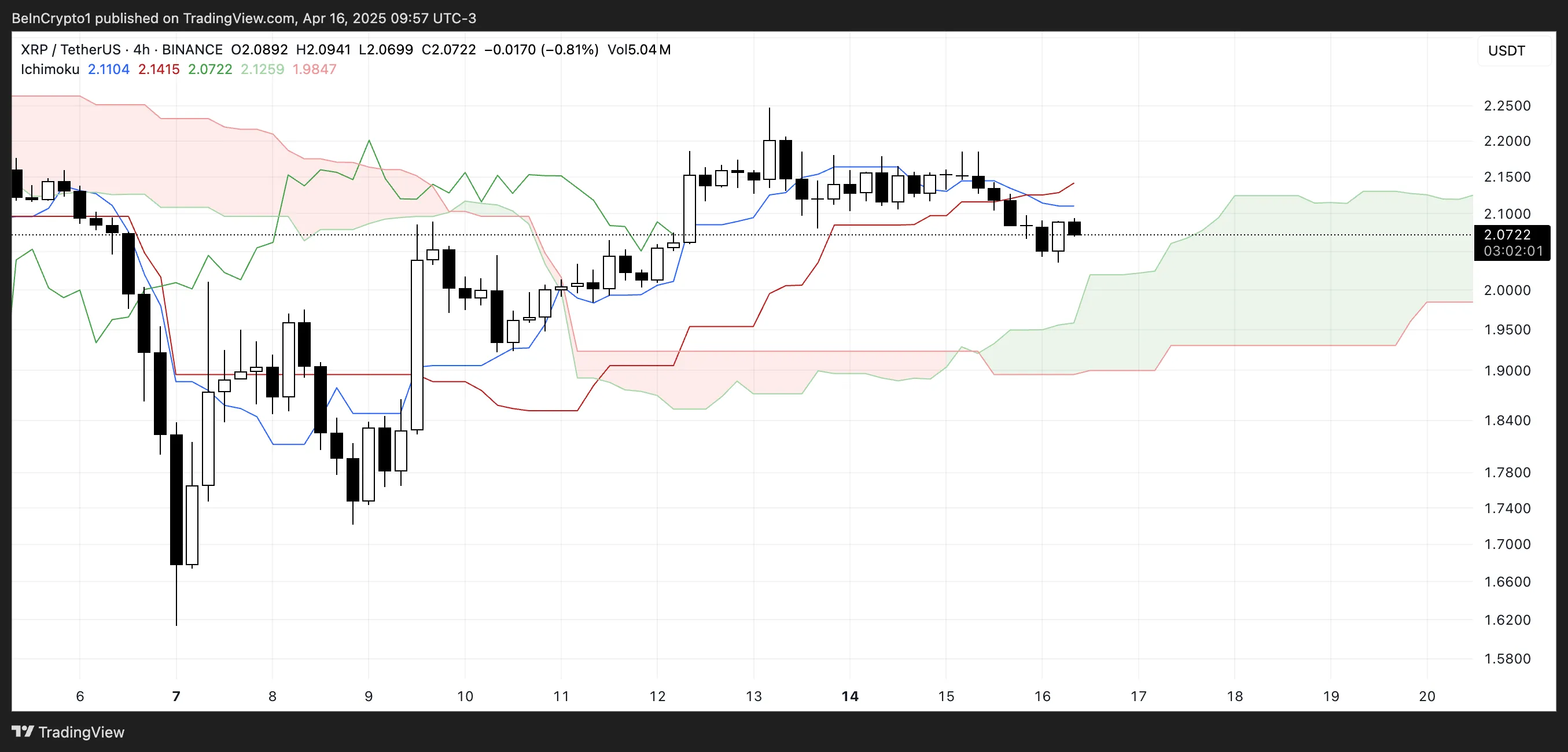

XRP Ichimoku Cloud Exhibits Momentum Is Shifting

XRP’s Ichimoku Cloud chart at present exhibits a shift towards short-term bearish momentum.

The worth has fallen under each the blue Tenkan-sen (conversion line) and the purple Kijun-sen (baseline), which is often considered as a bearish sign.

When the value trades beneath these two traces, it usually suggests weakening momentum and growing draw back threat until a fast restoration follows.

Moreover, the value is now coming into the inexperienced cloud (Kumo), which represents a zone of uncertainty or consolidation. The cloud forward is comparatively flat and huge, indicating potential help but additionally an absence of robust upward momentum.

The inexperienced Senkou Span A (main span A) stays above the purple Senkou Span B (main span B), signaling that the broader pattern continues to be barely bullish—but when value motion stays inside or breaks under the cloud, that pattern might start to reverse.

Total, the Ichimoku setup factors to warning for bulls until XRP reclaims the Tenkan and Kijun traces convincingly.

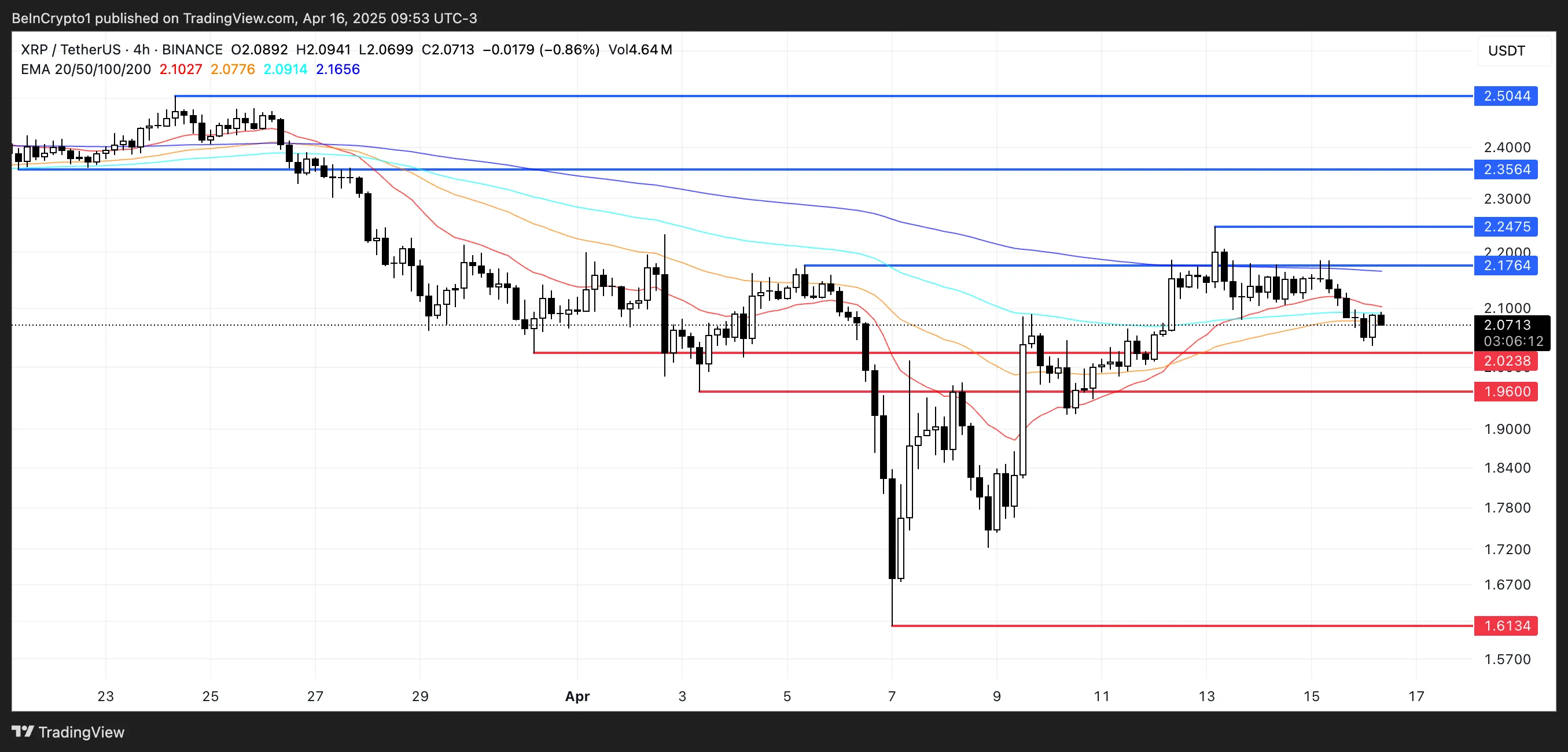

EMA Traces Recommend XRP May Fall Under $2

XRP’s EMA traces are displaying indicators of weak spot, with XRP value repeatedly failing to interrupt via the resistance close to $2.17—even amid hypothesis a couple of potential partnership with Swift.

This repeated rejection on the similar degree signifies robust promoting strain. The EMAs recommend momentum is fading because the shorter-term common is starting to bend downward.

A possible dying cross, the place the short-term EMA crosses under the long-term EMA, seems to be forming. If confirmed, it may sign a deeper correction forward, with XRP presumably retesting help ranges at $2.02 and $1.96.

A breakdown under these ranges may result in a drop towards $1.61. Nevertheless, if bulls handle to reclaim $2.17, the following resistance at $2.24 turns into the important thing goal.

A clear break above that would set off a stronger rally, doubtlessly pushing XRP to $2.35 and even $2.50 if momentum accelerates.

Disclaimer

In keeping with the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.