Ripple (XRP) has not too long ago skilled a surge in worth over the previous week, much like different altcoins. Nonetheless, it confronted a slight dip prior to now 24 hours, a setback that, in keeping with the XRP liquidation heatmap, seems to be short-term.

At the moment priced at $0.58, XRP’s latest decline is probably going a short-term pause. Right here’s why this stagnation may quickly reverse.

Indicators Bullish for the Ripple Native Token

In keeping with Coinglass, XRP has a number of value ranges and loads of liquidity, however probably the most notable one is round $0.62. As seen beneath, the XRP liquidation heatmap shade has modified from purple to a transparent yellow at that stage.

For these unfamiliar, the liquidation heatmap predicts value ranges the place large-scale liquidations may happen. It additionally helps merchants to determine areas of excessive liquidity. Most often, the upper the liquidity, the upper the probabilities of a value transfer to that area.

In XRP’s case, a excessive focus of liquidity appeared round $0.57 on November 10. However because the altcoin has overwhelmed that area, it signifies that the following stage to succeed in is the following main one, which is at $0.62.

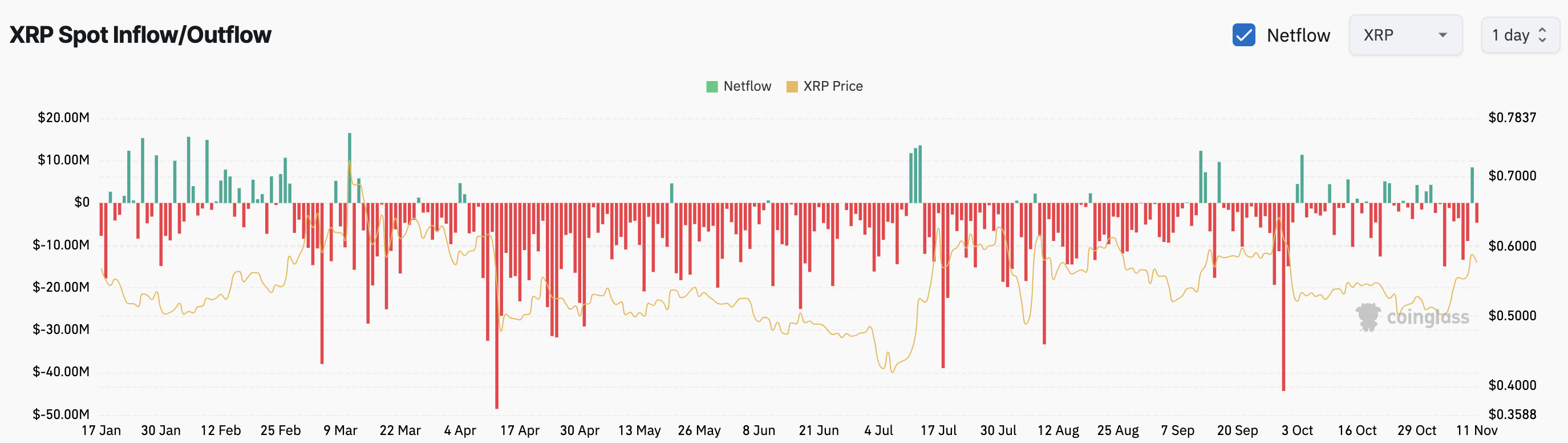

Additional, the Spot Influx/Outflow metric, which screens token motion to and from exchanges, is one other indicator suggesting a bullish outlook.

When giant portions of tokens circulation into exchanges, it could sign an intent to promote, growing downward value stress. Nonetheless, on this case, roughly $5 million value of XRP has exited exchanges inside the final 24 hours.

This outflow suggests that almost all XRP holders are selecting to carry relatively than promote, reflecting a bullish sentiment as traders exhibit confidence within the token’s potential for additional beneficial properties.

XRP Value Prediction: Rally Paused, Not Overruled

From a technical standpoint, XRP’s value transferring above the 20- and 50-day Exponential Transferring Averages (EMAs) signifies potential bullish momentum. These EMAs typically function assist and resistance ranges, and a value rise above them signifies a bullish development.

If XRP’s value was beneath them, then the development would have been bearish. Subsequently, the present studying means that XRP could possibly be arrange for an additional upswing. If that is still the case and shopping for stress grows, the altcoin’s worth may rise by one other 7% to $0.62.

Apparently, this place can be the place the essential 23.6% Fibonacci stage lies. Nonetheless, if the liquidation heatmap exhibits a motion of liquidity to a decrease space, then the altcoin worth may sink. In that state of affairs, XRP’s value may drop to the 61.8% Fibonacci stage at $0.55.

Disclaimer

Consistent with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.