XRP is at the moment exhibiting indicators of indecision, buying and selling sideways with restricted momentum as merchants await a clearer sign. Over the previous 24 hours, XRP’s buying and selling quantity has dropped by 20.37%, now sitting at $2.4 billion—a decline that displays cooling curiosity within the brief time period.

Technical indicators just like the RSI and Ichimoku Cloud counsel a impartial pattern, with no sturdy bullish or bearish dominance in play. Worth motion stays confined between key assist and resistance ranges, leaving the following breakout course nonetheless unsure.

Impartial RSI Studying Suggests Warning for XRP Merchants

XRP’s Relative Power Index (RSI) is at the moment sitting at 46.82, signaling impartial momentum out there. This impartial zone has continued since April 7, with no vital shifts into both overbought or oversold territory.

Notably, the RSI was at 57.30 simply three days in the past, indicating that XRP has skilled a current decline in shopping for stress.

The drop suggests cooling curiosity or a attainable shift in sentiment amongst merchants, because the asset now hovers nearer to the midpoint of the RSI scale.

The RSI is a momentum oscillator that measures the velocity and magnitude of current worth adjustments, sometimes on a scale from 0 to 100.

Readings above 70 typically counsel an asset is overbought and might be due for a pullback, whereas readings under 30 point out it might be oversold and probably poised for a bounce. With XRP now at 46.82, the asset is neither overbought nor oversold, implying indecision out there.

This degree, mixed with the current dip from 57.30, might sign rising warning or weakening bullish momentum. It might probably level to a consolidation section or slight downward stress within the brief time period except patrons re-enter with conviction.

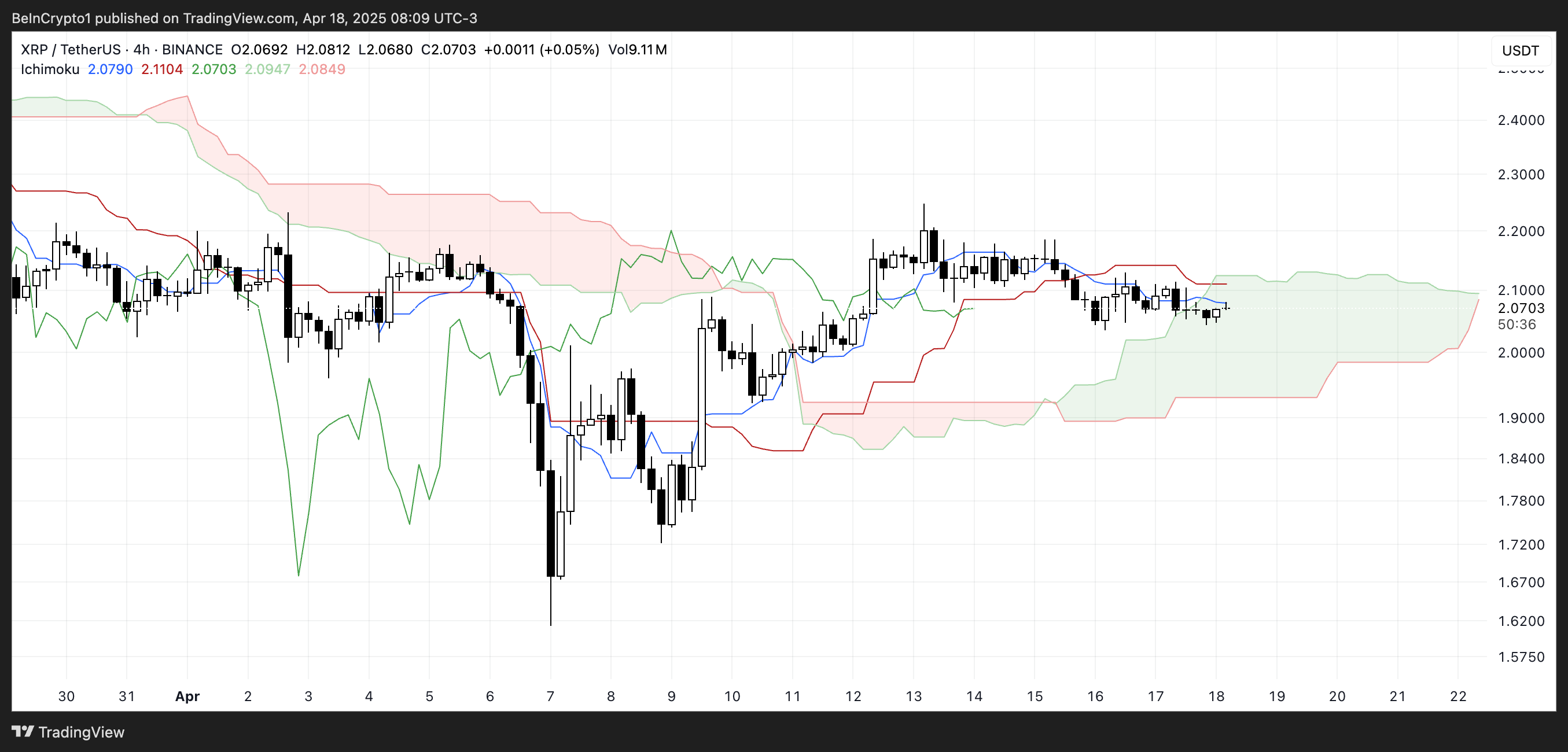

Ichimoku Indicators Present Indecision in XRP’s Worth Motion

XRP is at the moment buying and selling contained in the Ichimoku Cloud, reflecting a state of indecision or consolidation.

The Tenkan-sen (blue line) and Kijun-sen (pink line) are flat and carefully aligned, suggesting weak momentum and an absence of short-term pattern course.

The Senkou Span A and B (the cloud boundaries) are comparatively flat as properly, which generally signifies that the market is in equilibrium with out sturdy stress from both patrons or sellers.

The Ichimoku Cloud, or Kumo, helps visualize assist, resistance, and pattern course at a look. When the worth is above the cloud, the pattern is taken into account bullish; under it, bearish.

Contained in the cloud, as XRP at the moment is, the pattern is impartial, and volatility typically contracts. The flatness of the cloud’s main edges implies a consolidation section, and the truth that worth just isn’t breaking clearly above or under the cloud reinforces the concept of market uncertainty.

For now, the shortage of a decisive breakout suggests XRP might stay range-bound till a stronger pattern develops.

$2.03 Assist and $2.09 Resistance Maintain the Key to XRP’s Subsequent Transfer

XRP worth is at the moment buying and selling inside a slim consolidation vary, with key assist at $2.03 and resistance at $2.09.

The worth motion has been comparatively muted, however the EMA traces are beginning to present indicators of potential weak point, as a demise cross—the place the short-term EMA crosses under the long-term EMA—seems to be forming.

If this bearish crossover confirms and XRP breaks under the $2.03 assist, a transfer all the way down to $1.96 turns into more and more possible.

A robust continuation of the downtrend might set off a steeper drop. It might probably drive the worth as little as $1.61 if promoting stress accelerates.

Nonetheless, there’s nonetheless a bullish situation on the desk. If patrons handle to push XRP above the $2.09 resistance, it might open the door for a retest of the $2.17 and $2.35 ranges.

This could point out renewed energy and a shift in momentum in favor of the bulls. Ought to the rally achieve traction past these ranges, XRP might make a run towards $2.50, marking a major restoration.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.