Persistent bearish forces from two weeks in the past proceed to influence the cryptocurrency sector, which noticed its international market cap undergo a considerable lack of $350 billion, lowering by 10.4% to $2.15 trillion by the top of the week.

Listed here are our picks for prime cryptocurrencies to observe this week:

XRP breaks beneath bull pennant

XRP (XRP) started the week with a bullish push to a four-month excessive of $0.6580 on July 31.

Nonetheless, because the broader market collapsed, XRP corrected these positive aspects. It had shaped a bull pennant amid the consolidation from July 18 to 30.

The formation of the pennant had initially steered a continuation of the July 7 to July 17 uptrend. Nonetheless, the asset broke beneath the pennant on Aug. 2 when it collapsed beneath $0.55, indicating a shift in momentum to bearish. Consequently, XRP ended final week with a 6.5% drop.

On the each day chart, XRP has moved beneath the 0.382 Fibonacci stage at $0.5544. If bearish momentum continues, XRP may additional decline to 0.618 ($0.4910), which might function its final protection in opposition to a drop to the early July values.

At this level, the 0.5 and 0.618 retracement ranges are potential help zones. If the worth can discover help and stabilize at these ranges, there could also be an opportunity for a reversal. Nonetheless, if bearish strain persists, XRP may proceed its downward development.

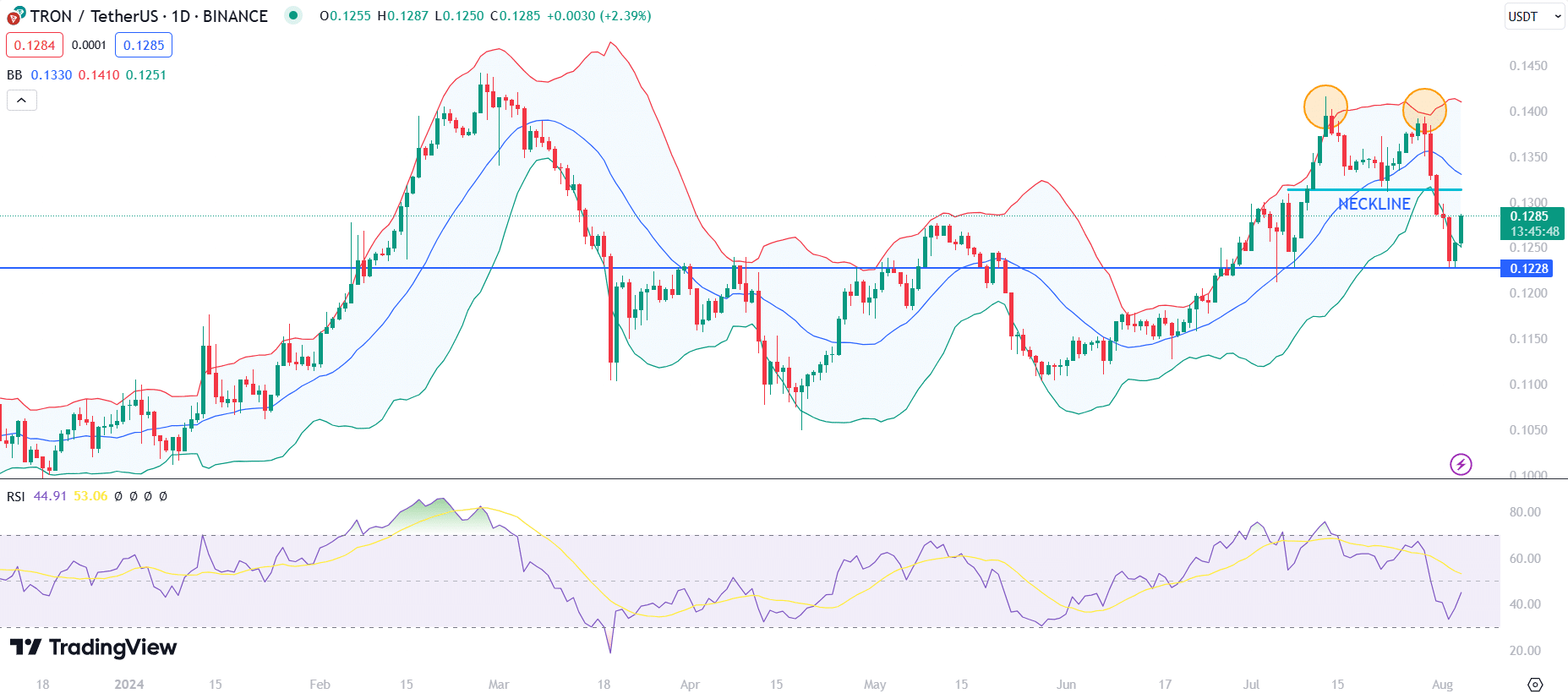

TRX suffers double prime declines

Tron (TRX) additionally began the week bullish, however its rise to a excessive of $0.1394 resulted within the formation of a bearish double-top sample. This additionally coincided with a retest of the higher Bollinger Band ($0.1397), bolstering the upcoming correction.

Following the formation of the double prime, TRX broke beneath the neckline, confirming the sample and leading to a pointy decline to a three-week low of $0.1228. Nonetheless, TRX discovered strong help at $0.1228 and is trying to get well.

The present restoration exhibits the worth shifting again towards the center Bollinger Band, which acts as a short-term resistance across the $0.1330 stage, representing the 20-day SMA.

Given the bounce from the help stage at $0.1228 and the present value close to $0.1285, it is very important watch if Tron can break above the neckline stage once more. Sustained buying and selling above this stage may point out a reversal of the bearish development and a possible transfer greater.

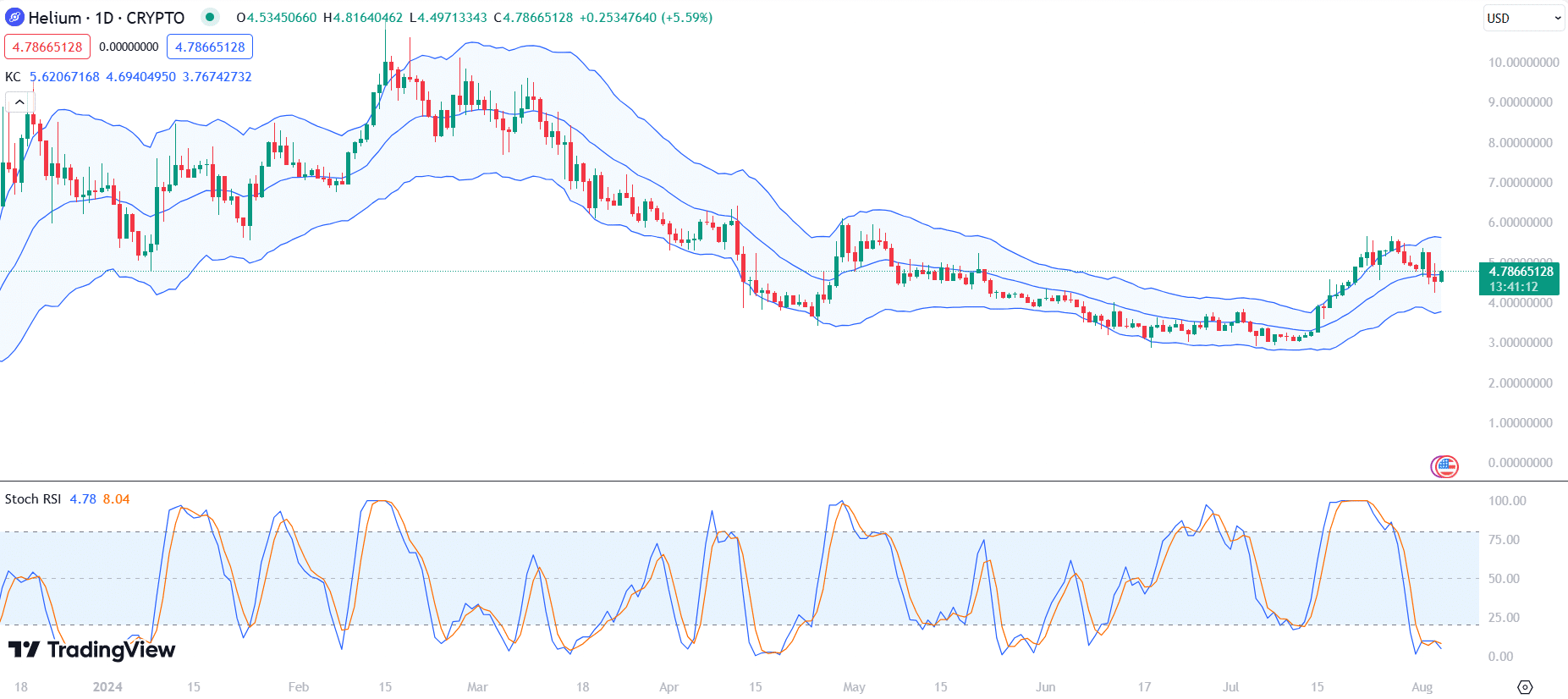

HNT slumps 18%

Helium (HNT) began final week on a bearish be aware, recording 4 consecutive days of declines. It staged an 8% intraday restoration achieve on Aug. 1, however these positive aspects had been snuffed out by a subsequent 11.47% drop the following day.

HNT ended the week with an 18% droop. Furthermore, chart information confirms that Helium at the moment trades close to the center line of the Keltner Channel (KC).

The Stochastic RSI, alternatively, signifies that HNT is in oversold territory. The Stochastic RSI values are round 4.78 for the %Okay line and eight.04 for the %D line. This means that the promoting strain could also be overextended, and a possible rebound may very well be on the horizon.

It’s important to observe for potential help across the center KC line at $4.69. If Helium holds above this stage and the Stochastic RSI begins to rise, it may point out a shopping for alternative.

Nonetheless, a break beneath this stage may result in additional declines in direction of the decrease KC boundary at $3.76.

Conversely, if HNT can regain momentum and transfer in direction of the higher KC boundary, it might must surpass $5.62 to indicate a robust bullish development.